- The Bitcoin market has rallied pretty significantly during the early hours on Monday after the weekend provided a lot of fireworks in the spot market.

- That being said, it's worth noting that we did not get an expansion of the Middle East War and that may have had enough people jumping back into the market to take advantage of this dip.

- This is value just waiting to happen, and therefore a lot of people will be interested in taking advantage of cheap coins.

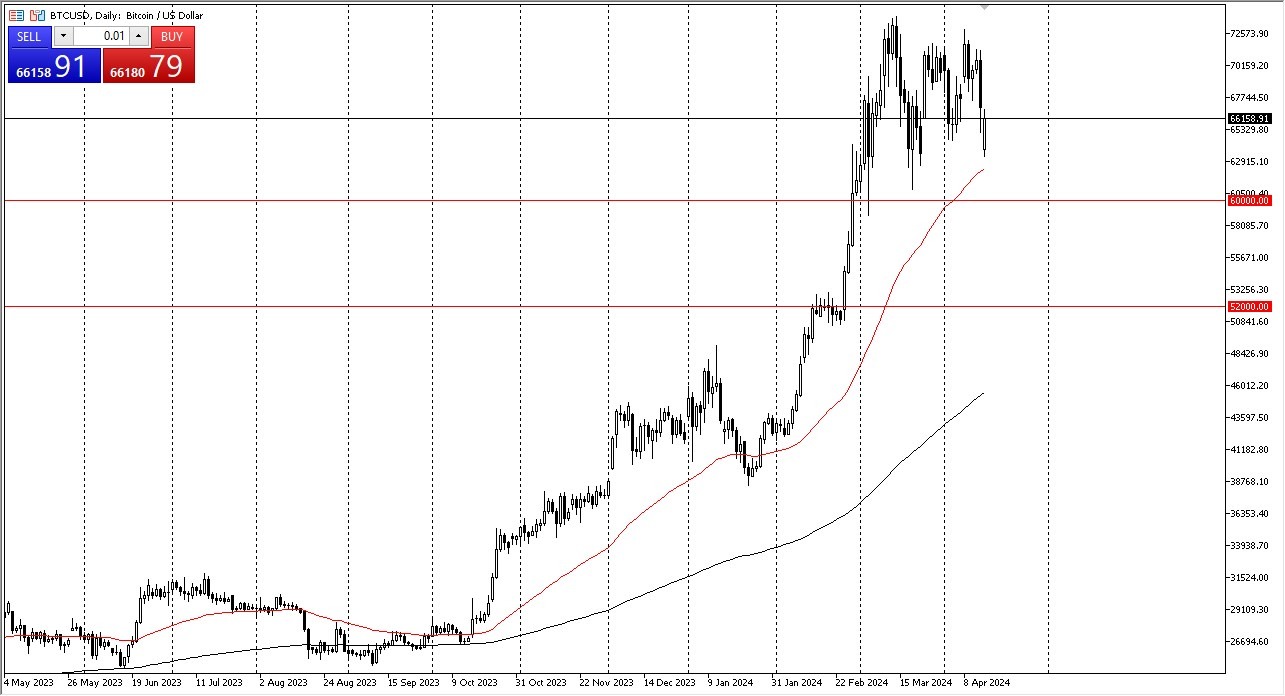

We have been consolidating for a while, and that, of course, makes a certain amount of sense, considering that we shot straight up in the air. 92% heading into this consolidation phase. So, all things put together, I think this is a scenario where this ends up being a buying opportunity. The $74,000 level above, of course, is an area that we've seen a lot of noise at and more specifically, resistance. However, I think it can only hold for so long as we have seen so many people involved in this market.

Top Forex Brokers

The Resistance Above

If we can break above the $74,000 level, then it's likely that BTC/USD could continue to go much higher, perhaps reaching towards the $80,000 level. Underneath, I see the $60,000 level as a major support level. And of course, we also have the 50 day EMA underneath as well. In general, this is a market that I think continues to see a lot of choppiness and consolidation to work off that excess momentum. Momentum can be a fleeting thing at times, but in the end, the trend is still ensconced in the market.

Remember a lot of the hot money that had flown into the Bitcoin ETF is probably now long gone, meaning that it will behave more like a normal market. With that, I am positive and bullish on this market, but I also recognize that we don't necessarily think that we should be jumping in with both feet. I think this is just a longer term secular bullish market. The inflows into the Bitcoin market will continue to be massive, as institutional traders now have an easy way to get involved.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.