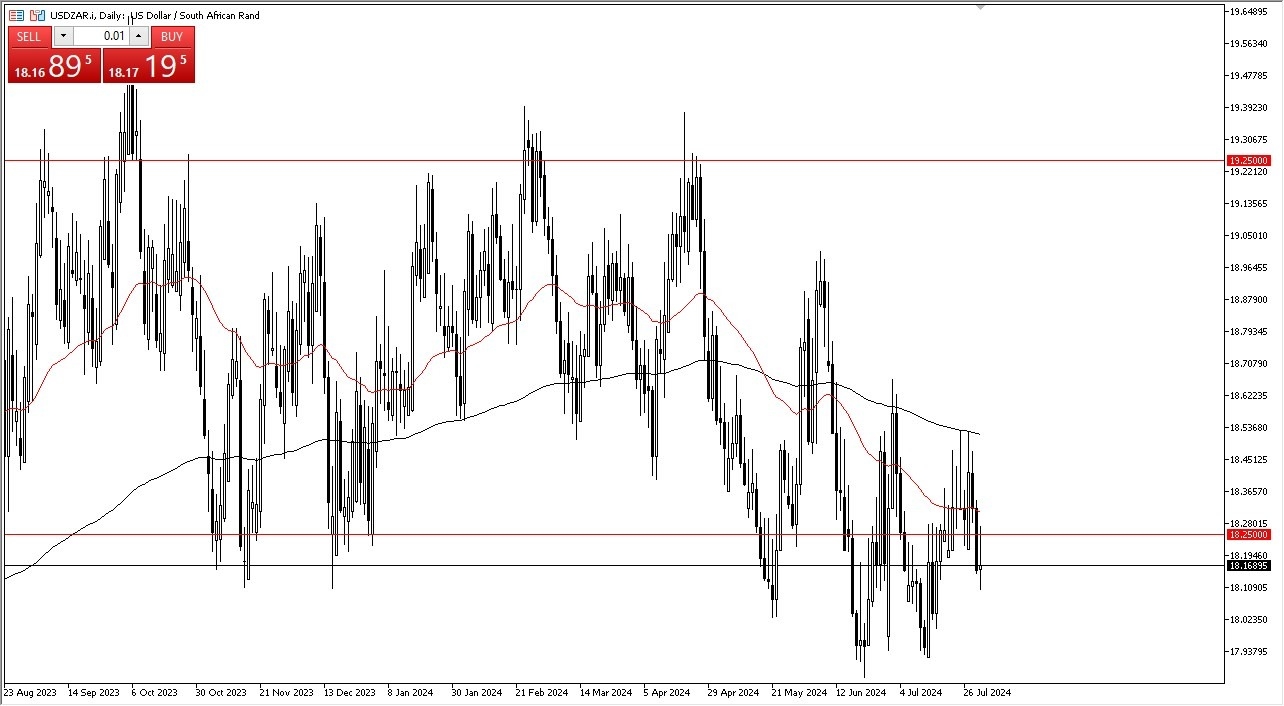

- In my daily analysis of the dollar against the Rand, the first thing I notice is that the 18.25 South African Rand level is an area that a lot of traders seem to be paying attention to.

- We did try to rally and break above there, but could not hang on to the gains, and it tells me that we are in the midst of still trying to sort out whether or not we can bounce from here.

That does make a certain amount of sense. I mean, after all, we have the jobs number coming out on Friday. And it's probably worth noting that the interest rates in South Africa are currently 8.25% much higher than the United States. So, it does pay you to short this USD/ZAR pair. However, if we enter a situation where we can, or risk off, then, that will help this pair rally and perhaps recapture the 50 day EMA. The jobs number could perhaps show that as a need. If that happens, then we could go to the 200 day EMA, which is right around the 18.50 level, followed by the 19 area. On the downside, the 17.92 level seems to be a little bit of a short-term floor. So, it'll be interesting to see how this plays out, but we are most certainly in an area of inflection on longer term charts, as we are in multiple currency pairs right now.

Top Forex Brokers

Emerging Markets

Keep in mind that emerging market currencies will continue to be very risk sensitive, and at this point in time it looks like risk appetite may be struggling. If that’s going to be the case, and especially if it looks like we are about to see massive economic slowdown, it makes quite a bit of sense to see the South African Rand take it on the chin versus the greenback, because most large investors will be looking toward something like the US Treasury market and US assets in general to protect their portfolios.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers with ZAR accounts to choose from.