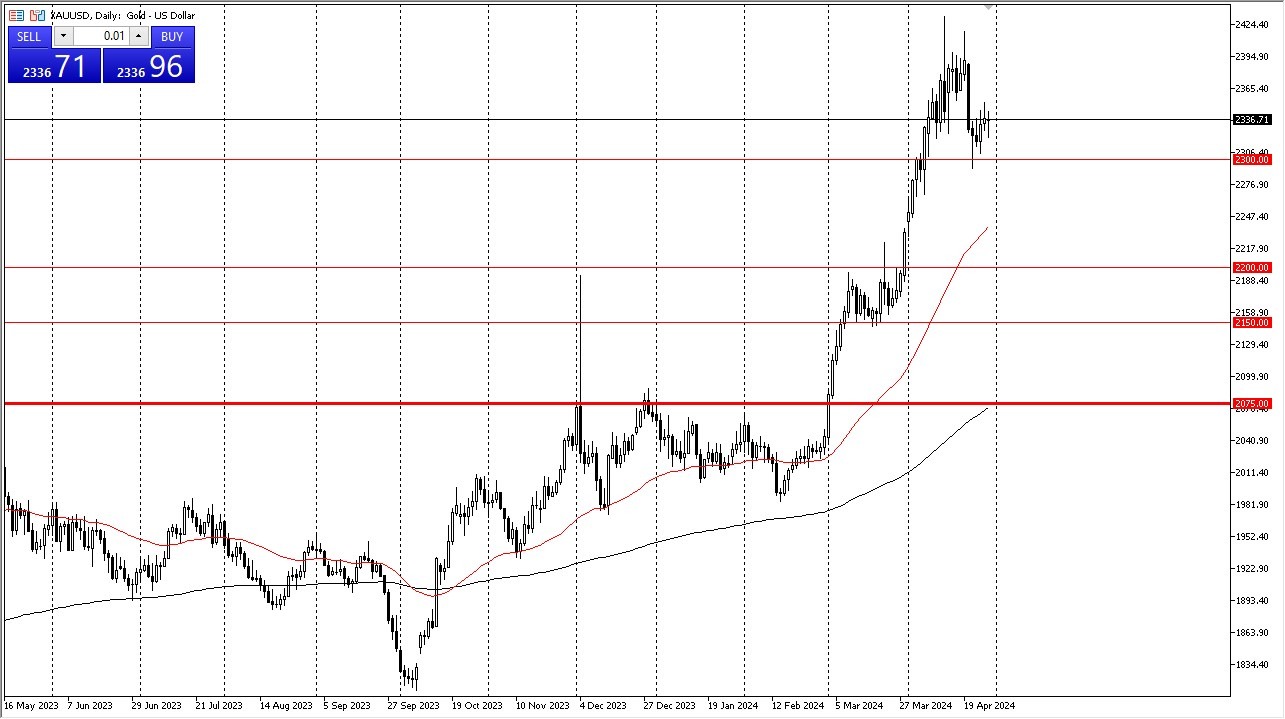

- You can see gold initially did pull back a bit during the trading session on Monday but continued to find buyers on dip.

- I think that's going to be the way forward. And gold continues to try to push towards the upside, but we recently did see a shot across the bow as it worked, and the market plunged from the $2,400 level.

- This is an area that I think we will try to retest sooner or later. And that’s the rub here: We might have a lot of work to do to get there.

It does make a certain amount of sense, but perhaps we need to find our footing here with the $2,300 level underneath offering a little bit of support. That area, I think, will be defended by the bullish traders out there, and there are plenty of reasons to think that perhaps gold will continue to rally. Overall, this is a market that, given enough time, will eventually digest some of these massive inflows and perhaps continue the overall uptrend.

Top Forex Brokers

Even if We Break Lower…

Even if we were to break down below the $2,300 level, I think at that point, you still have to look at the 50 day EMA as a potential support level, followed by the $2,200 level where we had seen a lot of noise previously. On the upside, the $2,400 level continues to be a major resistance barrier, but if we can break above that, then it's likely that we could go look into the $2,500 level.

The $2,500 level, of course, has a lot of psychology attached to it. But I do think at this point in time, it's very much a situation where the market is looking at that as its potential goal. Geopolitical concerns, interest rates, massive money printing by the American government. These are a lot of different reasons to push gold higher over the longer term, and as a result I am not looking for selling opportunities at the moment. In fact, gold could possibly have much further to go.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.