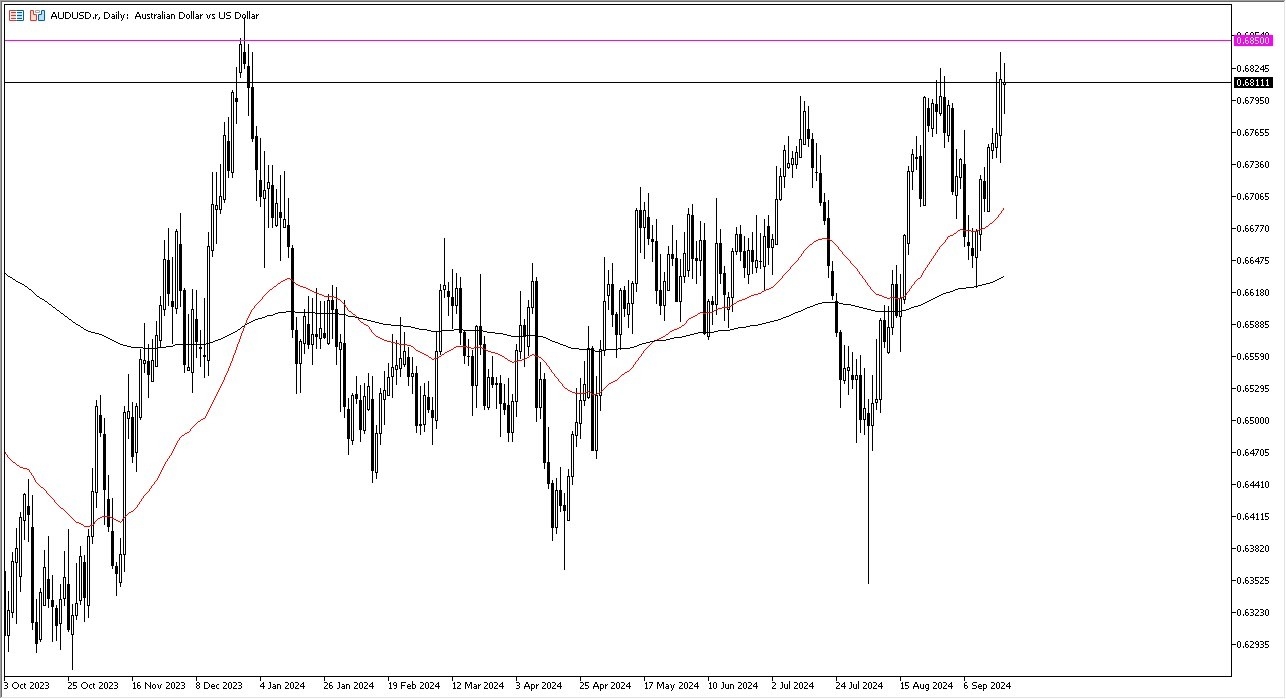

- The first thing I see is that we continue to see a lot of resistance just above, especially near the 0.6850 level, an area that has been a major barrier for quite some time.

- If we can break above that, then obviously changes a lot but right now it looks as if it will continue to be very difficult to come, and therefore I think we are getting closer to the top then we are the bottom.

It’s worth noting that the candlestick is a bit of a hammer, but if we were to break down below the bottom of the candlestick for the trading session on Friday, then it would turn into a “hanging man.” The hanging man is considered to be a major negative sign, and therefore could see a lot of sellers jumping into the market. In this environment, the market goes looking to the 50 Day EMA, which of course is an indicator that a lot of people pay attention to. That is currently just about at the 0.67 level, so I think it all comes together as an important level.

Top Forex Brokers

If We Break Out

if we were to break out, I think it would not only be a positive sign for the Australian dollar, but it probably would coincide with a lot of selling pressure in the US dollar overall. The US dollar of course is going to move in the same general direction everywhere, due to the fact that this is a measurement of risk appetite at the moment. After all, the Federal Reserve has cut interest rates by 50 basis points this week, so while we are seeing the US dollar softened overall, the reality is that the AUD/USD market could see things turn around if all of the sudden we get a lot of “risk off behavior”, as traders could run into the treasury markets. Ultimately, I think we are at a major point of inflection.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.