Fundamental Analysis & Market Sentiment

I wrote on 21st April that the best trade opportunities for the week were likely to be:

- Long of Gold. This gave a losing trade of 2.26%.

- Long of Silver. This gave a losing trade of 5.10%.

- Long of the USD/JPY currency pair. This gave a winning trade of 2.42%.

- Long of Cocoa Futures, but with only half a normal position size. This gave a losing trade of 3.94%.

The overall result was a net loss of 8.88%, resulting in a loss of 2.22% per asset.

The last couple of weeks saw higher volatility in the Forex market, which had been relatively low since 2024 started.

Last week’s key event was the US Federal Reserve's policy release, which produced a dovish tilt. Rates were kept unchanged, as was expected practically unanimously. Still, Fed Chair Jerome Powell rejected increasing speculation that the Fed's next move would be raising rates and not cutting them. He also said that he expected that the Fed would cut later in 2024. This pushed rate cut expectations in a more dovish direction. Rate cut expectations were given a further boost by Non-Farm Payrolls data at the end of last week, which considerably undershot expectations, with only a net new jobs number of 175k when 238k had been expected, producing a surprise uptick in the unemployment rate from 3.8% to 3.9%. There was also lower-than-expected Average Hourly Earnings data, which showed a monthly increase of only 0.2% compared to the expected 0.3%.

Other important data releases were:

- German Preliminary CPI – slightly lower than expected.

- Chinese Manufacturing PMI – as expected.

- Canadian GDP – lower than expected.

- US Employment Cost Index – higher than expected.

- US CB Consumer Confidence – lower than expected.

- New Zealand Unemployment Rate – slightly worse than expected.

- US Final Manufacturing PMI – as expected.

- US ISM Manufacturing PMI – slightly worse than expected.

- US JOLTS Job Openings – slightly worse than expected.

- Swiss CPI – higher than expected.

- US Unemployment Claims – as expected.

- US ISM Services PMI – worse than expected.

Top Forex Brokers

The Week Ahead: 6th – 10th May

The most important items will be policy releases from the Bank of England and the Reserve Bank of Australia over the coming week. Apart from these, there are only a few other important releases scheduled:

- US Prelim UoM Consumer Sentiment

- US 30-Year Bond Auction

- UK GDP

- US Unemployment Claims

- Canadian Unemployment Rate

Monthly Forecast May 2024

At the start of April, the long-term trend in the US Dollar was unclear, so I did not make any monthly Forex forecast.

As May gets underway, the long-term trend in the US Dollar is still unclear, so I again make no monthly forecast.

Weekly Forecast 5th May 2024

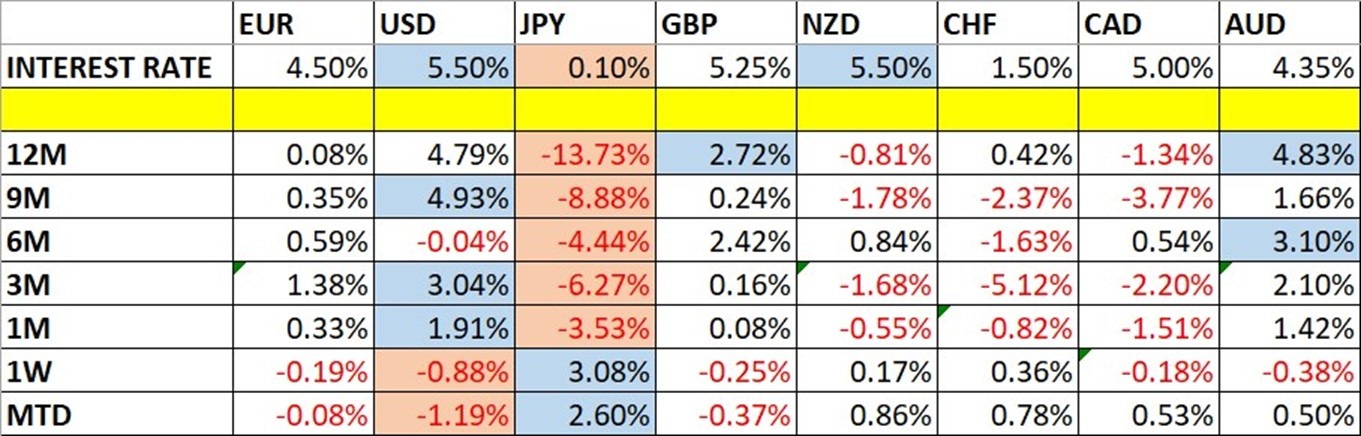

This week, I forecast that the Japanese Yen will decline against the Euro, Pound, New Zealand Dollar, Swiss Franc, Canadian Dollar, and Australian Dollar.

Directional volatility in the Forex market has increased markedly over the past two weeks, with 41% of the most important currency pairs fluctuating by more than 1% last week.

Last week, the Japanese yen showed relative strength, and the US Dollar showed relative weakness.

You can trade these forecasts in a real or demo Forex brokerage account.

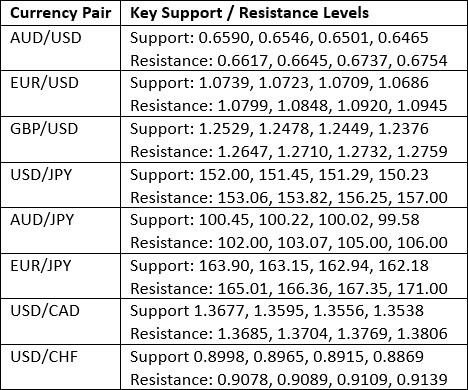

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

The US Dollar Index printed a large bearish engulfing candlestick last week after getting very close to making a new 6-month high price. The Dollar regained some of its losses, but this could be a technically significant bearish reversal.

The dollar's bearish performance last week was largely due to the US Federal Reserve ruling out a rate hike and reiterating its intention to cut rates later in 2024.

The weekly price chart below shows that the dollar has been swinging but has been in a consolidation pattern for quite a while.

The US Dollar seems to be in flux, so it may be best to avoid Dollar-focused trades over the coming week.

Japanese Yen Index

The Japanese Yen Index printed a large bullish engulfing candlestick last week after making a new 34-year low price the previous week. The Yen gave up some of its gains, but this could be a technically significant bullish reversal.

The strong recovery by the Japanese Yen was probably caused by two interventions in favour of the Yen by the Bank of Japan last week, with the second likely intervention seeming to have more lasting success.

Some analysts may be expecting the Yen to make more gains over the past week, but it is worth noting that historically, when a currency other than the US Dollar moves over 2% in a week, the following week, it rebounded against that.

This is a risky call with the Bank of Japan having an agenda of intervening, but I think the Japanese Yen will likely weaken somewhat over the coming week, with a rebound against last week’s excessive gain.

AUD/JPY

I expect the AUD/JPY currency cross to gain in value over the coming week because currency crosses tend to rebound after making exceptionally volatile directional moves, as seen here last week.

This suggests a long trade could work well over the coming week. One strategy might be to buy at the open and use a stop loss of half an average week's true range over a long-term average.

More conservative traders might wait for either:

- A retracement to any of the three nearby support levels above ¥100.00 followed by a bullish bounce or

- A sustained bullish breakout above ¥102.00.

This could be one of the best potential Yen crosses to trade long over the coming week because the cluster of support levels just above ¥100.00 looks likely to provide firm support.

CAD/JPY

I expect the CAD/JPY currency cross to gain in value over the coming week because currency crosses tend to rebound after making exceptionally volatile directional moves, as seen here last week.

This suggests a long trade could work well here over the coming week. One strategy might be to buy at the open and use a stop loss of half an average week's true range over a long-term average.

More conservative traders might wait for either:

- A retracement to the nearby support level at ¥111.32 followed by a bullish bounce or

- A sustained bullish breakout above ¥113.81.

A long trade here would have the advantage of being very near support, assuming no price gap at the weekly open, so a relatively tight stop loss might be used.

CHF/JPY

I expect the CHF/JPY currency cross to gain in value over the coming week because currency crosses tend to rebound after making exceptionally volatile directional moves, as seen here last week.

This suggests a long trade could work well here over the coming week. One strategy might be to buy at the open and use a stop loss of half an average week's true range over a long-term average.

More conservative traders might wait for either:

- A retracement to the nearby support level at ¥168.03 followed by a bullish bounce or

- A sustained bullish breakout above ¥170.63.

A long trade here would have the advantage of being very near support, assuming no gap at the weekly open, so a relatively tight stop loss might be used.

EUR/JPY

I expect the EUR/JPY currency cross to gain in value over the coming week because currency crosses tend to rebound after making exceptionally volatile directional moves, as seen here last week.

This suggests a long trade could work well here over the coming week. One strategy might be to buy at the open and use a stop loss of half an average week's true range over a long-term average.

More conservative traders might wait for either:

- A retracement to the nearby support level at ¥163.90 followed by a bullish bounce or

- A sustained bullish breakout above all three nearby resistance levels at ¥165.00, ¥166.36, or ¥167.35. Waiting for the price to get beyond all of them would be safest.

A long trade here looks tough as there are three resistance levels close enough to suppress the price but distant enough to make a good breakout look unlikely, so it may be better to trade other Yen crosses long this week.

GBP/JPY

I expect that the GBP/JPY currency cross will gain in value over the coming week because currency crosses tend to rebound after making exceptionally volatile directional moves, as was seen here last week.

This suggests a long trade could work well here over the coming week. One strategy might be to buy at the open and use a stop loss of half an average week's true range over a long-term average.

More conservative traders might wait for either:

- A retracement to the nearby support level at ¥191.68 followed by a bullish bounce or

- A sustained bullish breakout above either the two nearby resistance levels at ¥192.88 or ¥195.75.

A long trade here looks somewhat tough. Two resistance levels are close enough to suppress the price but distant enough to make a good breakout look unlikely, so it may be better to trade other Yen crosses long this week.

NZD/JPY

I expect the NZD/JPY currency cross to gain in value over the coming week because currency crosses tend to rebound after making exceptionally volatile directional moves, as seen here last week.

This suggests a long trade could work well here over the coming week. One strategy might be to buy at the open and use a stop loss of half an average week's true range over a long-term average.

More conservative traders might wait for either:

- A retracement to the nearby support level at ¥91.68 followed by a bullish bounce or

- A sustained bullish breakout above all three nearby resistance levels at ¥92.07, ¥92.56, or ¥93.76. Waiting for the price to get beyond all of them would be safest.

A long trade here looks tough. Three resistance levels are close enough to suppress the price but distant enough to make a good breakout look unlikely, so it may be better to trade other Yen crosses long this week. Trading a breakout beyond the second resistance level at ¥92.56 might be a good compromise, as that is not very distant from last week's closing price.

Bottom Line

I see the best trading opportunities this week as follows:

- Long of the AUD/JPY currency cross. This is probably going to be the best trade.

- Long of the CAD/JPY currency cross. This is probably going to be one of the better trades.

- Long of the CHF/JPY currency cross. This is probably going to be one of the better trades.

- Long of the EUR/JPY currency cross.

- Long of the GBP/JPY currency cross.

- Long of the NZD/JPY currency cross.

Ready to trade our Forex weekly analysis? We’ve shortlisted the best Forex trading brokers in the industry for you.