- The US dollar has been strong for some time, and recently we have seen the GBP/USD pair go back and forth.

- We are currently trading in a 100 point range, and it does make a certain amount of sense that we would see quite a bit of confusion, as the Federal Reserve has changed its tune as of late.

- It looks as if the market participants may have to keep in mind that interest rates in America may remain higher for longer than expected, and that does put a lot of upward pressure on the greenback.

The Range

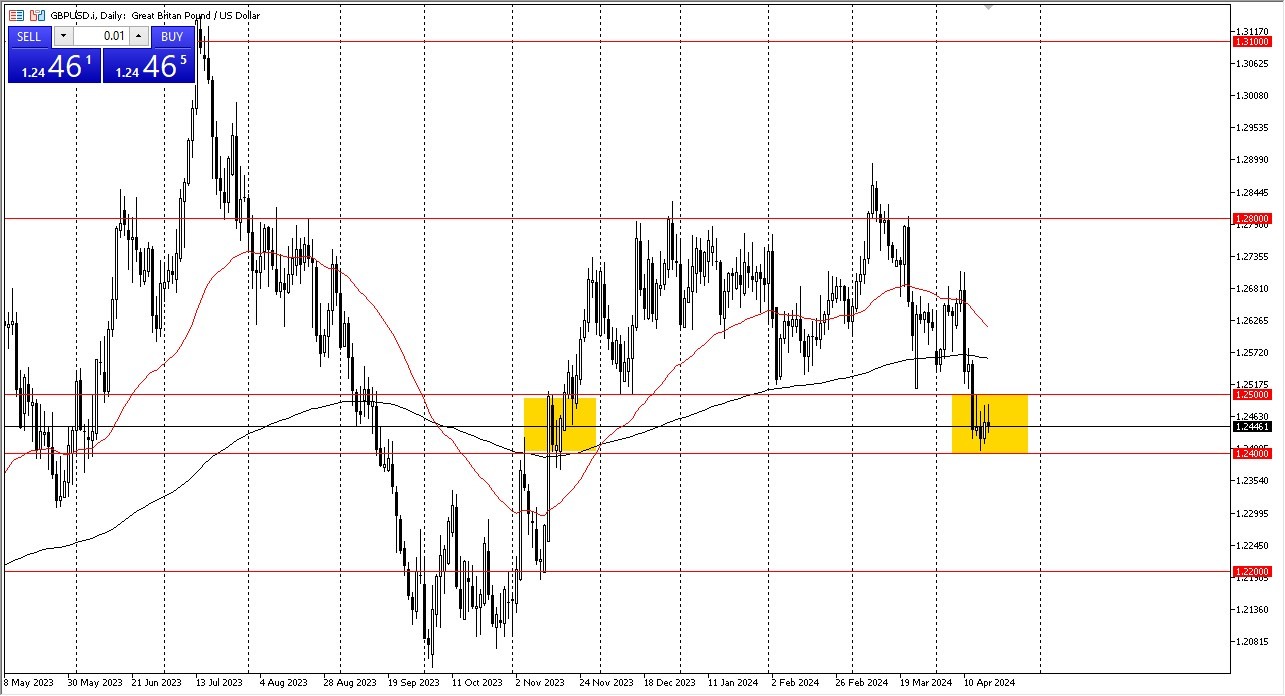

The range that the GBP/USD market has been in is between the 1.25 level above in the 1.24 level below. All things being equal, this is a market that I think continues to see a lot of noisy behavior, and therefore I think you are looking at a short-term sideways trading environment, as the market has been very noisy and confused, but ultimately if we can break out of this range, then I think we can start to look for a potential bigger move.

Top Forex Brokers

If we break to the upside, meaning that we clear the 1.25 level, then the market is likely to look into the 1.2650 level. Keep in mind that the 50-Day EMA and the 200-Day EMA indicators are above. On the other hand, if we were to break down below the 1.24 level, then it’s likely that the British pound drops down to the 1.22 level. In other words, we are building up a bit of inertia, and eventually we could break out given enough time. In fact, I anticipate that the breakout will be rather aggressive, but right now we are just simply squeezing so therefore you have to trade the market that’s in front of you, not the one you want.

Drilling down to the 30 minute chart might be more appropriate than trying to trade the daily charts, but as soon as we break out of this range that is so clearly defined, then we can move back to the daily timeframe and start to talk about trying to pick up a couple of handles in one direction or the other.

Ready to trade our daily Forex analysis? Here are the best regulated trading platforms UK to choose from.