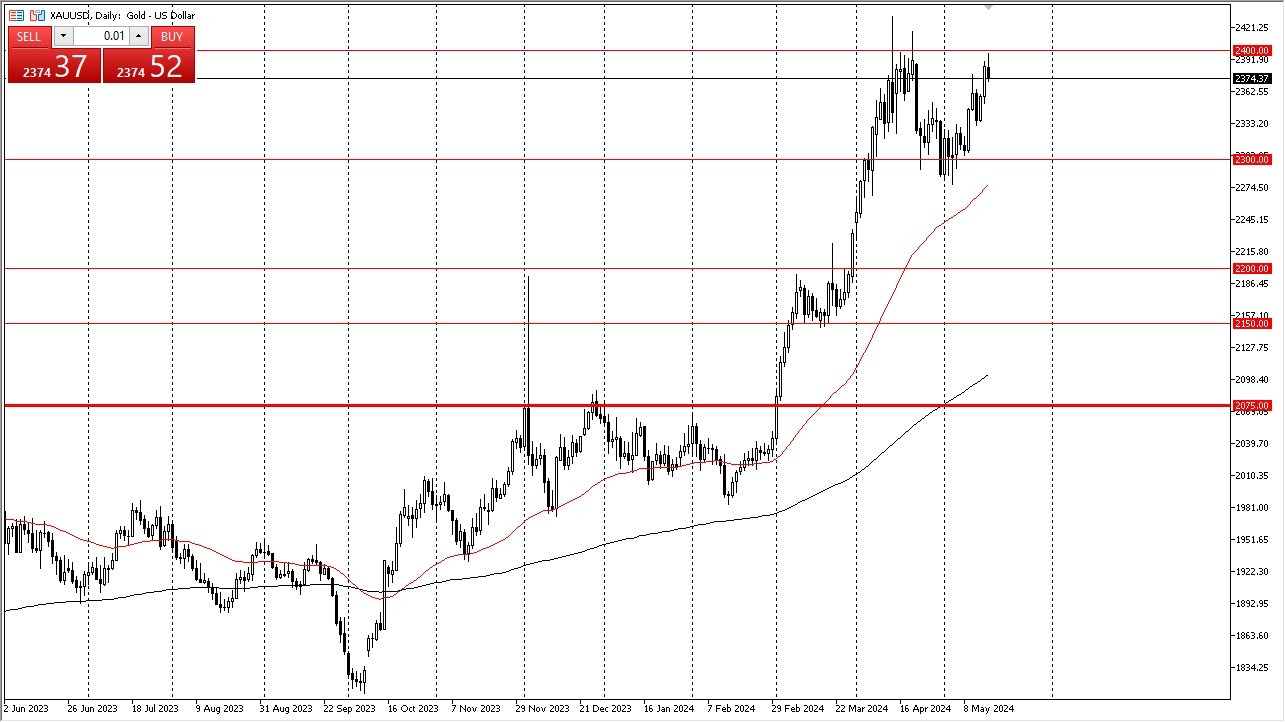

- Gold has pulled back from the crucial $2,400 level during trading on Thursday, which is an area that has been important multiple times.

- With that being said, I think we are just simply entering some type of consolidation area more than anything else.

- The $2,400 level above continues to be an area that I'll be paying close attention to, and therefore, if we can break above there on a daily close, then I'm interested in getting long.

If we pull back from here, then the market could drop all the way down to the $2,300 level, which of course is a major support level based on the previous action. And now that the 50 day EMA is racing towards that level, it makes a lot of sense that traders will continue to look at that as a short term flaw in general, and I think this is a market that remains bullish. But you could make an argument for an attempt at least to form a little bit of a double top. A lot of this will come down to interest rates, especially in the United States. So, we'll see how that goes. If interest rates start to really spike, that could work against gold.

Top Forex Brokers

Plenty of Buyers Overall

But at the same time, we do have central banks around the world buying gold. Hand over fist. Let's not forget all of those massive geopolitical issues that are still out there waiting to cause headaches. So, with that being said, I don't have any interest in shorting gold, at least not at the moment.

At this point in time, I look at a pullback as more likely than not going to be a buying opportunity in general. This is a market that I think continues to be very volatile, but that's not really that new for gold, and as such, traders should be cautious about getting “too big” in this market. This is a positive market overall, but at this point, it is obvious that a certain amount of discretion is necessary when putting money to work, instead of just piling into this market.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.