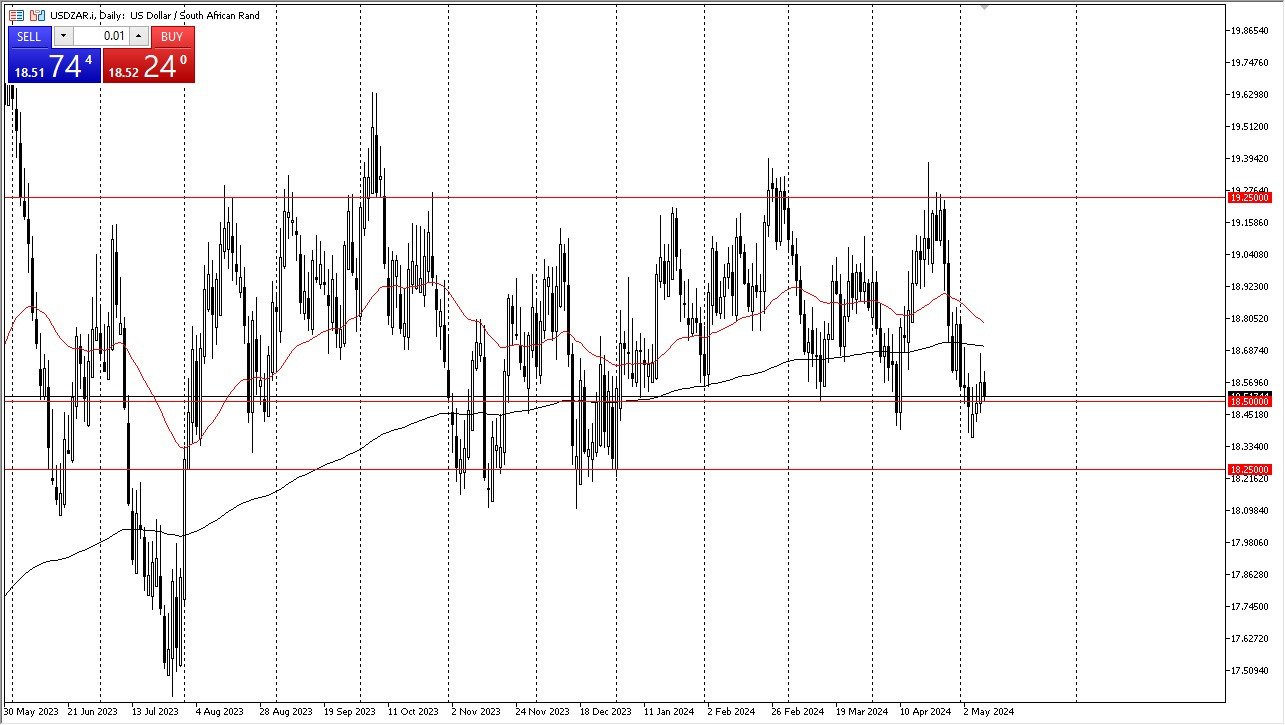

- The US dollar initially tried to rally a bit during the early hours on Thursday, but then pulled back to reach the 18.50 level.

- This is an area that's been an important support more than once, and therefore I'm not overly surprised to see that we are just hanging around in this area.

- This is an area that I think has been important multiple times and therefore it does make quite a bit of sense that we would see noise in this overall vicinity.

Compound this with the 200 day EMA sitting just above, and a little bit of choppy sideways action does make a certain amount of sense. That being said, keep in mind that the US dollar is definitely looking strong in general at this point across the board, so it is likely that eventually the greenback will take out the Rand and goes much higher. If that happens, I anticipate that you will see US dollar strength across the board in the Forex market.

Top Forex Brokers

Interest Rates Favor South Africa, So What?

However, it's worth noting that the interest rates in South Africa are 8.25%, so it's one of the few, currency pairs that we follow that actually favors the other currency from a swap perspective. However, risk appetite has a major influence on the South African rand against the US Dollar as well because it's not the first place you put money to work. However, in a situation where there are a lot of geopolitical concerns, it does make sense that the U.S. dollar should continue to be important and thoughtful as a safety asset. Check out all our USD/ZAR technical analysis here.

If we do break down from here in the 18.25 level as the next major support level. When you look at the chart, you can easily see that for at least the last year, we have been trading in this general pattern between 18.25 on the bottom and 19.25 on the top. And I think we are just building a case and a base for the market to go higher, perhaps reaching the top of this pattern again.

Ready to trade our daily Forex forecast? Here’s some of the best trading platforms in South Africa to check out.