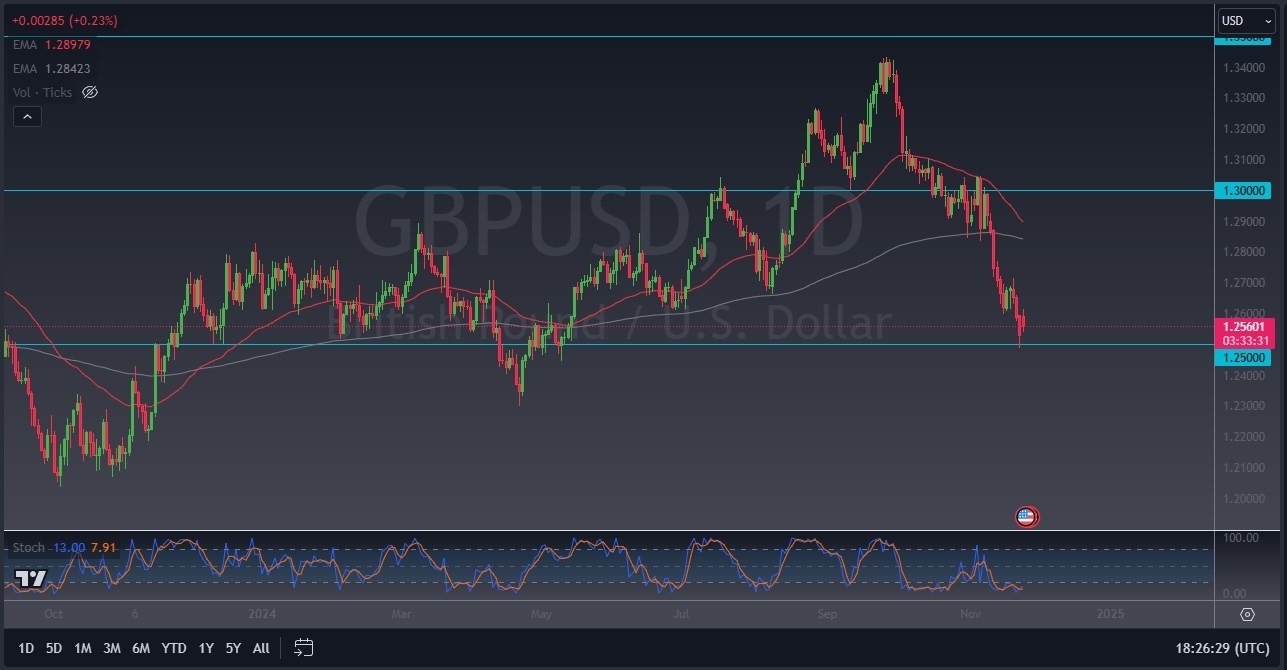

- The British Pound has pulled back just a bit during the early hours on Monday as we continue to see a lot of noisy behavior.

- With this being said, I think we've got a situation where the 1.25 level continues to offer significant support, an area that also has been very important multiple times.

If the GBP/USD market were to bounce from here again, then we could see a move to the 1.27 level, which is an area where we had bounced from and then came back below it, only to bounce back to the downside once we reached it again. In other words, there should be a lot of market memory in this area. If we can break the above there, then we have the possibility of going to look at the 200-day EMA.

Top Forex Brokers

On the Other Hand

On the other hand, if we were to break down below the 1.25 level, then it opens up the possibility of a move down to the 1.23 level, an area that I think will continue to be important as it also has a lot of market memory. All things being equal, the US dollar is by far one of the strongest currencies in the world right now. And while the British pound itself isn't too bad, it's not the US dollar.

So, I still think this is a market that rallies will get faded at the first signs of exhaustion, and therefore I'm looking for selling opportunities. If we do break above here, then I think we've got a lot of work to do to turn things around. This isn't to say that we won't get the bounce that looks like it's trying to set up, because quite frankly, a little bit of profit taking might make a certain amount of sense. But nonetheless, at this point in time, I think you've got a lot of work to go before we can truly turn things around for a longer term move.

Ready to trade our daily GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.