Friday’s trading in WTI closed with a sustained move higher and Monday’s opening could prove to be dramatic depending on developing news from the Middle East.

- Let’s get the noise out of the way immediately.

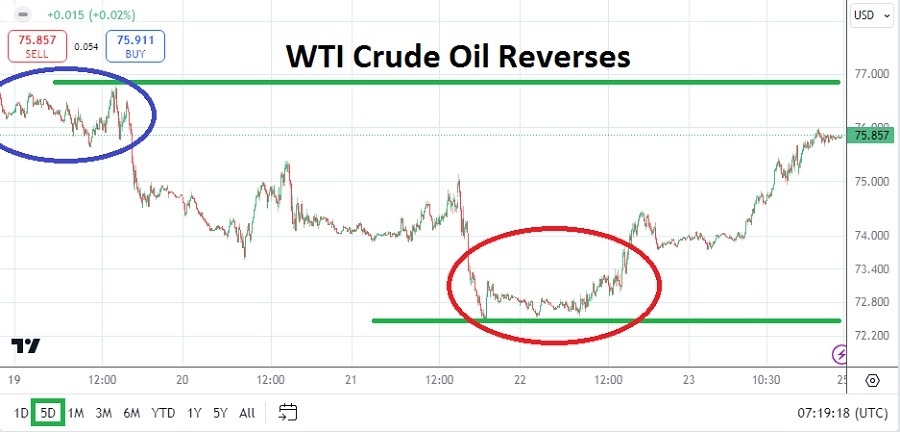

- On Thursday of last week WTI Crude Oil was trading rather serenely around a low of 72.520, a mark it had traded below on Wednesday, but suddenly the commodity began to traverse higher.

- It is suspected that news of an oil tanker in the Red Sea coming under attack and being abandoned played into some nervousness.

- There is also the possibility that the reversal higher which began on Thursday was a natural reaction to too much selling.

The price of WTI Crude Oil continued to climb on Friday and as the weekend approached, the commodity finished near 75.857 which were values below the starting point when last Monday’s trading began. The acknowledgement that Crude Oil finished technically below its start for the week could prove to be a worthwhile consideration. However, news from the Middle East has not stopped, tensions between Hezbollah and Israel escalated very early this morning and Iran continues to rattle swords.

Top Forex Brokers

Drama Not Going to Stop From the Middle East

Having pointed out the oil tanker trouble and this morning’s conflict in Lebanon and Israel it is now up to large players in the WTI Crude Oil market to decide if they are tranquil with current conditions. While the price of the energy climbed on Friday likely because of nervousness, WTI did spend the last three hours of its trading on Friday within a tight sustained range. The ability to finish in a rather tight range shows traders were not buying blindly.

When traders begin their pursuit of WTI Crude Oil this week inexperienced speculators may lean into buying positions assuming that nervousness will climb in the commodity again. Yet, experienced traders know that large players in WTI Crude Oil are rather immune to noise which doesn’t directly impact their outlooks. A game changer is possible in the coming hours, but if Iran stays relatively quiet it is possible WTI Crude Oil may open relatively calmly. There are no guarantees obviously and traders should monitor the new today and early tomorrow.

Higher Prices Possible but Resistance Has Been Durable

Early trading tomorrow will tell a lot of the story for WTI Crude Oil this week. If trading is relatively tranquil and traders do not suddenly leap into buying positions it may mean that large participants remain comfortable with the current price range. A price between 74.000 and 79.000 look technically feasible this coming week.

- Traders also need to remember that fear has been priced into WTI Crude Oil already; the tensions which are being displayed today have been an ongoing sags in the Middle East since October of 2023.

- Large traders understand the dynamics of WTI Crude Oil and the effect tensions in the Middle East can cause, but also understand they are often given too much attention.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 73.900 to 79.200

Support for WTI Crude Oil will prove to be interesting this week, if the commodity drops below the 74.000 level by Wednesday this would highlight a rather comfortable outlook and other lows could be tested again. Economic data from North America, Europe and Asia continues to be rather lackluster.

However, if WTI Crude Oil starts Monday higher and is still pushing upwards by late Tuesday that would likely mean Middle East tensions have caught the attention of large players. The 76.000 to 77.000 level could prove important in the coming days as a barometer and if the higher price is challenged it may be a location traders look for reversals – if the Middle East can remain relatively calm per its current status quo.

Ready to trade our weekly forecast? Here are the best Oil trading brokers to choose from.