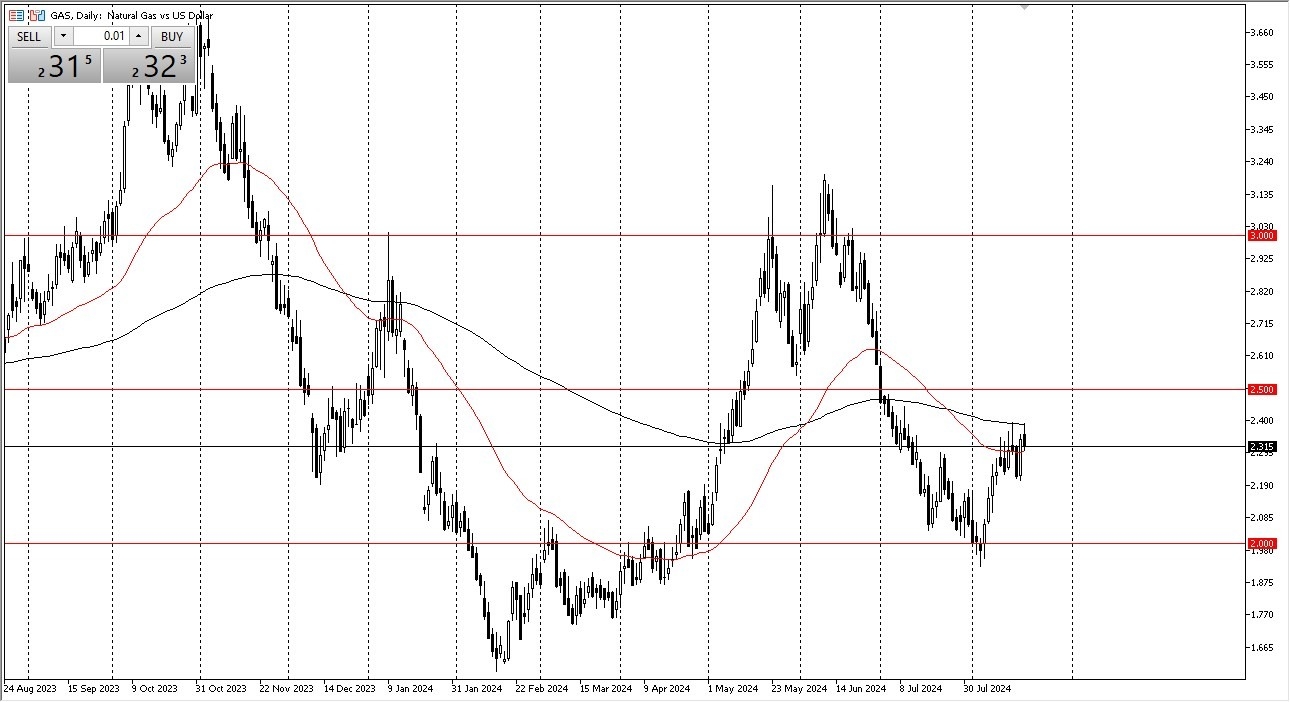

- The natural gas market initially trying to rally during the early hours on Tuesday but continues to struggle with the idea of the 200 day EMA offering a bit of a ceiling.

- We've seen this happen a couple of times here recently, and it suggests to me that the market is not quite ready to take off to the upside for a bigger move.

- This is not a huge surprise, considering that this time of year is typically rather poor for natural gas anyway.

The recent rise might have something to do with concerns about a hurricane in the Caribbean or perhaps the heat in the south which did pick up quite a bit. That being said we are getting late in the summer and traders may start to think about the idea of whether or not that cyclical trade will come into play again. After all heating demand will pick up in the United States rather soon. If and when that happens, it's likely that we will, of course, see natural gas demand soar right along with it, driving prices higher. This is a well-known phenomenon every year and a trade I take advantage of every year as well. I don't do it with a big position though, because quite frankly, I understand that natural gas is extraordinarily volatile.

Top Forex Brokers

Caution is the Better Part of Valor

I don't use leverage. I use an ETF, probably the best way to go at this point, as the market is clearly going to be one that could take off to the upside as we see temperatures plunge, but you also see these vicious pullbacks, even in the wintertime. I don't have any interest in shorting the market though, because it is so bullish that there's no point in going down that road at the moment.

The $2 level underneath, I think offers a bit of a interim floor. And as long as that's going to be the case, I think that short-term pullbacks towards that area might open up the possibility of buying ETF positions or adding to it in my case, and just hanging on to it until we get the next spike for winter trading. If you don't have the ability to use ETFs, you can always use CFDs, just use very small positions.

Ready to trade daily Forex analysis? We’ve shortlisted the best commodity brokers in the industry for you.