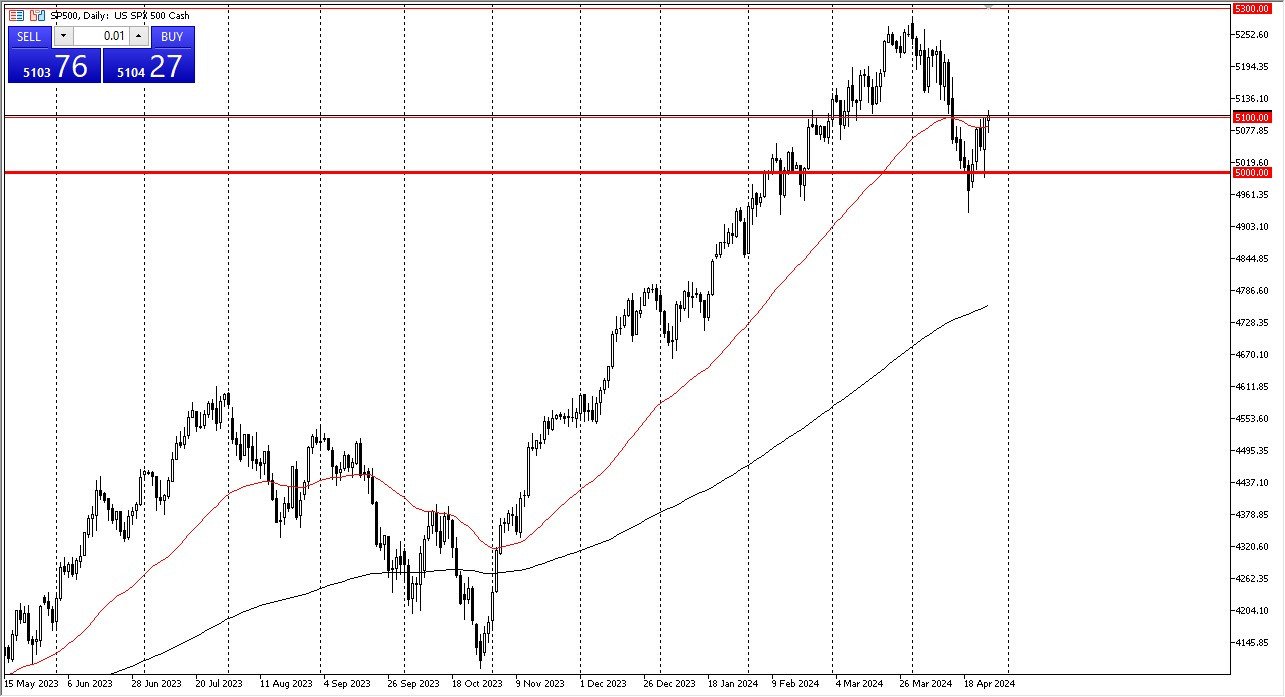

- The S&P 500 initially fell during the early hours on Friday, but we have turned around to show signs of life.

- The 50 day EMA slices through the bottom of the candlestick, and I think at this point we are trying to argue with the 5100 level and whether or not we can break above there.

If we can, then we will be more likely to continue to see the market go looking to the 5300 level. Ultimately, I think short term pullbacks continue to be buying opportunities, with the 5000 level underneath being a huge support level. The 5000 level of course is a large, round, psychologically significant figure. So that would attract a lot of attention in and of itself, and we should possibly looking at a lot of the options market participants that will undoubtedly be paying close attention to this “big number.”

Top Forex Brokers

We Have Earnings to Deal With

Remember that we are in the midst of earnings season so that also has a major influence. But quite frankly, Wall Street seems to be more worried about whatever it is the Federal Reserve is going to do as far as interest rates. So that, of course, is a major issue as well. Regardless, we have seen a significant pullback, and now it looks like we are trying to continue the longer term uptrend. This uptrend continues to be the main driver, as momentum continues to be one of the biggest factors in stock markets around the world.

But there is going to be some noise in that would be expected considering earnings season and of course the geopolitical concerns around the world. Either way any time the S&P 500 market dips, I'll be looking for value as long as we can stay above the recent swing low at the 4928 level, the 5300 level above is an area that I think you will have to be very cognizant of, because if we can break above 5300, then we can truly take it off to the upside.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.