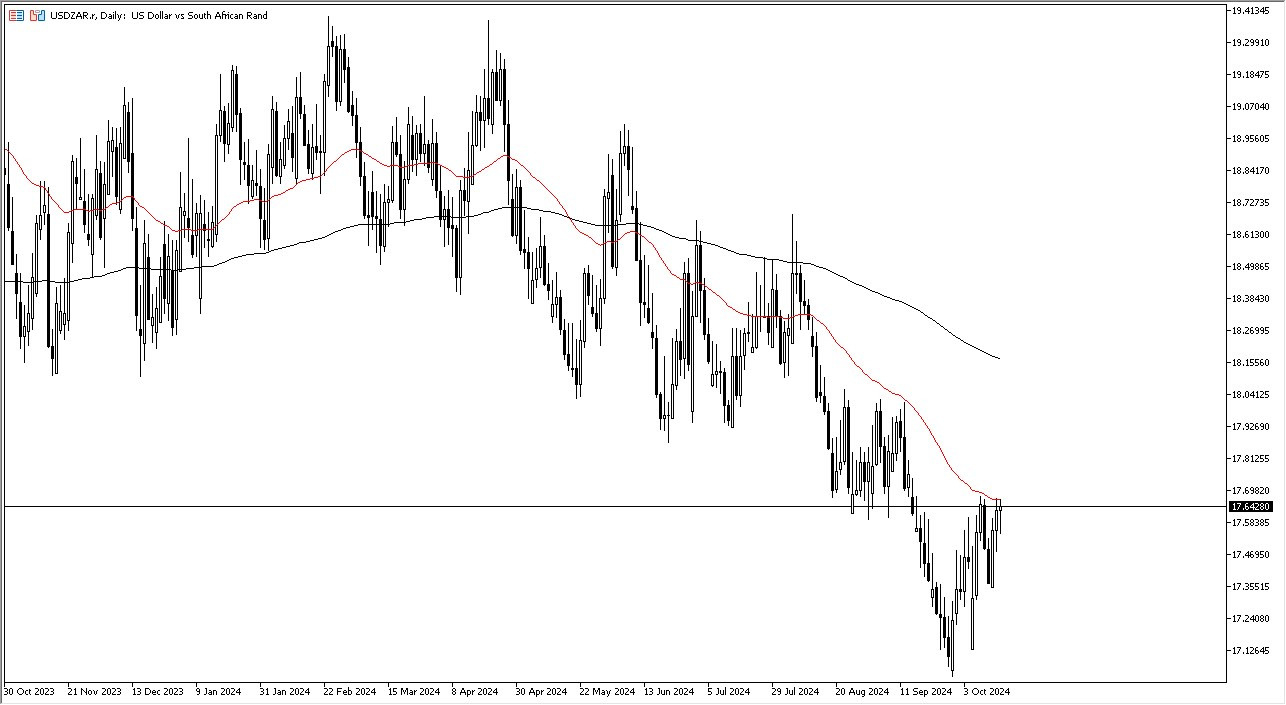

- During my daily analysis of the USD/ZAR pair, the first thing I see is that we initially pulled back, but we have turned around to show signs of life.

- By doing so, the market is threatening a bit of a breakout, because we are sitting just below a major potential resistance barrier.

- The 17.70 level previously had been support, and it now offers a significant amount of resistance.

The resulting candlestick is a bit of a hammer, but it’ll be interesting to see if this is going to end up being a bullish sign, or if we break down below the bottom of the candlestick, it could open up the possibility of a “hanging man” being formed. This of course is something that we will have to wait and see what happens, but it is worth noting that the market had recently recovered from an extreme selling pressure type of situation.

Top Forex Brokers

Emerging Markets

Keep in mind that when you are trading emerging markets, typically there are higher interest rates in those countries than the United States, but it also will more often than not follow the overall risk appetite of traders around the world. After all, the US dollar is considered to be a major safety currency, therefore it makes a certain amount of sense that the US dollar is attractive to traders when things get a little bit rougher.

On the other side of the equation, we have the South African Rand, which of course is a commodity currency. Furthermore, there are a lot of political issues in South Africa right now that suggests that traders might begin to fear putting a lot of money to work in the country, and therefore the geopolitical situation of course ends up being a major hurdle to putting money into countries that pursue monetary policies that are not exactly open to external investment. However, it’s likely that we will continue to see a lot of volatility.

All things being equal, we are testing the 50 Day EMA, and if we can break above there, then I anticipate that the US dollar goes looking to the 18.05 ZAR level. Above there, then we could break above the 200 Day EMA, and the market could turn around completely. All things being equal, I expect a lot of volatility but it looks as if we are trying to do everything we can to turn things around.

Ready to trade our daily Forex analysis? Here's a list of the best forex trading platforms South Africa to choose from.