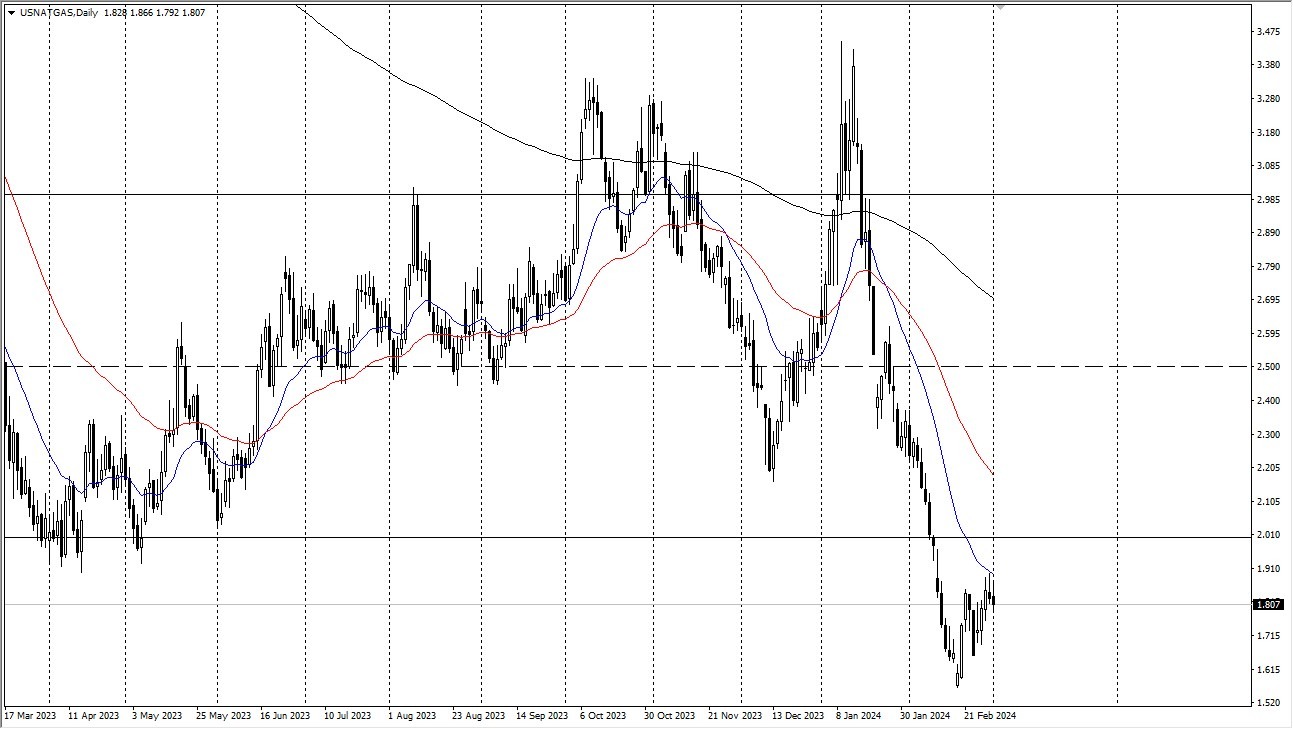

- Natural gas is currently attempting to establish some kind of base, but it will undoubtedly be a very noisy market as is customary.

- Additionally, the commodity is in a somewhat depressed period of the year, so short-term traders will likely be interested as we will almost certainly form a reliable range before taking off.

Although the Friday session's natural gas market has been extremely erratic, I believe it is still worthwhile to keep a careful eye on this market since there is undoubtedly a lot of base building, or at least prospective base building. This market has been overpriced for a considerable amount of time.

Top Forex Brokers

It would therefore not come as a major surprise to see it turn around, simply because drillers will quit the fields if they are forced to continue making very little money or, worse yet, losing money. The $2 level above will remain significant when drilling for gas, so keep an eye on it. And it's likely that natural gas will keep moving in the direction of $2.50 if we can break above that.

Short Term Pullbacks and the $1.50 Level Below

I believe we're seeing essentially what short-term pullbacks at this point will continue to view as a big floor being the $1.50 level down. Having said that, you do need to be concerned about whether or not something other than the cheap pricing of natural gas will cause it to rise. I don't see it right now, but whenever the weather becomes hot, we might experience a heat wave or a winter storm that creates some kind of rise.

I believe you will need to exercise a great deal of patience between now and then. It is very likely that many longer-term traders are constructing positions down here, but holding onto this for the length of time that may be required is challenging. You should maintain a reasonably proportionate position size as a result. When it comes to natural gas, you definitely don't want to leap in headfirst and establish a sizable position straight away. If all else is equal, I think the $2 level will be important.

Potential Signal: I am a buyer of ETF UNG at this point. I would also consider a smaller CFD position, recognizing that it will take some time. However, once we break $2 to the upside, then I will add a bit. I will try to get to the $3 level for a take profit.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.