- After challenging the 112.0000 vicinity in late November of 2024 and early January 2025, the USD/RUB has been able to move lower.

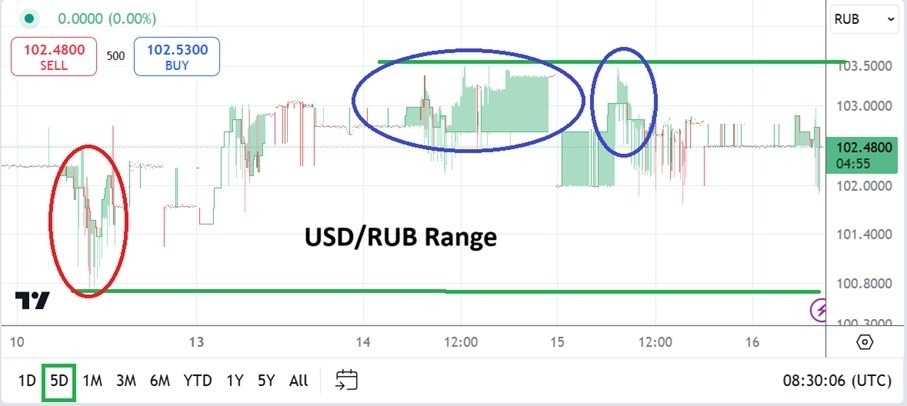

- The currency pair has achieved some relative calm the past few days and has begun to display the potential of challenging support levels near the 100.0000 level. The USD/RUB is near the 102.4800 ratio at this time, based on a large spread between bids and asks.

The coming days will prove interesting for the Russian Ruble as President-elect Donald Trump takes control of the U.S White House. Implications regarding the Ukraine – Russia war, trade, and the price of Crude Oil may all be factors in the weeks ahead, but the change of leadership in the U.S may be viewed as a potentially optimistic avenue for the Russian Ruble to gain some strength.

Top Forex Brokers

Correlations to Broad Forex and Sentiment in the USD/RUB

The USD/RUB has certainly seen a run upwards since the middle of August 2024, when the currency pair was trading near the 88.4000 level. The past handful of months have seen a strong bullish trend which have raised questions about the Russian economy. However, during the past few months most major currencies have struggled against the USD. The ability of the Russian Ruble to come off highs seen near the 112.0000 mark in early January should raise some eyebrows regarding outlook.

Some might believe the recent bearish trend has happened because the price of WTI Crude Oil has increased, but this may not be the whole story. Natural resources are crucial for Russia, but more important is behavioral sentiment and its influence on the USD/RUB. Transparency in the Russian Ruble is hard to attain, but the USD/RUB has produced a certain downturn which is traversing values seen before the Christmas holiday began. Financial institutions may be bracing for a potential change in political winds.

USD/RUB Wagering Near-Term vs. Mid-Term

The coming weeks will prove intriguing for USD/RUB speculators. Being overly ambitious is cautioned against, unless inside knowledge is within grasp. The presidency of Donald Trump which will begin on Monday of this coming week is likely to have immediate cause and effect scenarios in Forex and the USD/RUB is likely to react to rhetoric.

- There are no guarantees regarding outcomes of negotiations ahead with Russia and the U.S regarding the Ukraine war, but it is likely some positive results regarding outlook may be heard.

- Wagering on more downside from the USD/RUB may feel like a speculatively logical wager, but risk management is needed, because volatility and surprises certainly lurk as possible impetus.

USD/RUB Short Term Outlook:

Current Resistance: 102.7000

Current Support: 102.1000

High Target: 104.5000

Low Target: 100.7000

Ready to trade our free trading signals? We’ve made a list of the top forex brokers in USA for you to check out.