- The US dollar has rallied a bit during the trading session on Tuesday as the year ends on a positive note for the greenback, which is not a huge surprise considering that the greenback is pretty much doing everything we can to blow every other currency up.

- This will be especially true when it comes to emerging markets, such as Malaysia.

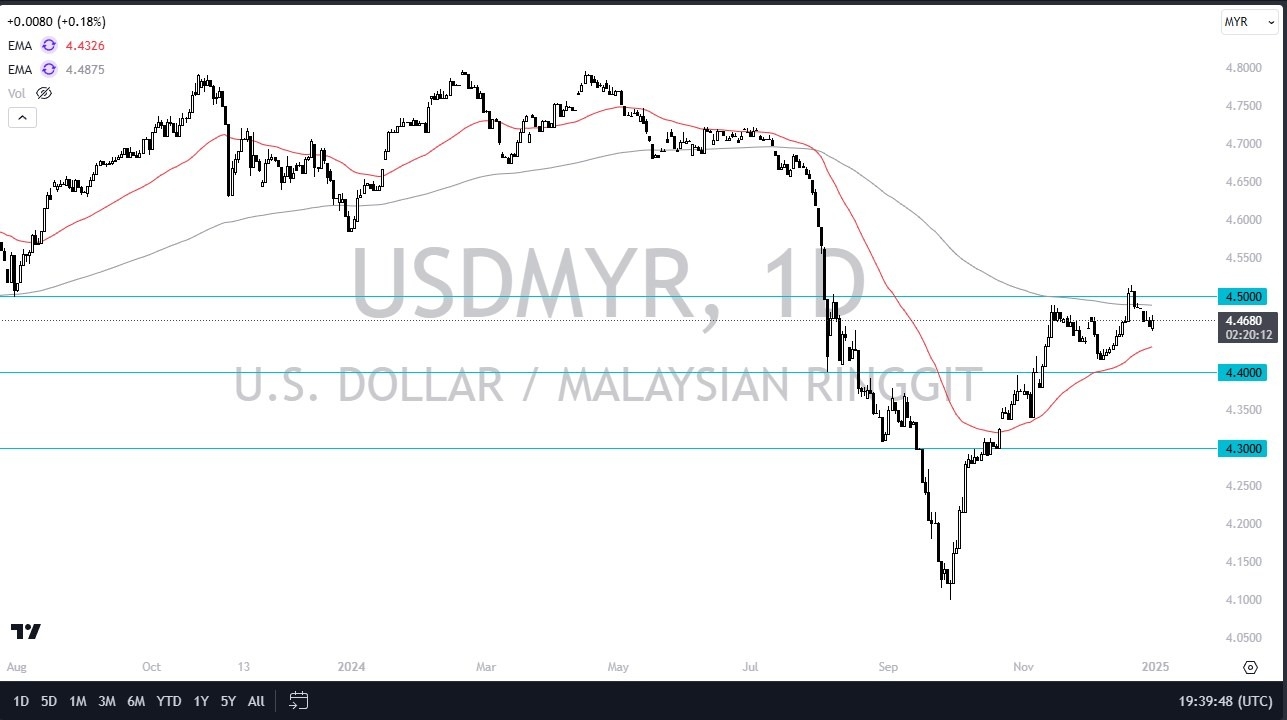

The Malaysian ringgit has been a little bit stronger than many other exotic currencies, though mainly due to the strength of the Malaysian economy. But the technical analysis does suggest that we are getting fairly close to some type of decision. The 4.5 level above is a significant barrier and if we can clear that, then I think we'll start to see the US dollar really take off. And I could make an argument for that happening, as we see it in various places around the world.

Top Forex Brokers

Dollar Supremacy Should Continue Going Forward

All one has to do is look at the Australian dollar and see that the US dollar is starting to really beat up on some of the other currencies in the region. With that being said, I anticipate that eventually we break out and once we do, I'll be looking for this market to go to the 4.65 level. Short term pullbacks are most certainly possible, but the 50 day EMA right around the 4.45 level is probably going to be support, and even if it isn't, the 4.40 should be. The US interest rates continue to stay stubbornly high, and as long as that's going to be the case, and as long as the Federal Reserve is likely to be cautious about cutting rates, you've got a very real possibility that the US dollar gets out of control against some of these smaller ones, like the Malaysian ring.

Ready to trade our daily forex forecast? Here are the best forex brokers in Malaysia to choose from.