- On Presidents Day, the US dollar was rather calm compared to the yen.

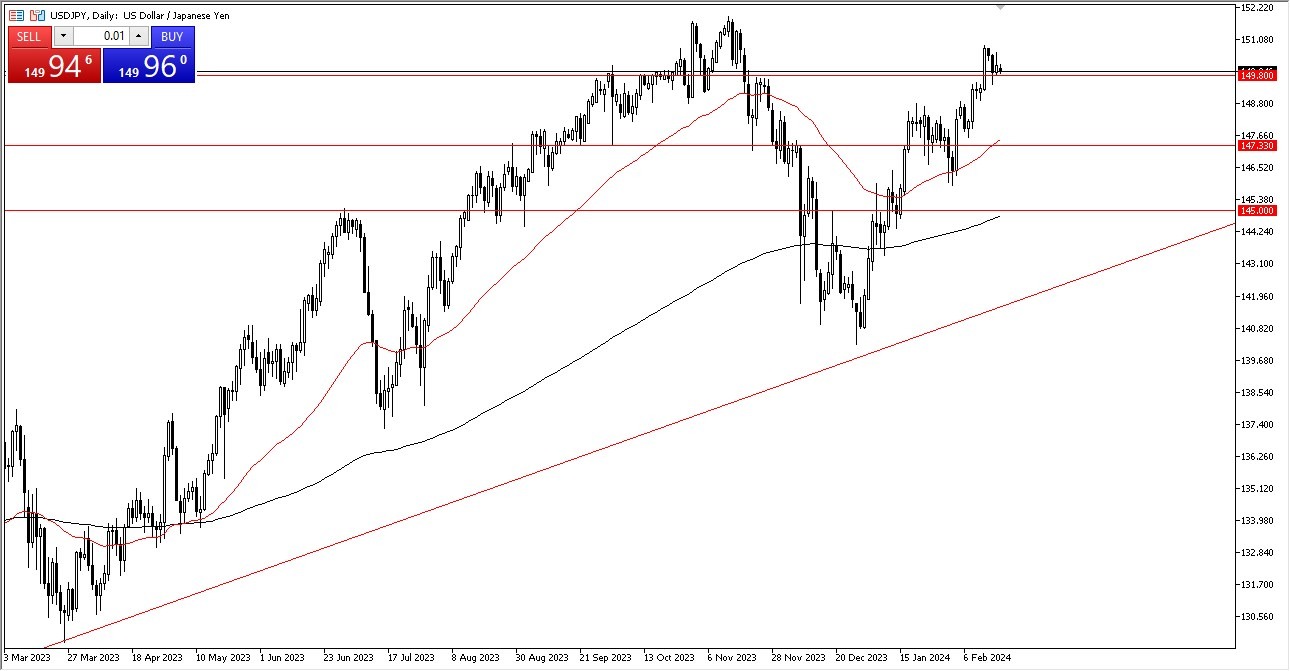

- We are currently sitting right around the 149.80 yen level, a level that I and other analysts have mentioned a few times in the past as having some market memory associated to it.

It does draw attention since this is an area where there has historically been both support and opposition. Remember that since most traders aren't at work, liquidity would have been a bit of a problem, particularly as we get closer to the New York session. The 50-day EMA and the 147.33 yen level provide the market with strong support if we should break down from this point.

Top Forex Brokers

To The Upside

However, if we reverse course and break above the 150 yen barrier, we test 151 yen and then 152 yen. There was a big swing high at the 152 yen level, so breaching above it could bring in some additional FOMO trade volatility. When all else is equal, this is a market that, in my opinion, breaks above that level given enough time because the Bank of Japan has very little leeway in tightening monetary policy.

To put it plainly, Japan has too much debt. As you can see from this daily chart, the price has simply been slowly moving higher with sporadic pulses of movement. That's typical of any upswing, therefore nothing about this chart truly alters my understanding of it. Right now, I think it makes sense to purchase dips and take advantage of discounts, and once we break through the 152 yen barrier, I believe we'll likely head toward the 155 yen level. Afterwards, anything above that turns into a buy-and-hold situation. We'll have to wait and see how that plays out but given that Japan has no compelling reason to alter its monetary policy, I could see that happening.

Ultimately, I have no interest in shorting and I do think that most traders feel the same way. Yes, occasionally the US dollar will lose some strength, but against the Japanese yen it’s a high bar to start shorting this market for any length of time. Quite frankly, if you choose to short the US dollar it should be against other currencies that have a possible interest rate hike ahead like the New Zealand dollar.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.