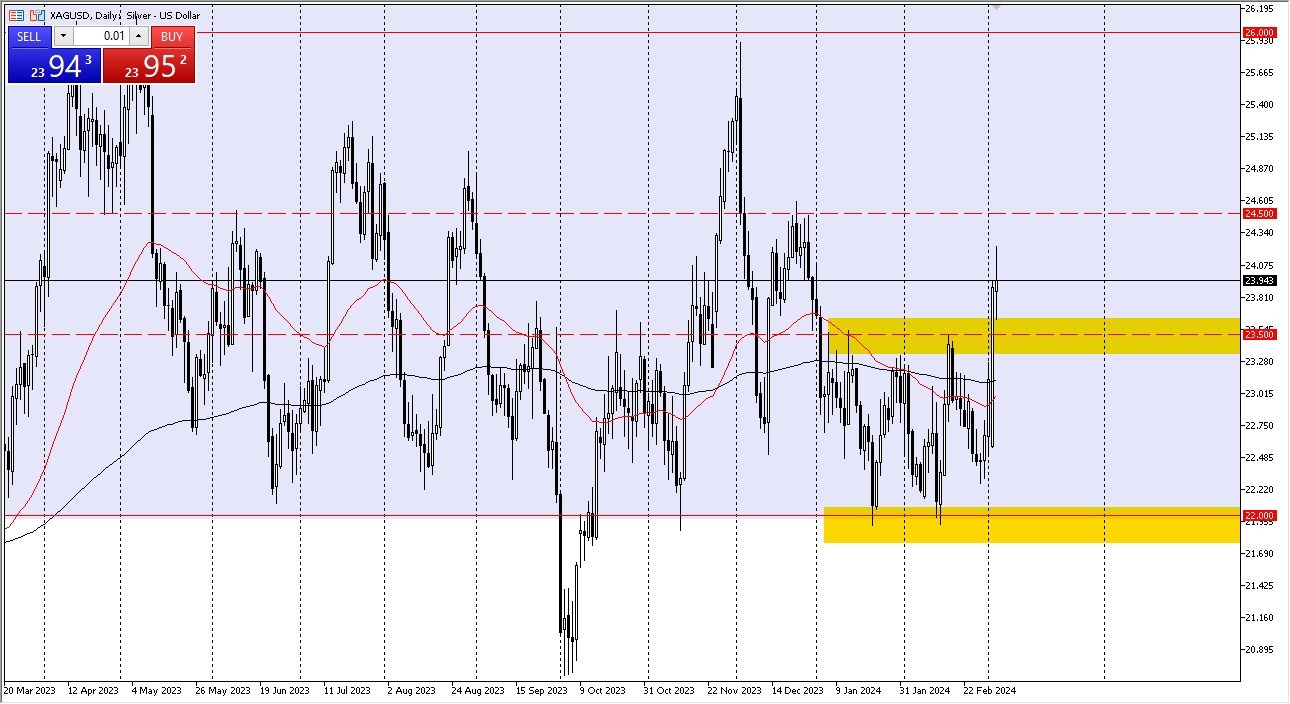

- During Tuesday's trading session, the silver market fell at first, but it later recovered and began to show signs of life once more.

- In the end, I believe that this market will follow gold and eventually aim for the $26 mark.

Tuesday Setting Up to Test $26 Later?

As you can see, we started the Tuesday trading session by slightly retreating, but then we turned around and shot straight up into the sky. I believe there will be a lot of this market going forward. Still highly bullish, but noisy behavior. From what I can tell, this means that it is a "one-way trade." Of course, the longer term charts also greatly benefit from the clearly defined consolidation range.

Top Forex Brokers

Considering that tremendous candlestick that we saw on Monday; it appears that we may be able to target the $24.50 level. In the end, I believe that traders will eventually continue to see this situation through the lens of whether or not they can extract any kind of profit. Naturally, silver is trailing the surge in gold, and while silver has experienced significant price volatility, it is not essentially at an all-time high like gold is. That being said, I believe that silver will likely keep trying to catch up, and I do believe that $24.50 will likely be reached very soon. I think the 200-day EMA and the $23.50 level are the next levels of support below.

Since the $22 level is still a very large floor, I believe you are merely buying dips in this scenario. It is not worth your time to attempt to shorten this. There is a good chance that we will advance to 26 if we breach at 24.50. Remember that the US currency, interest rates, and overall risk appetite are all factors that silver will consider. Never forget that trading silver differs slightly from trading gold because it is an industrial metal that can have a significant impact on the market.

Since the $22 level is still a very large floor, I believe you are merely buying dips in this scenario. It is not worth your time to attempt to shorten this. There is a good chance that we will advance to 26 if we breach at 24.50. Remember that the US currency, interest rates, and overall risk appetite are all factors that silver will consider. Never forget that trading silver differs slightly from trading gold because it is an industrial metal that can have a significant impact on the market.

With silver, you must be careful about when and how much you risk your money in this market, as there are a lot of risks when trading this massively volatile market. Also, I would suggest using smaller positions and looking for pullbacks in order to get involved with.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.