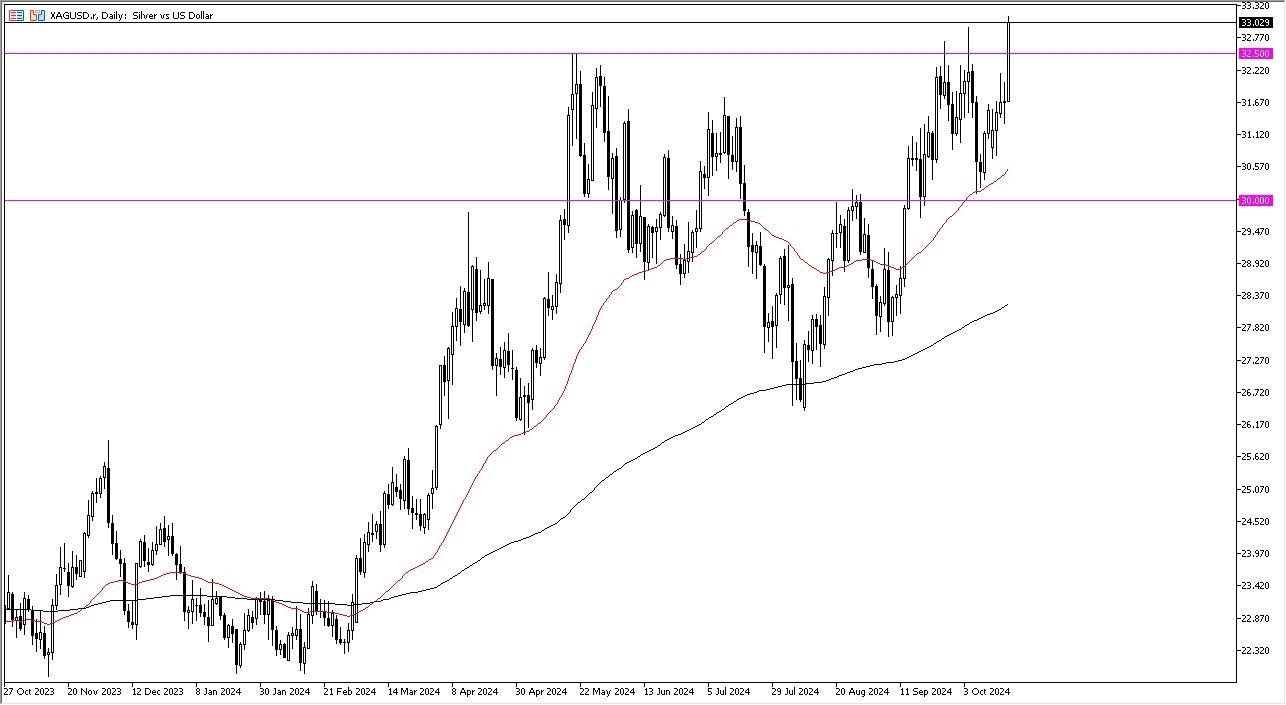

- Silver rocketed to the upside during the trading session on Friday as we continue to see a lot of bullish pressure in general.

- That being said, the market is likely to continue to see buyers as we are above the $32 50 cents level.

- The $32 50 cents level of course is an area that a lot of people have paid attention to multiple times.

The size of the candlestick is very bullish, and therefore you should see quite a bit of follow through. Even if we do pull back from here, the market is likely to continue to see a lot of value hunting and of course, FOMO trading. I think at this point in time, it's likely that we could go looking to the $35 level.

Top Forex Brokers

The Pullback

The market had previously pulled back to the 50 day EMA, but now it looks like the 50 day EMA is light years away from where we are now. So, with that being said, I think this is a situation where a lot of people are paying attention to interest rates dropping around the world. The geopolitical concerns around the world continue to be a major issue.

I have no interest in trying to short this market, and therefore I look at pullbacks as more likely than not to be the best way to get involved, but quite frankly there's only one direction silver looks likely to go. Because of this, I do think that silver will continue to grab the attention of traders, and you also have to keep an eye on gold, because gold does tend to lead, or vice versa at times.

Keep your position size reasonable. Silver can be extraordinarily volatile. And therefore, you traded with a little bit less of a position than you would in gold markets. Silver is always such a vicious move just waiting to happen, as we have seen so many times in the past. This is a situation where we have a lot of upward momentum, but furthermore, we have seen relentless momentum.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.