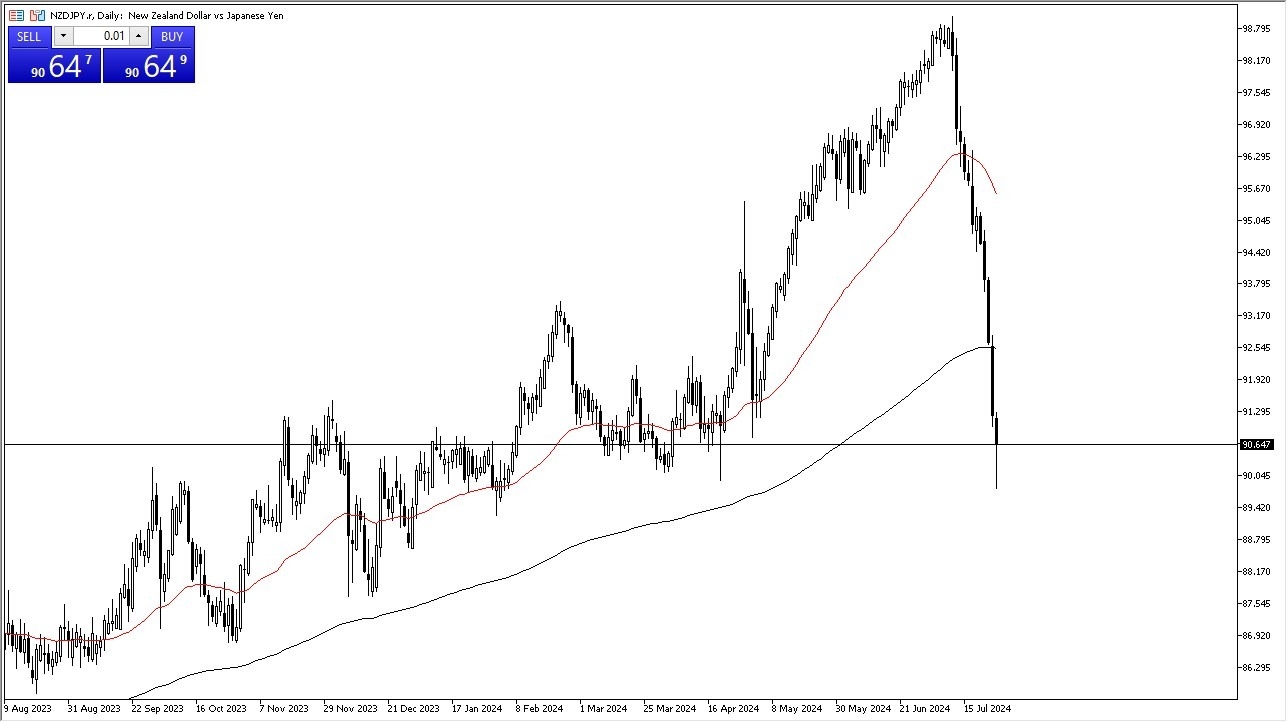

Potential signal:

- I am a buyer of this pair if we can break above the ¥91.33 level, with a stop loss at the ¥90 level.

- At that point, I would be aiming for the ¥92.75 level.

In my daily NZD/JPY analysis, it’s hard not to notice that this has been like a “falling knife” as of late, and therefore sooner or later we needed to see some type of bounce. We may have seen that in the early hours during the trading session on Thursday, but quite frankly I think this is a situation where we will continue to see a lot of noisy behavior, but keep in mind that the interest rate differential is a mile wide between these 2 currencies, and eventually that will come back into play.

Top Forex Brokers

New Zealand of course is an economy that is highly sensitive to the commodities markets, so with that in mind, you will have to watch a lot of soft commodities to see how that goes. Furthermore, New Zealand is almost solely held by what’s going on in the Chinese economy, which obviously is a bit ugly considering that the Peoples Bank of China can’t stop cutting rates suddenly. In other words, New Zealand may have some problems with its biggest customer.

Technical Analysis

This is without a doubt a very bearish market, and just about anybody on the planet who can take a look at this chart can figure that out. We have completely collapsed at this point, so I think you have to look at this through the prism of a market that is oversold, and we could get a massive bounce. Quite frankly, would not surprise me at all to see this market bounce toward the 200-Day EMA, which is closer to the ¥92.75 level. In general, this is a market that I think continues to be very noisy and negative, but I do think that we are closer to the bottom then the top, and therefore I think it’s probably only a matter of time before we move to the upside. Because of this, I do think that you have an opportunity here, but you need to recognize that you are going to be dealing with a lot of volatility.

Want to start trading daily Forex signals? Get our top Forex brokers to work with here.