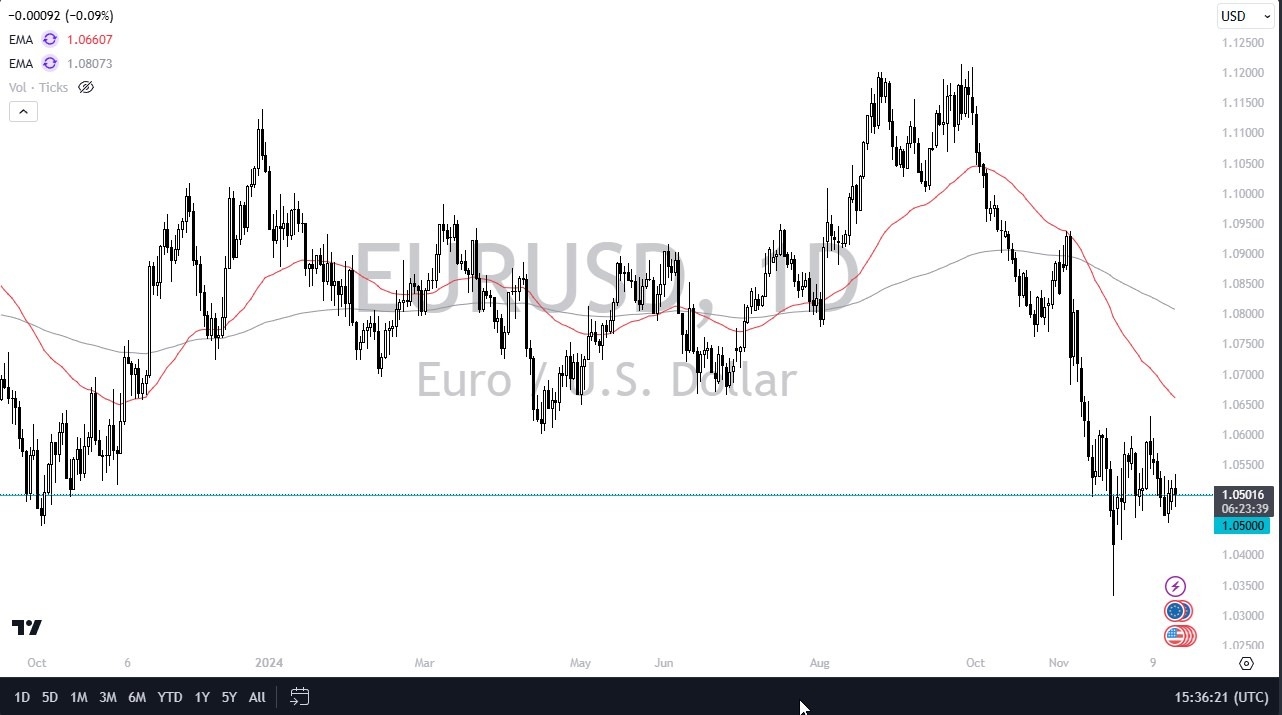

- In my daily analysis of the EUR/USD pair, I see the same thing that I have seen for several days: the EUR/USD simply grinding sideways.

- I think there are a lot of reasons for this, not the least of which is that the market has to catch its breath after the stunning selloff that we had seen previously.

- That being said, it is probably worth noting that there is the Federal Reserve announcement on Wednesday that will certainly have a major influence on the US dollar itself.

While the Federal Reserve is an expected to do anything crazy, and it is expected to cut 25 basis points, the real question will be what Jerome Powell says in the press conference. The statement will be parsed as usual, but at this point in time the FOMC has gotten pretty good about trying to keep the statement somewhat uneventful.

Top Forex Brokers

The other side of the equation of course is the European Union, and all of the drama that goes with that part of the world. France is an absolute basket case, and the economic data coming out of Germany is starting to suddenly look pretty dire. I think at this point in time it continues to set up the same trade that I have been looking at over the last 2 or 3 weeks.

Technical Analysis

The technical analysis for the EUR/USD pair is obviously pretty poor, but I also recognize that we may be running out of time between now and the end of the year to do anything of note. After all, the volatility can absolutely disappear as the volume does. However, there’s also the possibility that we see some type of massive, short covering rally heading into the end of the year, so traders can book their profit. It is because of this that I typically will cut down my position sizing this time of year, but all things being equal, I still prefer to short rallies that show signs of exhaustion, which is something that we will see from time to time. I am not looking for a huge move, but I still favor the downside.

Ready to trade our Forex EUR/USD daily forecast? We’ve shortlisted the best forex broker list for you to check out.