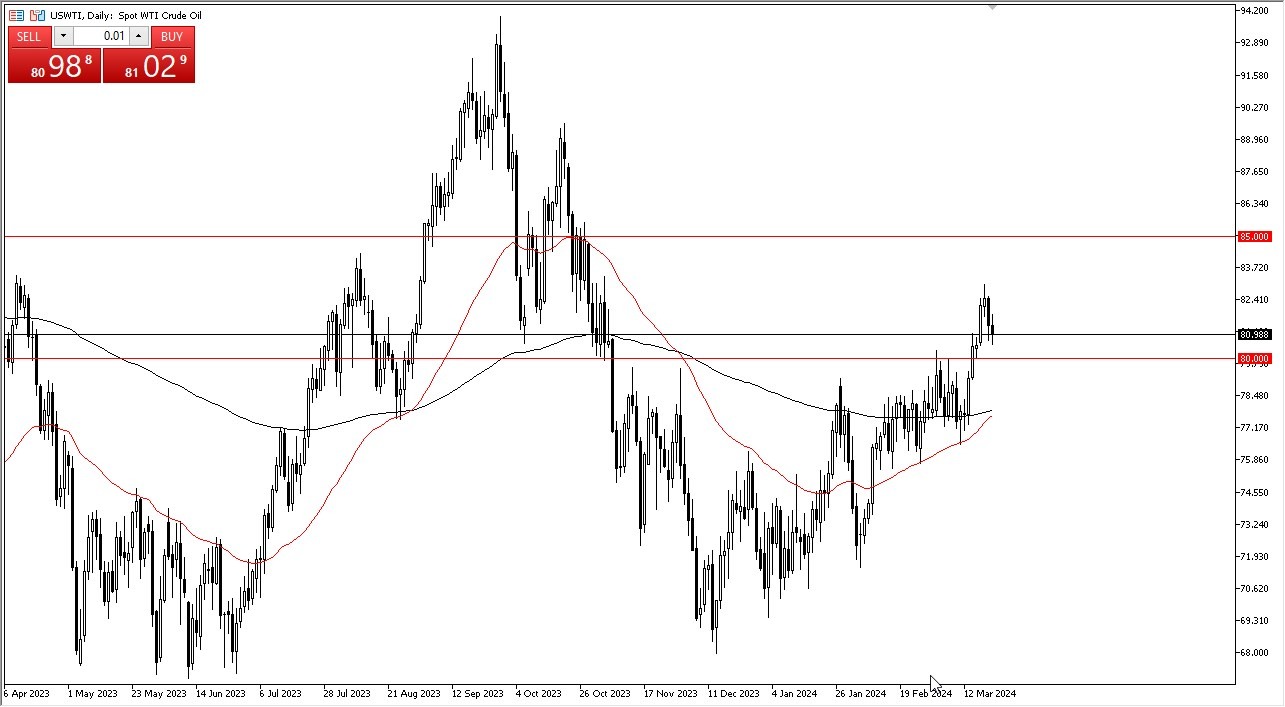

WTI Crude Oil

The West Texas Intermediate crude oil market pulled back slightly during the trading session on Thursday, but at this point in time, it looks like the $80 level underneath is going to hold up as support. I do believe that this is a buy on the dip type of opportunity, and there are plenty of reasons to believe that crude oil continues to go higher.

Top Forex Brokers

The $80 level is an area that will attract a lot of attention, obviously, and we are getting ready to have the so-called Golden Cross where the 50-day EMA breaks above the 200-day EMA. Ultimately, I think that we could go to the $85 level, which is an area that previously had been important as well. Remember, this time of year is typically bullish for crude oil, as we see a lot of travel pick up. Ultimately, this is a cyclical trade that we see every year. This is a well-known phenomenon that a lot of people will be taking advantage of.

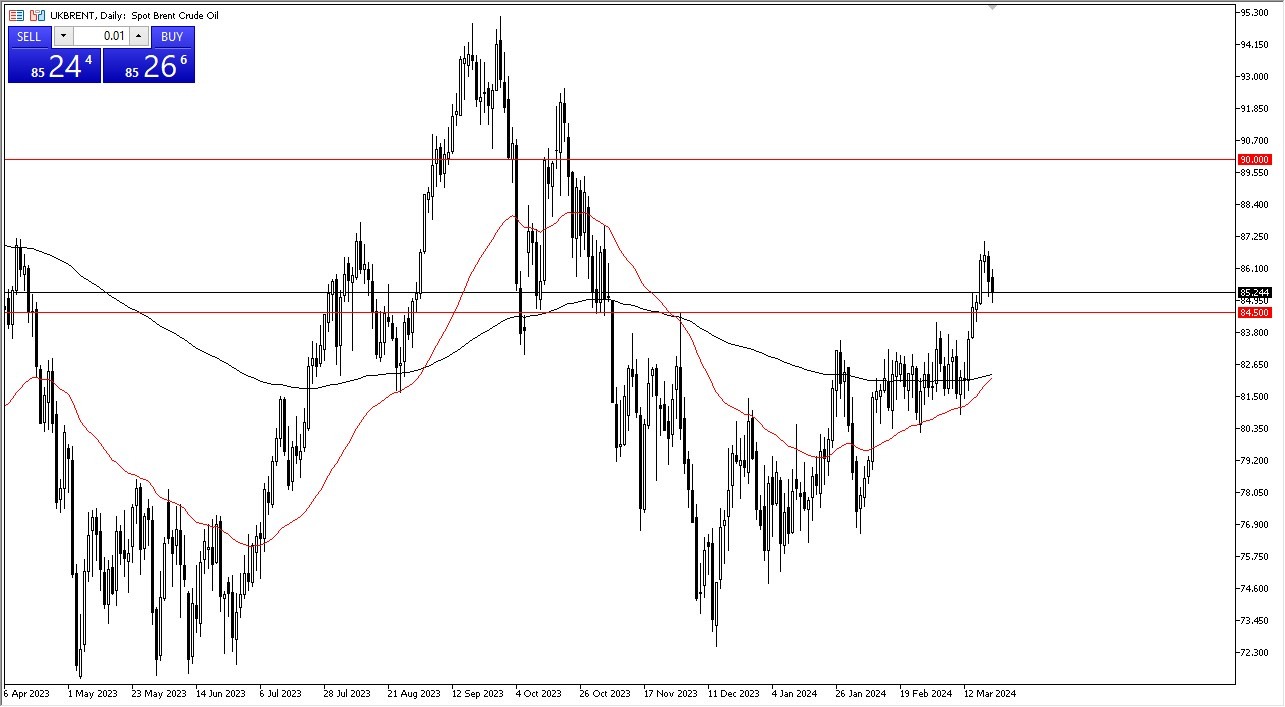

Brent

Brent looks very much the same with the $84.50 level offering support and I am a buyer of this dip as I believe we continue to see the breakout take off to the upside. There's a lot of concern out there about supply in both directions for that matter, but quite frankly, I think it's probably only a matter of time before we rip to the $90 level due to the fact that central banks are going to do everything, they can to liquefy the markets as monetary policy loosens. With this, we also have the golden cross getting ready to happen, and that's yet another reason to think that we are going to go higher. Momentum begets momentum, and that's exactly what I think we're about to see here.

Ultimately, this is a market that cannot be sold anytime soon, as the demand for oil will likely to be a major factor over the next several months. This is a scenario that a lot of people will be eyeing very closely.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.