- During my daily analysis of global indices, the DAX has caught my attention due to the fact that it is hanging around a very crucial support level.

- The index rallying a bit during the trading session of course is also something worth paying close attention to, as market participants continue to see value on dips.

- The question of course at this point is going to be whether or not that remains the case going forward, or if we finally break down.

- There are a couple of different technical factors to pay close attention to that could give us a little bit of a “heads up” going forward.

Technical Analysis

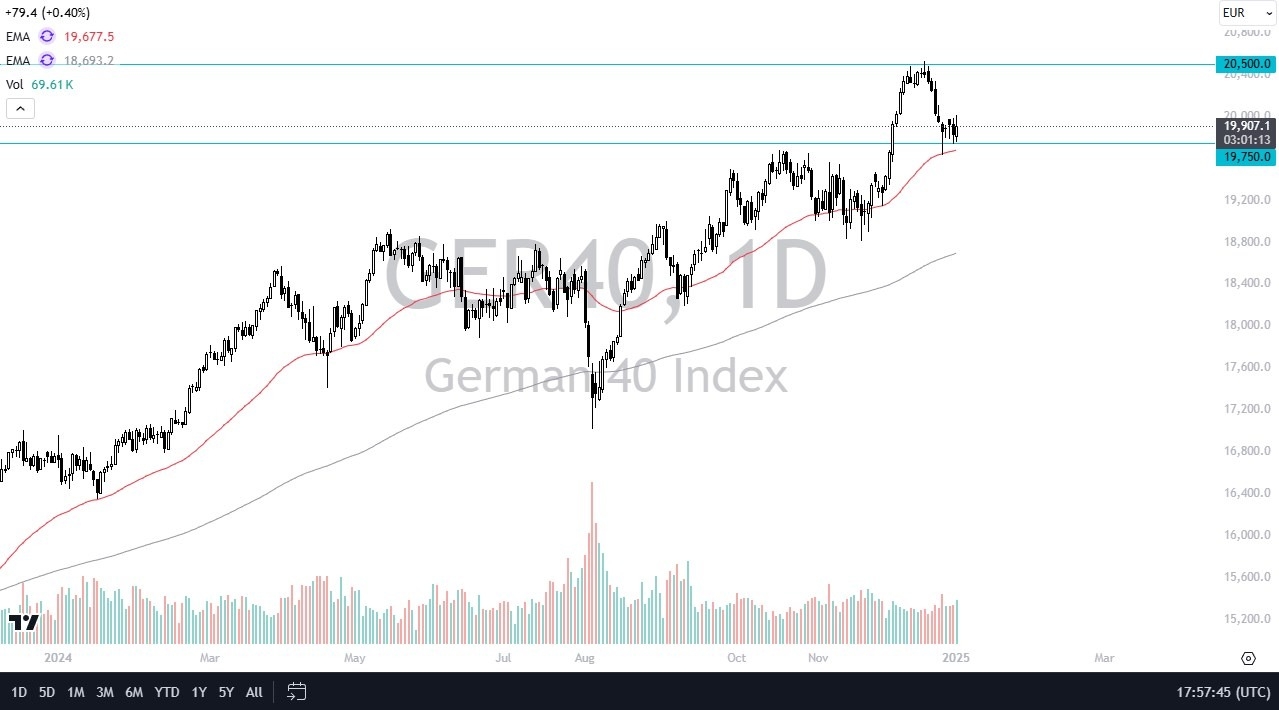

At this point, the most obvious level on the chart for me of course is the €19,750 level. This is an area that’s been important multiple times, both from a support, as well as resistance, standpoint. The 50 Day EMA sits just below there, and I think that would be something that you need to pay close attention to as well. The fact that the market continues to hang on to this area is a very positive sign, and with that being the case I think it is worth noting that the market participants continue to look at this through the prism of value and continue to rely on this area for a little bit of a floor.

Top Forex Brokers

If we were to break through that region, then it’s possible that the market could go looking down to the €19,000 level, but I don’t necessarily think that’s as likely as a move to the upside. After all, we had seen a little bit of bullish pressure during the trading session on Thursday, but it’s also worth noting that the thing that turns the market back around would have been the specter of the €20,000 level. If we can break above there, then I think it opens up a move to the recent highs near the €20,500 level, which is obviously an area that would attract a certain amount of attention due to the round figure aspect of it. In general, I believe this is a market that has plenty of people willing to buy into it.

Ready to trade our daily stock forex analysis? Here are the best CFD brokers to choose from.