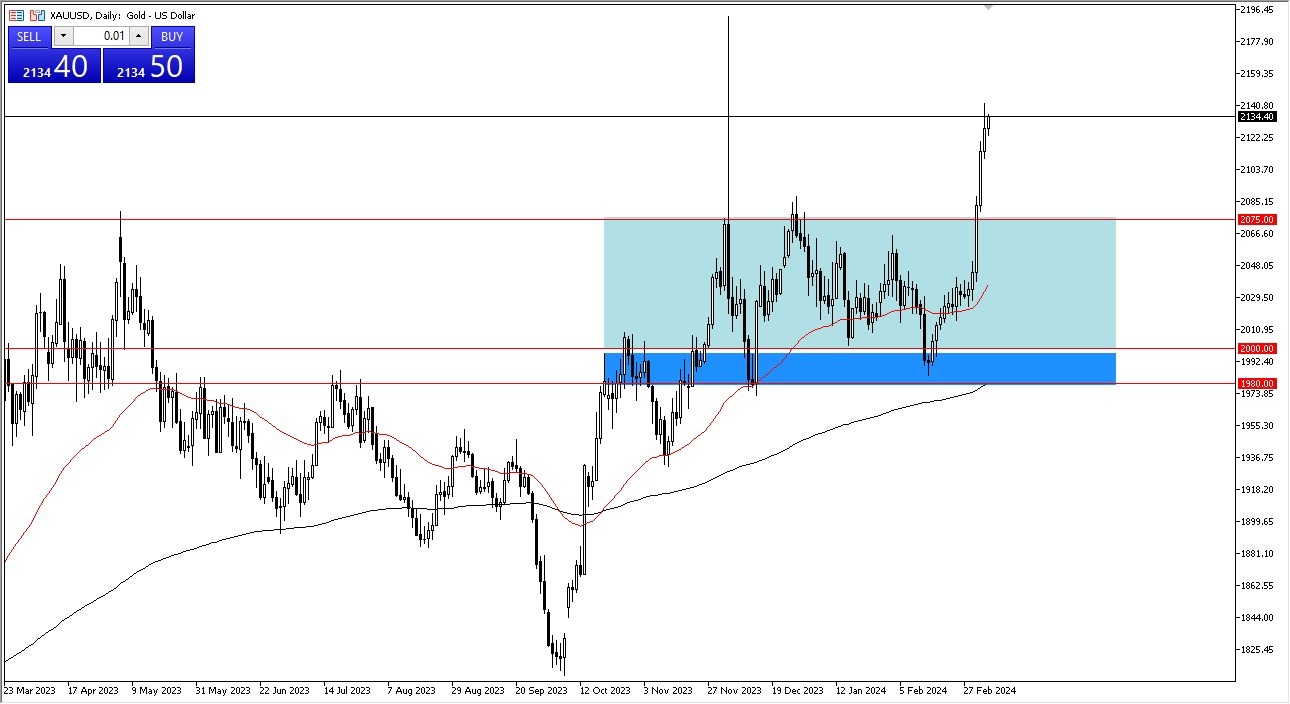

Wednesday's trading session saw a nice recovery in the gold markets, as traders continue to enter this market for a variety of reasons. It makes logical sense that we are witnessing a small "FOMO trade" after breaking through a significant resistance level at 2075.

Gold Should Continue to Bring in New Buyers

Wednesday morning saw another rally in the gold markets, and it appears that this trend will continue. The fact that gold cannot be shorted and that the bullish trend is most likely to continue is evident at this point. After all, there are many geopolitical factors by themselves that support the idea that gold should perform well. This also is backed up by the central bank actions that will undoubtedly happen later this year.

Top Forex Brokers

We're a little overextended, so I would advise you to exercise extreme caution before becoming hostile here. Since this market has gotten too far ahead of itself, I would love to see some kind of pullback at this point that I can take advantage of. Given that this is the case, I believe that market players will continue to view the 2,075 level below as a possible buying opportunity because it may indicate market memory given that it was formerly a resistance level.

With that said, I believe that in order to find sufficient value, you should probably watch the market retreat to this area. Once more, long to the upper side. Since we were previously in that area during an odd illiquid spike during Asian trading on December 4th, there really is no ceiling. I don't think you should look too deeply into that wick for guidance at this time because that was a bit of an anomaly.

We are therefore in a new territory. And usually what you get is a retreat of some kind. Following that, people will attempt to hide any vulnerable positions. In either case, I believe you should have a good opportunity to purchase gold if you have enough patience. And when we do drop from here, you absolutely should look at it for a value play of some kind. This is a market that has no real way to short it at the moment, even if it is a bit stretched.

Ready to trade today’s Gold prediction? Here’s a list of some of the best Gold brokers to check out.