- As we wait to see what happens with the Nvidia earnings call after the bell, the Wednesday session was extremely calm in the early hours.

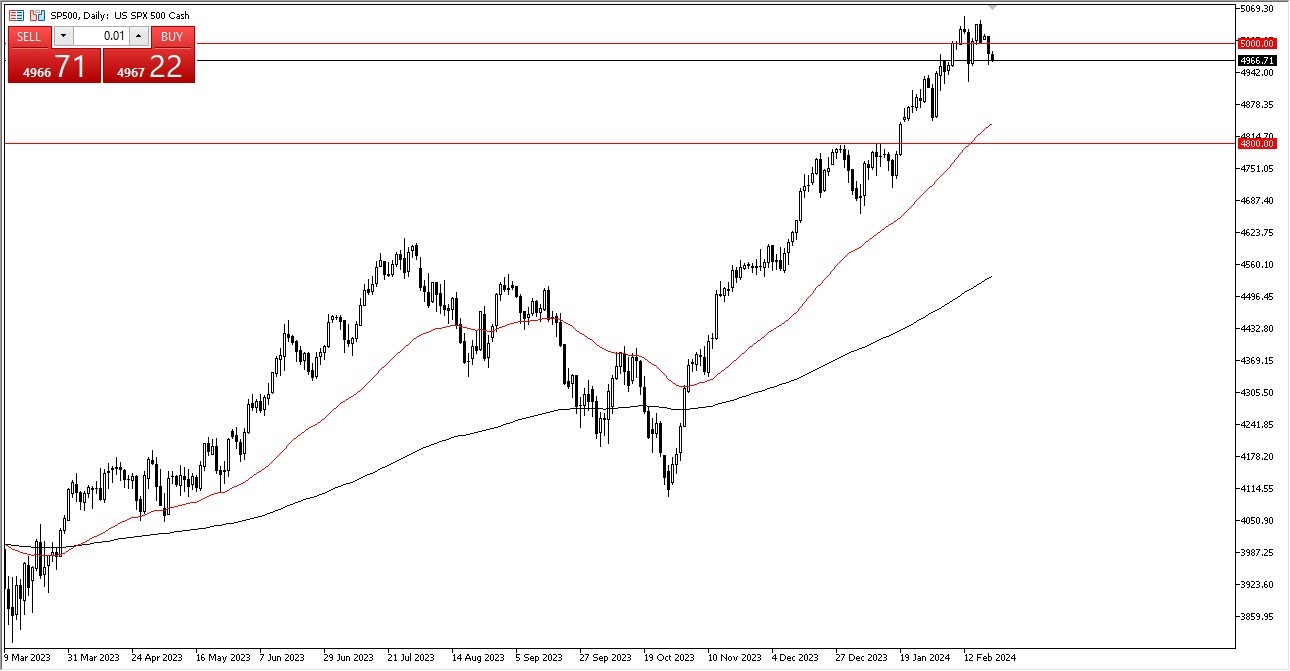

- Naturally, markets are a touch overextended because the 5000 level is still very much in play.

The market has been fluctuating over the past few weeks, as can be seen by looking at the S&P 500. However, at this moment, I believe that the 50-day EMA will also hit the 4900 level beneath, which is an area where we would see support. In the end, this market is in desperate need of a correction, and traders are essentially speculating about when it will occur without intending to lose money by being overextended in this bullish run.

Top Forex Brokers

If everything stays the same, I believe that value seekers will keep returning to this circumstance. However, bear in mind that Nvidia's earnings are scheduled for after the bell, which naturally has Wall Street's players twiddling their thumbs and speculating about what might come next. Ultimately, though, the S&P 500 is really an ETF comprising around five, if not seven, businesses. As long as the major participants in the market keep rising, the S&P 500 will rise as well. The fact that we are oscillating about the 5000 level is not shocking when you consider the situation in the long run. That is a rather large, spherical figure that draws a lot of attention. Remember that we've increased by 23.5% since Halloween last year, which is not typical.

A Breakout Above?

Thus, a retracement is indeed required. We'll have to wait and see how deep it is in order to determine whether or not we get it. But the best scenario would be 4,800 to the 50-day EMA. I'm not sure. Either that or we'll work sideways to pass the time. My view is that if we do break above the 5,050 barrier, we could advance to 5,100 and then 5,200 quite rapidly.

Also, take note of American interest rates. Stocks may benefit if they begin to decline, unless, of course, there is some extremely negative economic news to be concerned about. After all, negative news does ultimately turn into positive news again, and then people come into the markets to pump up FOMO trading.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.