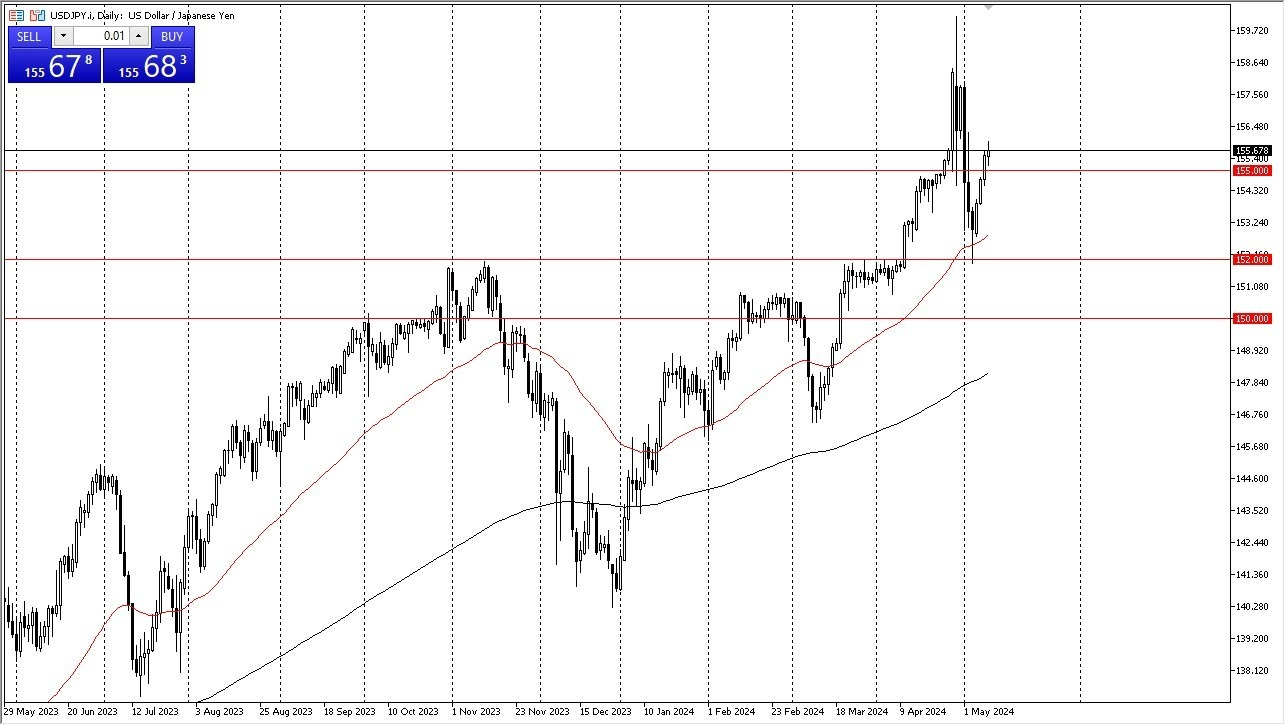

- The US dollar has gone back and forth during the course of the trading session against the Japanese yen on Thursday, as we have seen the weekly Unemployment Claims in the United States surprise to the upside, suggesting that the labor market may be struggling a bit.

- That being said, it’s likely that we will continue to see this market pay close attention to the ¥155 level, an area underneath that could offer significant support.

Top Forex Brokers

Technical Analysis

The technical analysis of course is that the USD/JPY currency pair is extraordinarily bullish, despite the fact that we have recently seen a certain amount of volatility. The volatility of course comes from the fact that the Bank of Japan has intervened, but ultimately the question remains whether or not they can intervene for very long? Quite frankly, intervention typically doesn’t work in the long term, but it can slow down the momentum of the overall market.

Short-term pullbacks at this point in time should continue to be buying opportunities and a market that has been so bullish. In fact, I think the support extends all the way down to the ¥152 level, which is just below the crucial 50-Day EMA. The 50-Day EMA has been fairly reliable over the last 6 months or so, so therefore you can somewhat think of it as a pseudo-trendline.

If we do continue to go higher, I would expect a lot of trouble near the ¥158 level, but ultimately it does look like the US dollar is going to try to get to the ¥160 level. I recognize that there are still threats of intervention, but quite frankly those end up being buying opportunities. In fact, the last time the intervention got involved in the markets, we bounced a literal textbook “break out, pullback, retest, and continuation” pattern from the previous ascending triangle that extended all the way to the ¥152 level.

At this point, the Japanese are going to struggle to be able to keep the yen from getting eviscerated, because quite frankly they have far too much in the way of debt to raise rates. The Japanese yen could very well shrink to levels not seen for 50 or even 70 years at this point. This doesn’t mean that we get there overnight, but clearly this is a bullish market.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.