- The USD/PKR is trading near the 279.5860 ratio as of this writing.

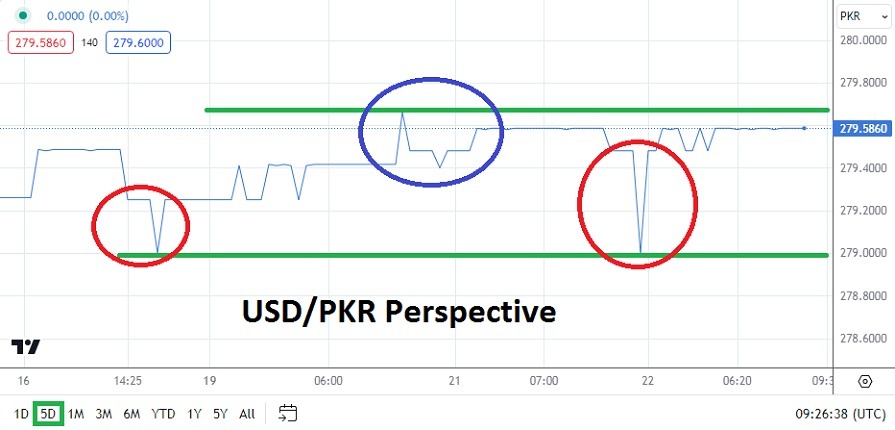

- Trading in the currency pair has been rather consistent and the 279.7000 level has proven to be rather durable resistance, in fact the lower mark of 279.6000 can be pointed at and said to have worked as a place where speculators may claim to have been able to sell the USD/PKR as a value which has ignited reversals lower.

- Spikes occur in the USD/PKR and traders need to be prepared for outliers happening.

Support levels for the USD/PRK recently have tested the 279.0020 earlier this morning and on Friday of last week. Speculators who are using stop loss ratios may be wise to set a price near the 279.0000 or 278.9990 levels to try and withstand any moves lower if they are wagering on the USD/PKR to move upwards after touching what is perceived as current technical support. Conservative leverage is urged.

Trading the USD/PKR and Risk Taking Tactics

Traders who want to pursue the USD/PRK need to understand that the currency pair is not widely traded. Its volume is lackluster at best when compared to other major currencies. The State Bank of Pakistan is respected, but the current foreign cash reserves within Pakistan remain troubling and this creates a constant state of affairs in which certain ‘parties’ are trying to obtain USD.

Top Forex Brokers

Having said this the USD/PKR needs to be acknowledged for achieving a significant bearish trend after hitting all-time highs in early September of 2023, this when the USD/PKR traded near the 307.3400 vicinity momentarily. In the middle of November the USD/PKR was trading near the 288.1500 area, this after reversing higher from a low around 275.7370 on the 17th of October. The USD/PKR then traversed lower from the middle of November and has been challenging depths around 279.0000 since the 30th of January.

Economic Issues after Recent Election and Coalition Government

The recent national election in Pakistan has achieved a coalition government which was announced a couple of days ago. While concerns have been heard about the transparency of the election and method of vote counting it appears a government has been agreed upon. Inflation remains above the 28% level in Pakistan and is a cause for concern. The government will also have to negotiate an agreement with the International Monetary Fund in order to create a more stable foreign cash reserve capability moving forward.

- Traders of the USD/PKR must use risk taking tactics that include entry price, stop loss and take profit orders. They must remember the potential of sudden spikes exists.

- The current price range of the USD/PKR includes a large spread between ‘bid and ask’ ratios that traders need to be aware of in order to wager on direction within the USD/PKR.

Pakistani Rupee Short Term Outlook:

Current Resistance: 279.5940

Current Support: 279.5590

High Target: 279.6650

Low Target: 279.0020

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.