Israel attacked Iran over the weekend, but before traders bet blindly on upside they need to consider a couple of important viewpoints which have become evident in the WTI Crude Oil marketplace.

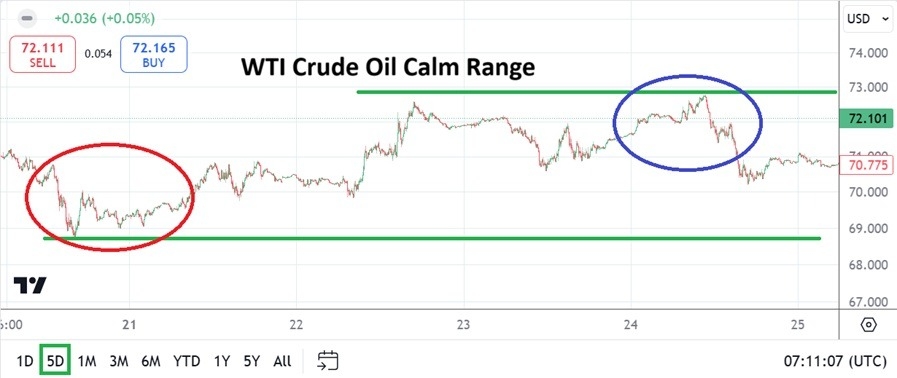

- The price of WTI Crude Oil went into the weekend near the 70.775 price, having experienced a high for the week only a day earlier when the commodity was around 72.780.

- However, lower price movement on Friday showed that large traders of WTI Crude Oil remain unconvinced about upwards momentum and sold rather strong going into the weekend. A low of nearly 70.245 was seen on Thursday after the week’s high was made.

The low for WTI Crude Oil was early on last Monday when the 69.000 mark was challenged. Some traders might interpret last week’s run up as a sign nervousness from the Middle East conflict caused some of the early nervous buying seen from Monday until Thursday and they may be right.

They may then think because Israel retaliated against Iran this weekend that large oil traders will show even more nervousness when WTI Crude Oil opens tomorrow. And on this point, day traders may be wrong.

WTI Crude Oil and the Middle East Conflict

Large and experienced traders in the energy sector understand political intrigues better than most, and they also have solid information at their disposal to gather insights.

The fact that Israel did not bomb Iran’s oil infrastructure may actually make large traders more comfortable for the moment. ‘For the moment’ is the key phrase, because now it is all up to the Iranians. If Iran remains muted and doesn’t react to Israel’s strike, this should help WTI Crude Oil return to an environment where supply and demand rules the price of the commodity.

However, if Iran does act upon an ego fed path to ruin and fire missiles again upon Israel, this would be very bad – and it would likely be bad for Iran. Because what Israel did in their attack over this weekend was take out a lot of the air defense systems Iran has around their oil infrastructure, besides other things. Meaning that if Iran were foolish enough to attack Israel again, then Israel almost definitely would up the ante and begin to hit Iranian oil production.

Top Forex Brokers

WTI Crude Oil Behavioral Sentiment and Risk Management

Day traders who want to pursue WTI Crude Oil need to understand they are playing a game of poker because behavioral sentiment is going to rule price action this week. They need to ride the coattails of large oil players who are taking positions based on their gut instinct regarding the Middle East conflict, besides complex supply and demand outlooks. Crude Oil went into this weekend traversing the middle of its one week range, but did show signs because of the large selloff on Thursday that it is a potentially overbought market.

- The opening of WTI Crude Oil will be interesting to watch on Monday.

- It is likely there will be no big news from the Middle East in the next two days, which should allow for calm to return and the potential of lower price action.

- If the 70.500 support ratio falters and is proven vulnerable on Monday, WTI Crude Oil may again start to trade below 70.000 USD per barrel.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 68.500 to 73.200

Traders who believe that WTI Crude Oil is going to soar in the coming days because of this weekend’s escalation in the Middle East may be proven wrong. If calmer heads prevail and WTI Crude Oil is allowed to trade on considerations regarding supply and demand, the commodity may start to again challenge support levels that are nearby and may find a renewed test of lows.

While it may seem to go against the thoughts of day traders, they need to consider that large players in WTI Crude Oil have a lot of knowledge and have a solid historical perception regarding behavioral sentiment and Middle East noise generated from saber rattling. Yes, things could escalate and get worse in the Middle East, but there is a chance that things will remain tranquil too. And if there is quiet, WTI Crude Oil may find some rather calm sentiment among traders in the coming days.

Ready to trade our Crude Oil weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.