Potential Signal:

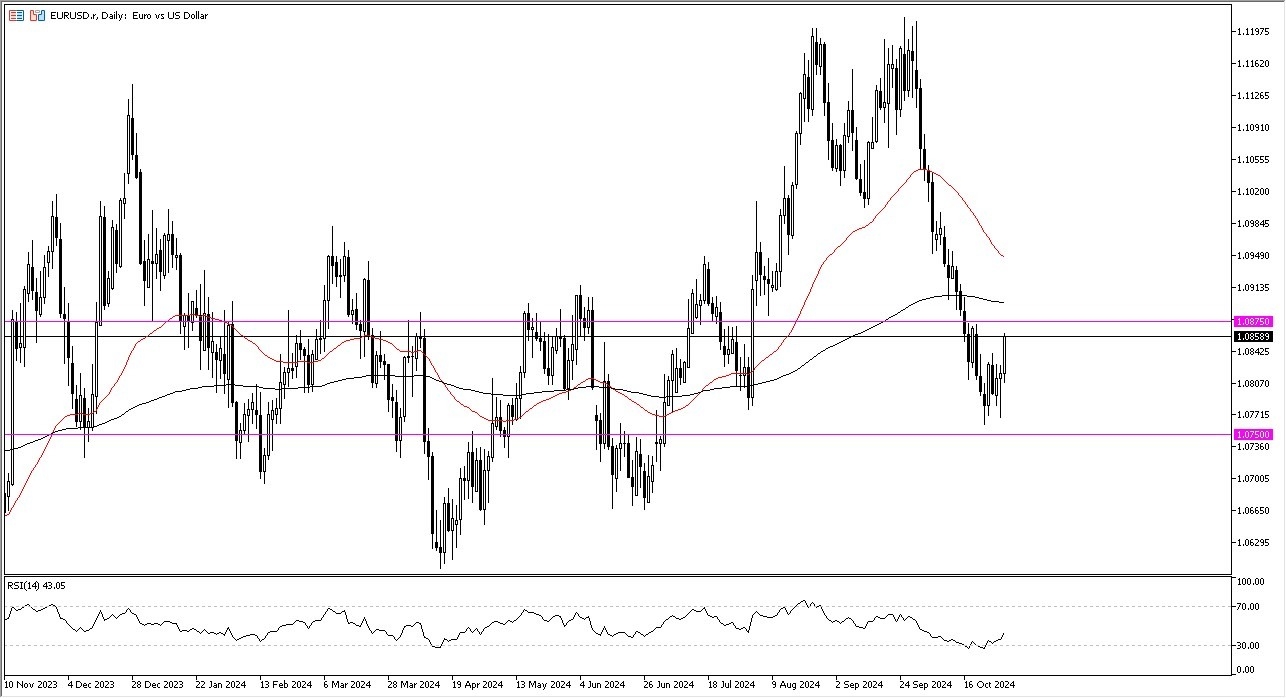

while I’m not necessarily too excited about the idea of owning the euro, the reality is that you have to trade the market that you have got. If we can get a break above the 200 Day EMA, essentially the 1.09 level, then I would be a buyer with a stop loss at the 1.08 level.

- In my daily analysis of the EUR/USD pair, it’s obvious to me that we are starting to see more and more momentum in this market.

- Quite frankly, the market had recently been doing a lot of potential “bottoming”, near the 1.0750 level.

- This is a market that I think will end up looking for some type of momentum to go forward.

Top Forex Brokers

Keep in mind that the market is likely to continue to see the next couple of days as crucial, the least of which would be the Non-Farm Payroll announcement on Friday.

If the Non-Farm Payroll announcement is noisy most months, but this month it could be even more so, mainly due to the fact that there are still a lot of questions as to what’s happening with the US economy and perhaps even the US Presidential elections.

Furthermore, we have seen a lot of noise in the US bond markets, as interest rates continued to rise despite the fact that the Federal Reserve has done everything it could to cut rates.

Technical Analysis

The technical analysis for the EUR/USD currency pair is still fairly negative, but I do think that there are a couple of scenarios where you could see this market truly take off. For what it is worth, the 1.0875 level has been somewhat significant resistance, but above there we have the 200 Day EMA coming into the picture. The 200 Day EMA of course is an indicator that a lot of people would watch to determine the overall trend, so therefore I think you could see a lot of dynamic technical trading in that particular region.

The 1.0750 level underneath would be a major support level, as we have bounce from there a couple of times in the past. As long as we can stay above there, then it’s likely that the market could see this as a potential “floor in the market.” In general, I also look at the candlestick for the trading session on Wednesday as a potential sign of sustainable strength.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best forex brokers in Europe to check out.