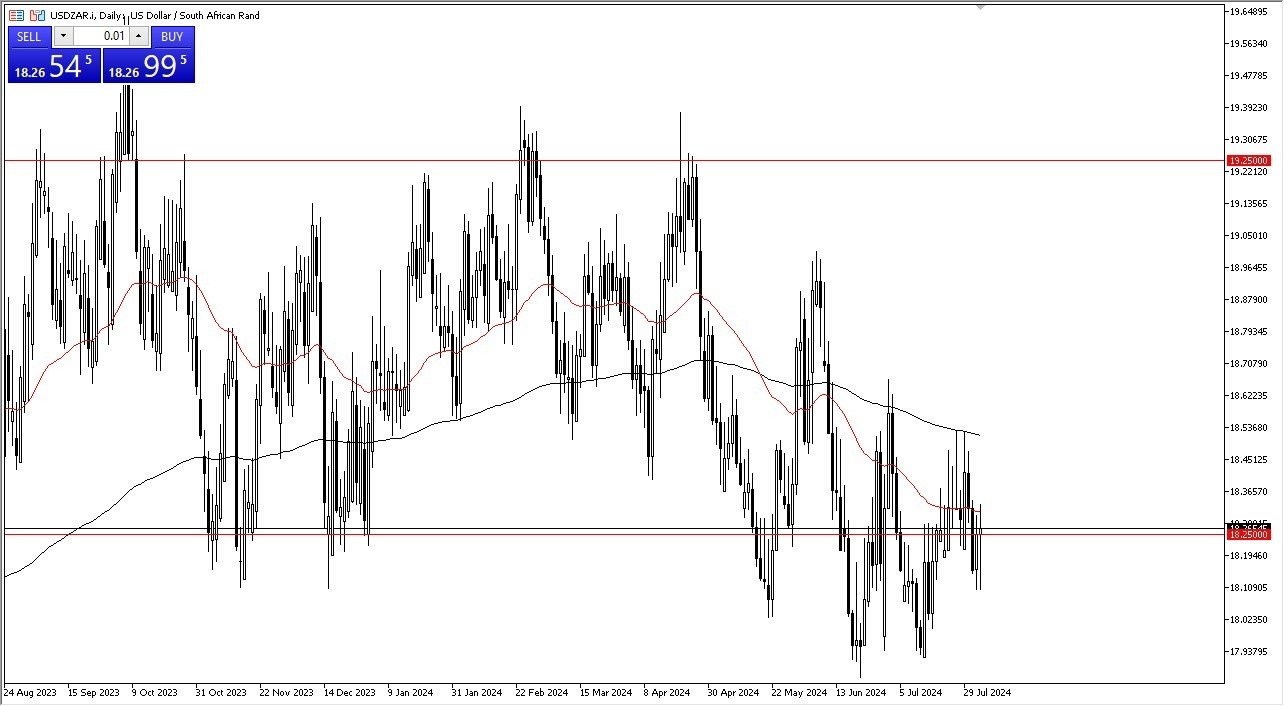

- In my daily analysis of the US dollar against the South African Rand, it's obvious that we continue to hang around the 18.25 level.

- This area has been a bit of a magnet for price and therefore it's not a huge surprise to see the market head back to that area.

- Friday has been very noisy as the jobs report in the United States came out with an addition of 114,000 jobs for the month of July while the market expected 175,000.

Because of this, it was a massive shot to risk appetite during the trading session on Friday, and I think that continues to be the one thing that people pay attention to, whether or not the global economy is starting to slow down. As things stand right now, the United States is the last great hope for strength, so if we were to start seeing the US economy fall apart, it will certainly make ripples throughout the global financial system. That being said, we have been choppy over the last couple of weeks.

Top Forex Brokers

Noisy Volatility Ahead

In other words, this is a market that has continued to be very noisy, and the Friday drama of course has not helped. Keep in mind the interest rate differential favors South Africa slightly but over the longer term this is a market that tends to move on risk on or risk off behavior. If we get more risk off behavior, we could very well see the US dollar strengthen against the South African Rand as well as other emerging market currencies.

Underneath we have a lot of support at the 17.92 level offering massive support. But at the same time, we have the 18.53 level above offering massive resistance at the 200 day EMA. As things stand right now, it looks to me like the USD/ZAR market is just simply bouncing around the same area it has been in for the last couple of weeks. Ultimately, it remains neutral, but we do have a couple of levels worth paying close attention to give us an idea as to where the market's going next.

Ready to trade our daily USD/ZAR Forex analysis? Here's a list of the best forex trading platforms South Africa to choose from.