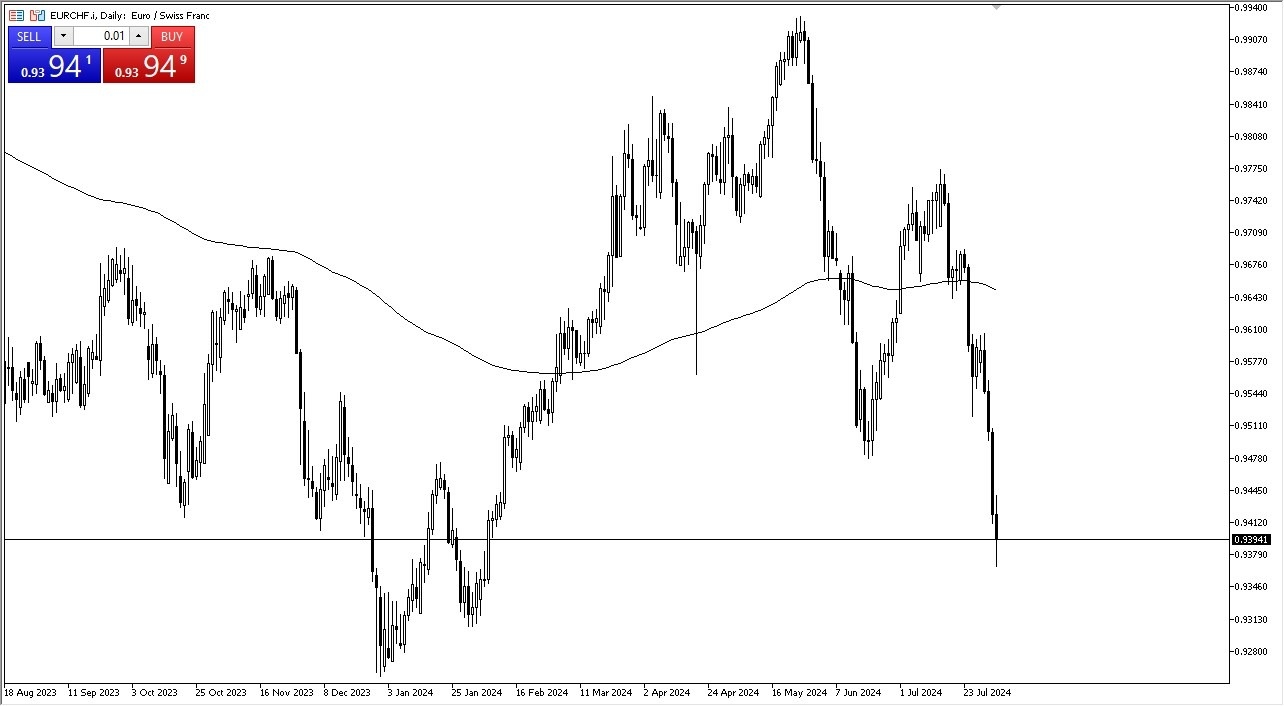

- It’s easy to see that the EUR/CHF pair is falling off of a cliff.

- We broke well below the 0.94 level during the trading session on Friday as traders are looking toward the safety currencies for a bit of a place to hide.

- Needless to say, with the jobs number in the United States coming out at 114,000 jobs added for the month of July instead of the expected 175,000 jobs, there has been a dull being of anything that’s considered to be risky.

Technical Analysis

Looking at the technical analysis in this pair, it’s easy to see that the market is oversold. You don’t need to be a market wizard to see that. However, as long as there are a lot of people out there terrified that the economy is going to fall apart, it does make a certain amount of sense that money would run into Switzerland. Remember, the European Union is struggling overall, so if we start to lose the United States, then it’s going to be a rush toward the safety Haven such as Switzerland and Japan.

Top Forex Brokers

Underneath, I see the 0.93 level is a major support level and I think a lot of people will look at it in the same vein. In fact, although I don’t necessarily like the idea of trying to buy this pair, I don’t want to chase it to the downside either. In fact, I will be watching this on the weekly timeframe in order to see whether or not I can find some type of bounce that’s worth buying. Quite frankly though, this will more or less end up being a tertiary indicator for the Swiss franc from what I see, due to the fact that the market is likely to use this as a barometer on what to do with the CHF against a multitude of other currencies, as the EUR/CHF pair is heavily traded across the borders. In general, this is a market that I think you have a situation where we are getting close to the bottom, but we need to see some type of reaction in order to put any money to work.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.