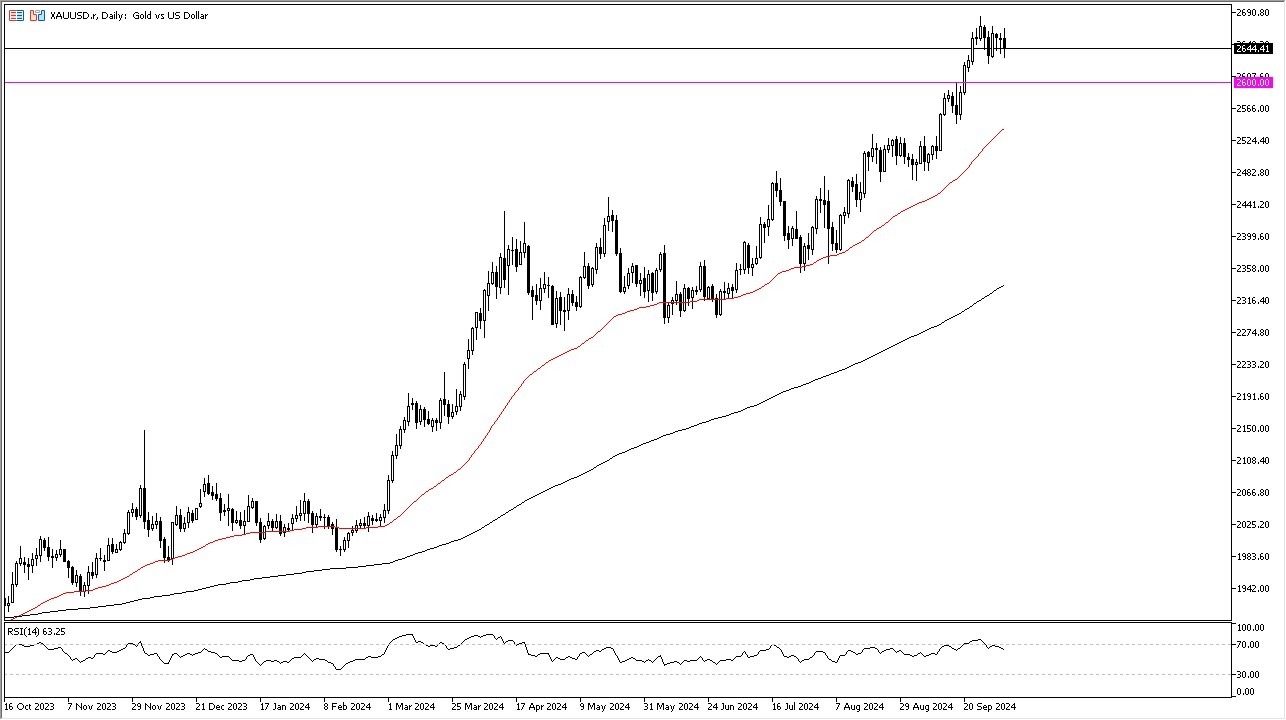

- It has become obvious that the gold market still has plenty of buyers underneath, and short-term pullbacks will more likely than not end up being a nice opportunity to get involved in what has been a very strong uptrend.

- All things being equal, when I look at this market, I can see that we are trying to consolidate some of the massive gains that have been a feature of this market for several months.

Technical Analysis

The technical analysis of gold is extraordinarily strong, as we continue to go back and forth in the region of the $2650 level, an area that has been a bit of a magnet for price over the last 2 weeks or so. After breaking above the $2600 level, it suggests that the market is ready to go higher, and I think that the $2600 level should be supported based upon the previous resistance barrier that we had seen. Furthermore, the 50 Day EMA is coming into the same area as well, so I think you’ve got a situation where there are plenty of buyers willing to take advantage of any value that steps into the market.

Top Forex Brokers

On the upside, the $2700 level seems to be a bit of a barrier, and if we can break above the $2700 level, I think that opens up the next several hundred dollars to the upside. In fact, I think you’ve got a situation where Golden will eventually go looking to the $3000 level. After all, there are a whole handful of reasons to think that this market will continue to go higher. Some of them include the fact that Russia, China, and India are all major buyers of gold at the moment, and then of course we have the ability to witness central banks around the world cutting rates, and therefore it looks likely that the gold market will continue to go higher. After that, you also have to keep in mind that there are still plenty of geopolitical issues out there that will continue to drive people into gold to look for safety.

Ready to trade our daily Forex forecast? We’ve made a list of the best Gold trading platforms worth trading with.