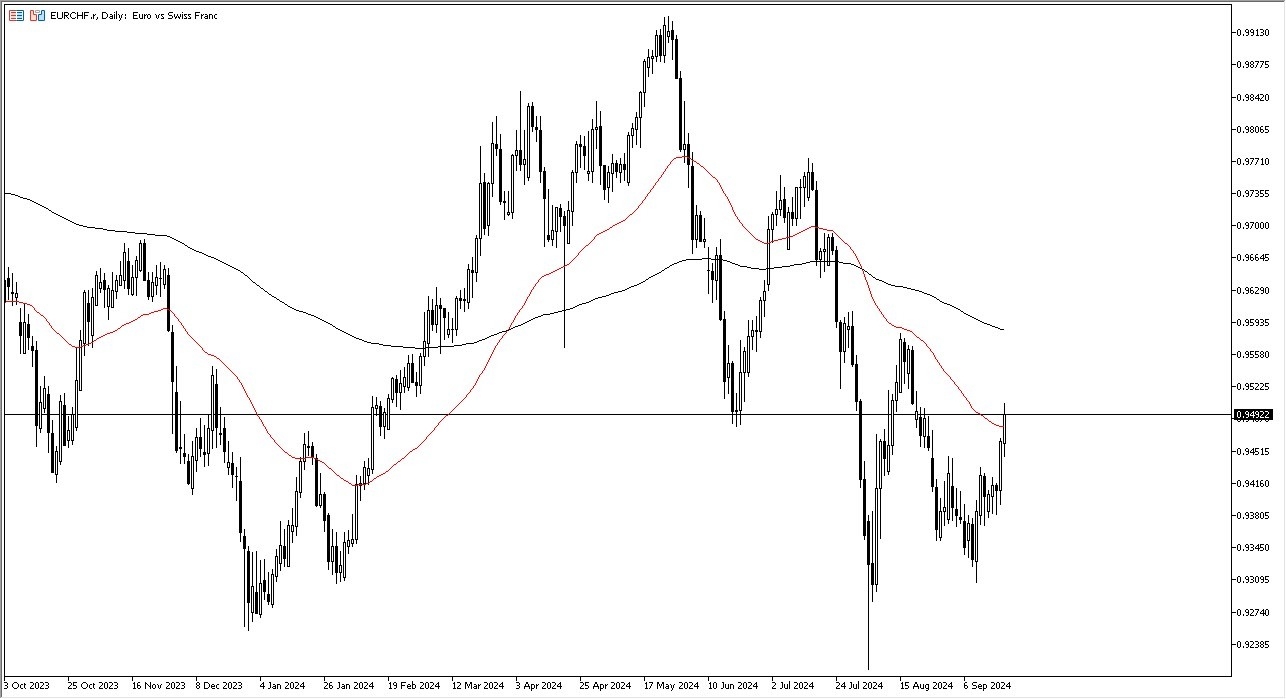

- The euro rallied a bit again during the trading session on Friday, breaking above the 50 day EMA to show signs of strength.

- This is a continuation of a bigger move from the Thursday session, and the question now is whether or not we can continue to go higher, as there has been a lot of pressures, but at the end of the day, the market sees momentum being important.

I think the 0.95 level has offered a little bit of resistance, and that makes a certain amount of sense because the market is so technically driven. And of course, this is an area that had been both support and resistance model times in the past. So, we're kind of at a point of inflection. If we can continue to go higher, then it's possible that the market could go looking to the 200 day EMA, which is fairly close to the 0.96 handle.

Top Forex Brokers

A pullback at this point in time could see support near the 0.9433 level, which is an area that had been significant resistance. I do think this is a market that's worth watching because it is a gauge on risk appetite. Remember, when risk appetite is stronger, money tends to flow into the European Union. However, if people are concerned about risk appetite, then we could see the money flow into Switzerland.

How This Pair Typically Works

For example, German traders will quite often put money away in Switzerland if they are worried about growth in the EU. And of course, take that money out of Switzerland when they want to invest in a riskier market such as Spain. So, with all of that being said, I think you've got a situation where we are at a major inflection point. It'll be interesting to watch. This is a market that even if you don't trade, you want to watch because it will give you an idea of what to do with other markets.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.