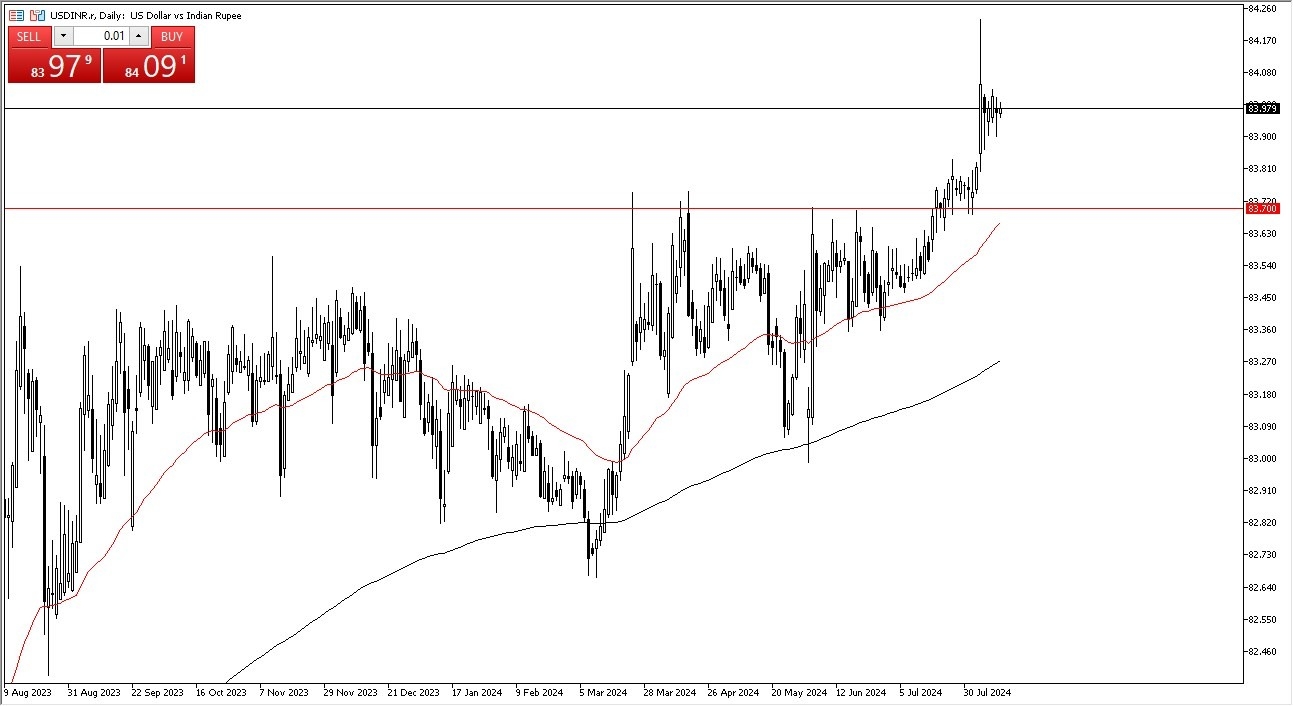

- I noticed that we continue to hang around the 84 Rupee level.

- This is an area that has been somewhat resistive over the last week or so, so I think at this point in time it’s going to be very interesting to see whether or not we can break out to the upside.

- I think at this point, the market is likely to continue to see a lot of volatility, which makes a certain amount of sense considering that the global markets are all over the place.

Technical Analysis

The technical analysis for this market of course is very bullish, as we have rallied quite significantly, but I also would point out that we have stalled over the last several sessions. If we do pull back from this point in time, we could go looking to the 83.70 Rupee level, which is an area previously serving both as resistance and then later, support. Furthermore, we also have the 50-Day EMA racing toward that area, and therefore I think you’ve got a situation where it should offer a bit of a floor in the market.

Top Forex Brokers

You also have to keep in mind that the Central Bank of India has major influence on this pair, as it is likely that the central bank will continue to let the USD/INR pair trade in a little bit of arrange, but over time, they have to worry about the external factors around the world, not the least of which will be risk appetite. If there continues to be a lot of concern, it makes a certain amount of sense that the US dollar will continue to rally. Short-term pullbacks at this point in time should be thought of as value, unless of course the Federal Reserve suddenly changes its overall monetary policy in an aggressive manner. If they do not, it’s likely that the market should continue to go higher over the longer term, because quite frankly the economic outlook for the globe isn’t exactly strong.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading apps in India to choose from.