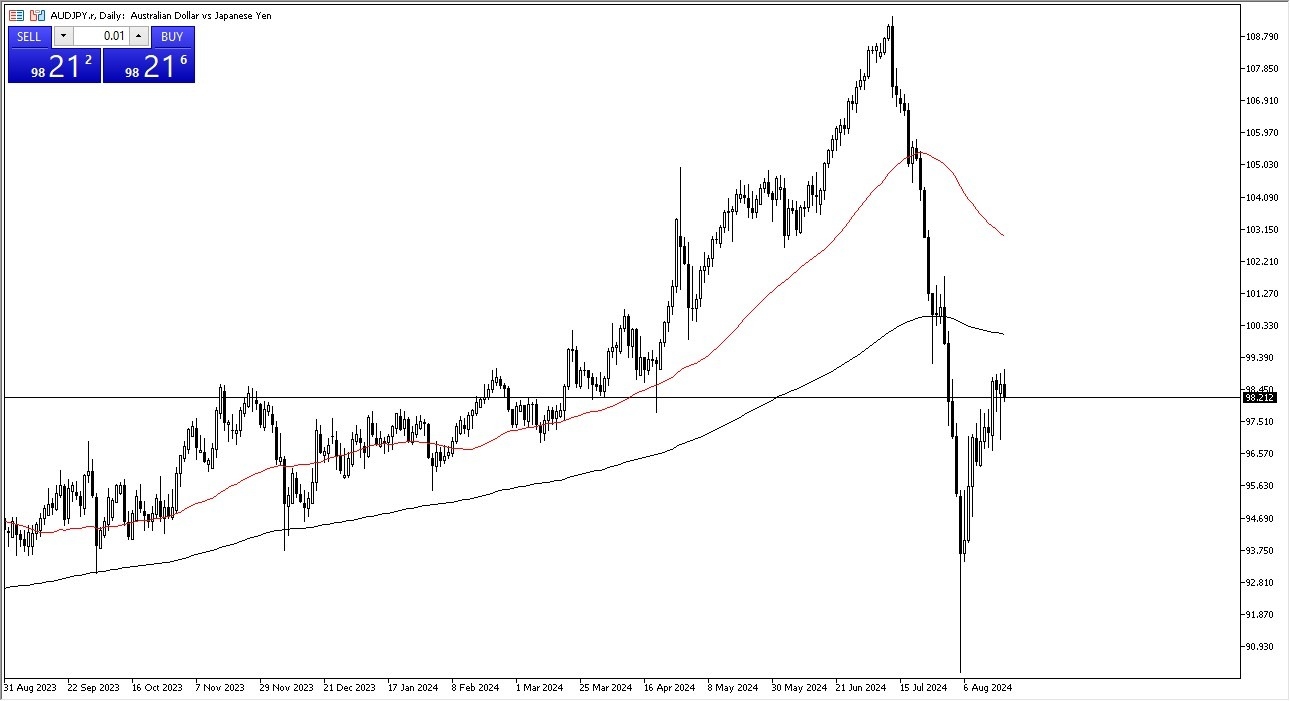

- The first thing I notice is that we have given back an attempt to break out to the upside and it suggests that perhaps we are not quite ready to see enough momentum come into the market to push things to the upside for a bigger move.

- That being said, the market will continue to look at the ¥98 level as an area of importance, and I do believe that if we break down below there we could go looking to the ¥96.50 level.

On the other hand, if we were to turn around and rally from here, we need to keep a close eye on the 200-Day EMA, which is near the ¥100 level, which in and of itself will attract a lot of attention as well. If we can break above there, then the market is likely to go much higher, perhaps reaching toward the ¥103 level. In general, this is a market that I think continues to be noisy, especially as there are a lot of questions asked about the overall risk appetite of traders around the world.

Top Forex Brokers

Carry Trade Over?

At this point, a lot of traders are starting to ask whether or not the carry trade is over. This involves borrowing Japanese yen and buying assets in other parts of the world as there are massive amounts of interest rate differentials out there that you can pick from, and of course Australia is one of the places that people go looking to in order to make money on the Japanese yen loans. By purchasing bonds that pay more, as long as the currency markets are relatively stable, this is a situation where people just simply “print money.”

The question now is whether or not the carry trade is over. Pay close attention to the overall monetary flows around the world, and you should also keep in mind that this is why JPY-related pairs all tend to move the same, because it’s all about the carry trade. In other words, you can watch other currency pair is to get a bit of a “heads up” as to where this market might go.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.