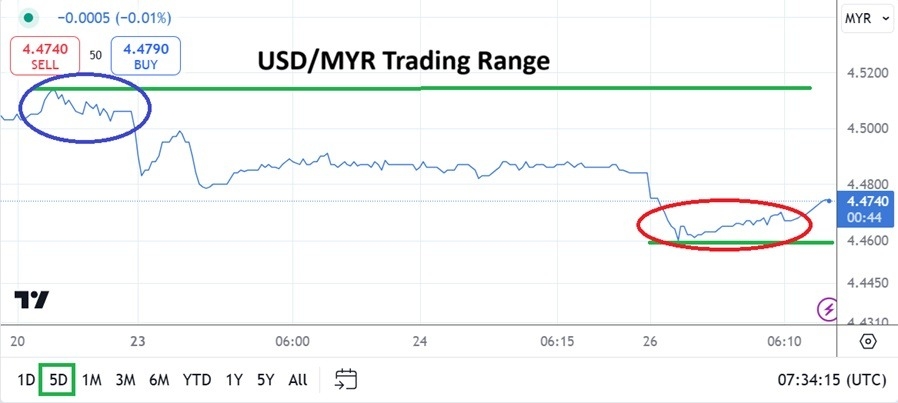

The USD/MYR has managed to see some lower trading and is near the 4.4700 ratio at the time of this writing, this as volumes remain extremely low as holiday markets demonstrate quiet and caution.

Having trading lower to the 4.4700 ratio it now occupies, the USD/MYR has accomplished a slight selloff. Before speculators get too excited and decide to try and jump on a sustained reversal lower, they must understand trading volumes in Forex and the USD/MYR are extremely thin. Holiday markets are in full effect as global financial institutions remain shuttered or minimally staffed.

Top Forex Brokers

The USD/MYR was trading near the 4.5150 ratio on Friday of last week, a high that was last seen in the first week of August. The ability to come off of the high is interesting, but before speculators make too much of the lower move achieved since the end of last week, they need to understand it is possible large players who need the USD may not be active for the moment.

USD/MYR Correlations to the Broad Forex Market

The price action of the USD/MYR the remainder of this week and next will continue to see extremely light trading. Retail traders who want to participate in the currency pair should be cautious and think twice before participating. Technical perspectives in holiday conditions are often changed with the blink of an eye. The movement lower in the USD/MYR should be treated skeptically.

Traders also need to be aware the USD/MYR offers a large spread on typical trading days, now because of the holidays being celebrated, globally the difference between the bid and ask is further apart. Speculators who insist on pursuing the USD/MYR over the near-term are recommended to use entry orders with specific prices, this so ‘fills’ meet expectations. The USD/MYR remains correlated to the broad Forex market, but price action in the near-term may look rather hard to define.

USD/MYR and Behavioral Sentiment Views

Global Forex conditions continue to see strong USD centric notions. Risk adverse trading remains rather pronounced and most major currencies are struggling against the USD, including the USD/MYR. However, the bullish trend that has been seen since early October in the currency pair remains under values which were seen in the spring and early summer of 2024 in the Malaysian Ringgit.

- The Malaysian Ringgit has done a fairly good job of retaining value even though it has certainly been weaker in recent months.

- Shifting behavioral sentiment globally will be a key element in the USD/MYR, and nervous conditions may remain the status for the next handful of months.

- For USD/MYR speculators the 4.5000 level could prove to be interesting in the near-term.

- Again, traders wanting to pursue the USD/MYR today and tomorrow should be conservative with their wagers.

USD/MYR Short Term Outlook:

Current Resistance: 4.4760

Current Support: 4.4670

High Target: 4.4850

Low Target: 4.4590

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.