Fundamental Analysis & Market Sentiment

I wrote on 18th August that the best trade opportunities for that week were likely to be:

- Long of the EUR/USD currency pair. This produced a winning trade worth 1.48%.

- Long of Gold in USD terms. This produced a winning trade worth 0.24%.

- Long of the S&P 500 Index following a daily close above 5,668. This did not set up.

Top Forex Brokers

These trades gave a total win of 1.72%, averaging a win of 0.57% per asset.

Last week’s key takeaways were:

- US Preliminary GDP data came in higher than expected over the previous quarter, showing annualized growth of 3.0% when 2.8% was expected. This was a bit hawkish for the USD as it relieved a little pressure for rate cuts on the Fed.

- US Core PCE Price Index data, often seen as a key inflation metric, came in as expected, with a 0.2% month-on-month increase.

- German Preliminary CPI (inflation) data came in lower than expected, showing a month-on-month deflation of 0.1% when no change was expected.

- The Eurozone CPI flash estimate came in as expected, showing an annualized rate of 2.2%.

- Australian CPI data came in a fraction higher than expected, at 3.5% annualized, while 3.4% was expected.

- Canadian GDP data showed no growth, but monthly growth was expected to be 0.1%, which was a minor disappointment.

- US CB Consumer Confidence data was slightly stronger than expected, which will be hawkish for the USD.

- US Unemployment Claims data came in almost exactly as expected.

- Chinese Manufacturing PMI data came in a fraction below expectations.

The Week Ahead: 2nd – 6th September

It will be a busier week ahead in terms of data, with the most important items this coming week expected to be:

- US Non-Farm Payrolls and Average Hourly Earnings—these will be key in influencing the US Federal Reserve's decision to make a second rate cut in its first meeting after the September meeting.

- US JOLTS Job Openings

- US ISM Services PMI

- Bank of Canada Rate Statement and Overnight Rate: The Bank is expected to cut its Overnight Rate by 0.25% from 4.50% to 4.25%.

- Swiss CPI (inflation)

- Australian GDP

- US Unemployment Claims

- Canadian Unemployment Rate

Monday will be a public holiday in the USA and Canada.

Monthly Forecast September 2024

I forecasted that the EUR/USD currency pair would rise in value during August. The performance of my forecast was as follows:

I forecast that the EUR/USD currency pair will again increase in value in September.

Weekly Forecast 1st September 2024

Last week, I made no weekly forecast, as there was no large group of currency crosses with unusually large directional movement, which is the basis of my weekly trading strategy.

This week, I again give no weekly forecast, as no currency pairs/crosses fluctuated in value by more than 2%. The odds of profitable reversals are better when several crosses have abnormally large price movements.

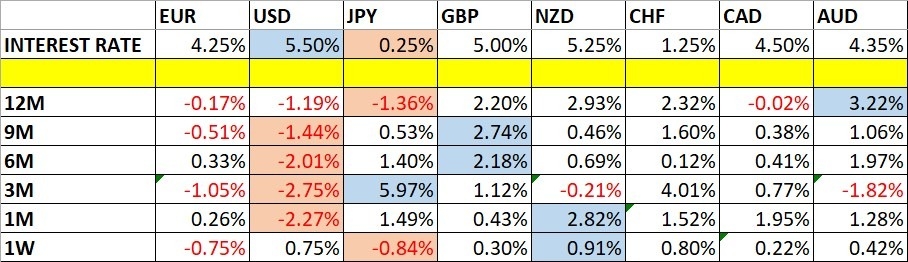

Directional volatility in the Forex market fell last week—26% of the most important currency pairs and crosses fluctuated by more than 1%.

Last week, the New Zealand Dollar was the strongest major currency, while the Japanese Yen was the weakest.

You can trade these forecasts in a real or demo Forex brokerage account.

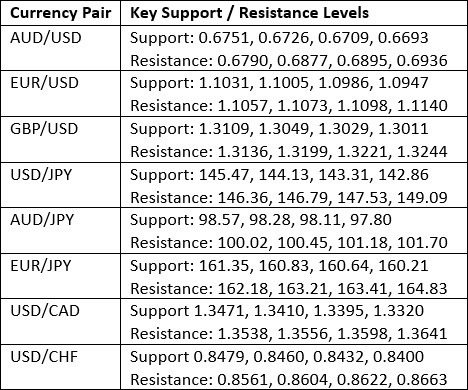

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

The US Dollar Index printed a bullish candlestick last week, with the close very near the high of the week’s range, indicating short-term bullish momentum. However, the price is below its levels three and six months ago, suggesting a long-term bearish trend in the greenback. Recently, the price broke down below the long-term consolidating triangle pattern, which was a significant bearish sign.

The overall picture is bearish, but it makes sense to see what happens to this new recovery by the US Dollar. Data from last week suggested that the US economy is still stronger than expected, which cast some doubt on the increasing expectations for further rate cuts by the Fed after its September meeting. There is only a 50% expectation that there will be a second rate cut at the November meeting.

This week, I am cautiously bearish on the US Dollar due to the bearish trend. However, I would like to see a lower daily close first to confirm that bias.

EUR/USD

The EUR/USD currency pair ended the week before last at a new 1-year high, making a very bullish close at the top of its weekly range just below $1.1200.

This was a very bullish sign, but the price spent the past week making a deep bearish retracement and ended the week closing right on its low.

Stronger-than-expected US economic data last week gave the move a tailwind, suggesting the Fed may not be able to cut rates as quickly as many hope.

The price ended the week very close to 3 times the 100-day ATR indicator lower than the previous weekly close, suggesting that most trend traders will be very close to exiting long trades here.

I think a long trade here is still a good possibility, provided that the nearest support level at $1.1031 survives, and we get a daily close this week above the nearest resistance level at $1.1057.

USD/JPY

Last Tuesday, the USD/JPY currency pair made its lowest close in over eight months at about ¥144, drawing a short trade entry from trend traders like me. I was doubtful about this trade, and so far, my doubts seem to have been proven correct, as the price action twice rejected this area with bullish lower wicks, which can be seen in the hourly chart below. The price has advanced now by more than 200 pips from the entry point.

Many people in Japan are betting on a stronger Yen as the Bank of Japan finally managed to ditch its ultra-loose monetary policy as wage inflation begins to rise to a reasonable level. There are good reasons to look for a long-term trade long of the Yen. However, the US Dollar got a boost in recent days after US economic data showed a more buoyant economy than previously thought.

The price action looks bullish now, so I think it's wise to wait until the price makes daily closes below ¥144.

GBP/USD

The GBP/USD currency pair ended the week before last at a new 1-year high, making a very bullish close at the top of its weekly range just above $1.3200. Early last week, it briefly reached a new 2-year high before turning bearish and falling over the week, closing very near the low of its range.

The British Pound was one of the most bullish currencies when it was making these new long-term highs, and despite this week’s bearish retracement, it still looks relatively strong compared to other currencies against the US Dollar.

Although bulls will be hoping the price will rise again, which it will likely do according to the long-term trend, sudden falls from long-term highs which are briefly reached then rejected are often bearish signs, or at least signs that the price will not be making more long-term highs in the near future.

I think a long trade here can still be a good possibility, provided that we get a daily close above $1.3261 before an entry is made.

XAU/USD

Gold has been grinding higher for weeks in a choppy, long-term bullish trend. Over the last couple of weeks, it has rejected the blue sky above the big round number $2,500 no less than four times. Despite the long-term bullish trend and recent record highs, this is a bearish sign.

The bearish retracement from the record high is still shallow, so it could be too soon to go short, especially if the price keeps finding support at $2,494.

Something to watch for is if the price turns strongly bullish again and takes out the record high. This could be a decisive bullish sign after the four rejections, suggesting that a new long trade entry could be an excellent trade.

I see Gold as a buy if we get a daily close this week above $2,525.

S&P 500 Index

The S&P 500 Index consolidated during most of last week before breaking higher on Friday and closing right on the high of its weekly range, showing bullish momentum for the third consecutive week.

Bulls shouldn't get too excited yet, as the price is only approaching the recent record high. There has been some selling, so we might expect more profit-taking as the price gets closer and closer to an all-time high.

The index will probably start rising next week but may fall back before it gets much higher. It would be wise to wait for a new record high in New York to close at or above 5,668 before entering any new long trade here.

I usually prefer to trade the NASDAQ 100 Index, but the S&P 500’s wider market is outperforming the technology sector, so I see this as the best equity index to focus on right now.

Bottom Line

I see the best trading opportunities this week as:

- Long of the EUR/USD currency pair following a bullish daily close above $1.1057.

- Long of Gold in USD terms following a daily close above $2,525.

- Long of the S&P 500 Index following a daily close above 5,668.

Ready to trade our Forex weekly forecast? We’ve made a list of the best Forex brokers worth checking out.