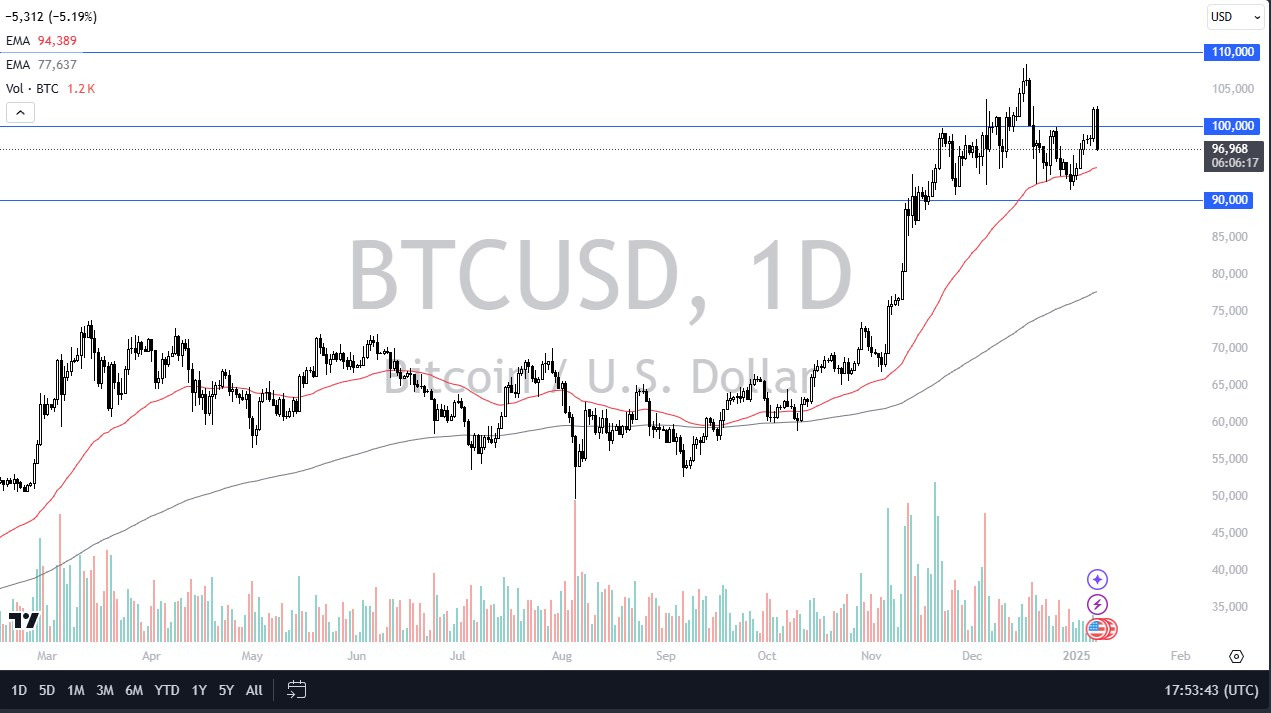

- My daily analysis of crypto obviously starts with Bitcoin, which was absolutely crushed during the trading session on Tuesday.

- There are a multitude of reasons to think that this happened, but quite frankly I think the most obvious one is that the 10 year yield has broken higher yet again in the United States.

- With that being said, this outsize candlestick does suggest that we could see a little bit more trouble, but I don’t know if anything is changed longer term.

Consolidation?

I believe at this point in time we will continue to see a lot of consolidation, and I think that makes a certain amount of sense considering just how explosive the growth in Bitcoin price had been during 2024. After all, the market has seen a lot of inflows over the last year, and I suspect at this point in time any time Bitcoin drops a bit, traders are more likely than not to come in and start buying more. I do believe that there is a hard floor underneath here, but the question of course is going to be exactly where is it?

Top Forex Brokers

I think accumulation is going on at the moment, and it’s probably worth noting that the volume has dropped a bit, and this is something that leads me to believe that the interest has waned a bit in the short term. However, I see significant support at the $90,000 region, assuming that we can even get down there. The upside, I see a lot of noise around the $103,000 level, and then again at the $109,000 level. I suspect at this juncture we have a scenario where $110,000 is a major hurdle that will take a lot of effort to get beyond. However, if we were to get beyond there, that could open up a massive move to the upside.

This is my base case scenario, although I think it’s going to take some time to make this happen. I do believe that Bitcoin will continue to go higher over the longer term, but we have a lot of things to work through, not the least of which of course is going to be waiting to see what the new administration in Washington DC will do about crypto adoption.

Ready to trade daily Bitcoin forecast? Here’s a list of some of the best crypto brokers to check out.