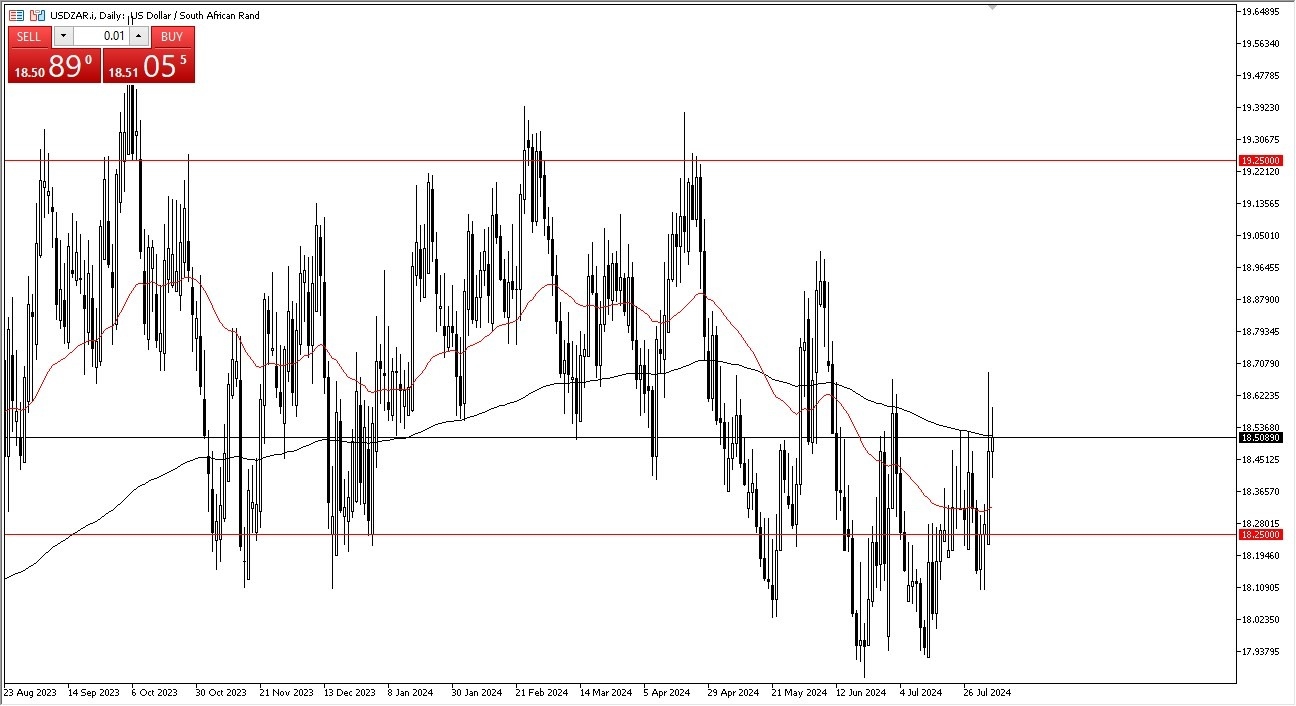

- The US dollar has been bullish against the South African rand for the last couple of days, showing signs of life from an extremely oversold condition.

- At this point, I think you've got a scenario where traders will continue to look at this through the prism of risk on versus risk off as the US dollar is most certainly a safety currency.

The 18.25 level has offered significant support, just as the area right below it has. Ultimately, when I look at this mark and I recognize that the 18.7 level is an area that a lot of traders will be paying attention to because it could open up further US dollar strength. In an environment where most people are concerned about the global economy, it's difficult to imagine a scenario where people want to go running toward the South African rand and away from the greenback.

Top Forex Brokers

The Fed May Cut. However, Its Not Bullish for Risk

The Federal Reserve may start cutting rates, but I believe that is more or less a short term phenomenon for U.S. dollar weakness. Once they start cutting rates, people will begin to worry about whether or not they are behind on the curve. At this point, we would have to see some type of blood in perhaps the Treasury markets driving the US dollar higher.

I think that we are closer to the bottom than the top of the overall range. So, I do think that we've got a situation where buyers will, more likely than not, continue to buy dibs. If we were to break down below the 17.93 level, then we could see the US dollar capitulate. But that is more likely than not, would see US dollar weakness around the world. And in this risk off type of environment, it would take a lot to make that happen.

Ready to trade our daily USD/ZAR forecast? Here’s some of the best trading platforms in South Africa to check out.