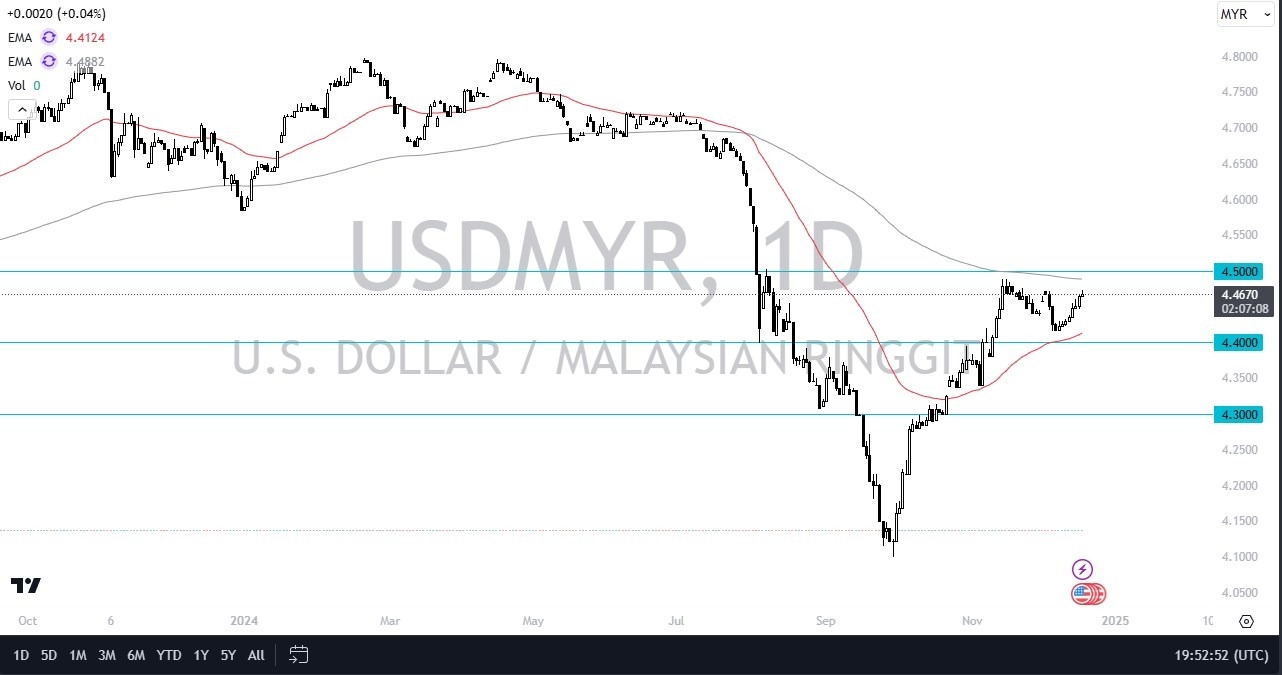

- The US dollar initially rallied against the Malaysian ringgit during the trading session on Wednesday, but as we got through the FOMC meeting, it seems as if the market continues to hit a bit of a wall.

- Ultimately, I think this is a situation where we have a lot of questions asked as to whether or not we can break above major technical levels just above.

Top Forex Brokers

Technical Analysis

The technical Analysis of course is somewhat mixed at the moment as we are between the 200 Day EMA above, and the 50 Day EMA below. As we are trading between these 2 major moving averages, it does make a certain amount of sense that there would be a bit of noise. Furthermore, just above the 200 Day EMA, we have the 4.50 MYR level, which is an area that a lot of people will be looking to test. If we can break above that level, it would obviously be very bullish, and it could send the USD all the way up to the 4.65 level over the next several months. I do believe that at this point in time it’s worth noting that the United States economy seems to be stronger than many others, and that is something that you cannot overlook.

To the downside, the 50 Day EMA is near the 4.42 level and rising, with the 4.40 level underneath there offering support. Anything underneath that level could send the market plunging, perhaps back down to the 4.30 level. All things being equal though, I do think that the US dollar will remain somewhat resilient, and with this being the case, it’s a situation where market participants will probably continue to look at this through the idea of the market being more sideways than anything else, at least in the short term. However, it’s worth noting that the US dollar has been jumping all over everything else, and therefore the Malaysian Ringgit may get sold off just due to this.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.