- During my daily analysis of the currency markets, the GBP/CHF pair is very interesting in my estimation, due to the fact that we have seen a bounce from an area that had been previously supported as well.

- All things being equal, this is a market that I like a lot, because the interest rate differential is pretty wide, and therefore you can really start to build up profits over the longer term if you just simply collect the swap.

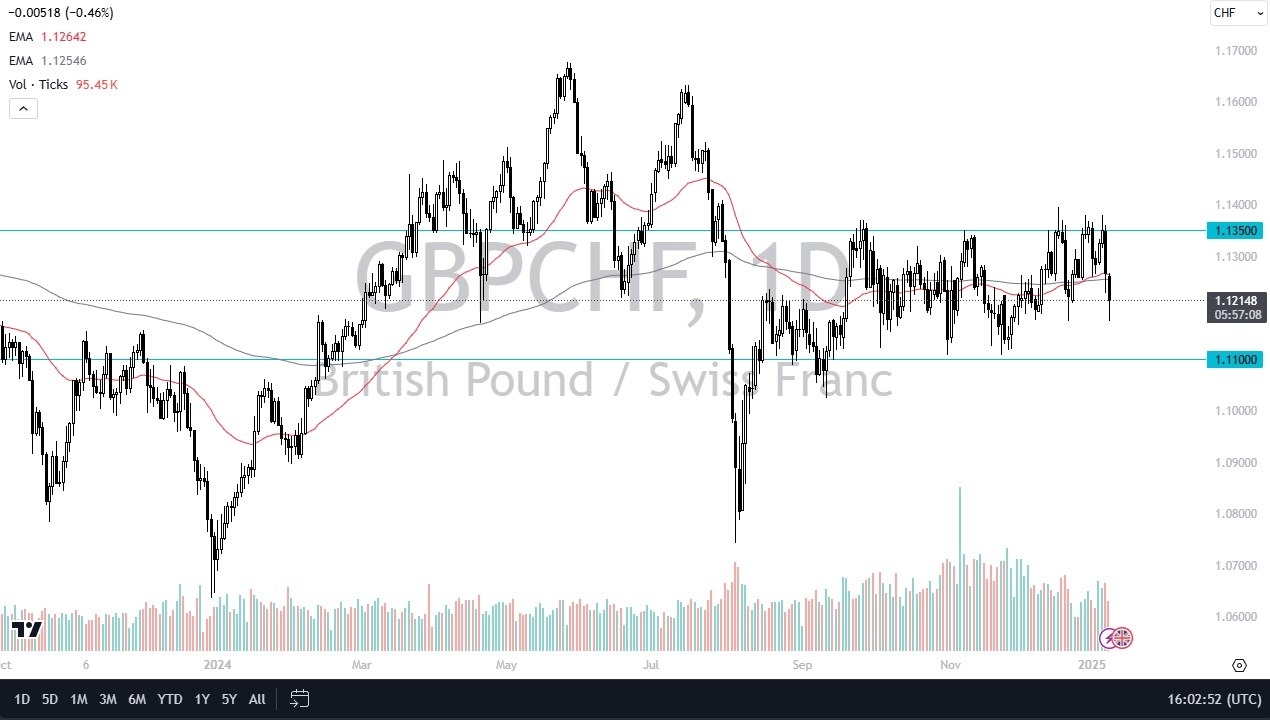

The shape of the candlestick for the trading session on Friday is one of negativity, but there is some hope, considering that we did bounce from the 1.1170 level again, which is an area that’s been somewhat supported model times. The market turning around and bouncing the way it has does suggest that we may try to stay in the same trading range that we had been in previously. Furthermore, the technical analysis adds a few other factors to pay attention to in this market as well.

Top Forex Brokers

Technical Analysis

The technical analysis for this market is essentially sideways, as the market has been going back and forth between the 1.11 level below, and the 1.1350 level above. We are essentially in the middle of that range, so it shows you just how neutral we are. The 50 Day EMA is very sideways as well, right along with the 200 Day EMA as well. With that being the case, it just shows that the longer-term attitude is still very much to the downside. However, what if you were to simply hold onto this GBP/CHF pair and collect swap over several weeks, if not several months? That’s exactly what the carry trade is about, and I suspect that’s exactly would a lot of professionals have been doing.

If we can turn around a break above the 1.14 level, that would obviously be a very bullish sign, but at this point, think it’s obvious that buyers continue to come back into this market every time we drop, I think this will be the way going forward, and I do think eventually we break out to the upside, mainly due to the Swiss franc weakness.

Ready to trade daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.