The ability of the USD/BRL to close around the 5.7875 level was a solid sign for the Brazilian Real, the currency pair has achieved a rather steady incremental selloff since the last week of December. Financial institutions have now returned the USD/BRL to levels traded in the last week of November. In late September and early October of 2024 the USD/BRL was trading near the 5.4000 ratio.

Certainly risk premium had been built into the USD/BRL over the past three months as financial institutions braced for the Donald Trump Presidency. However, the USD/BRL had been in a solid bullish trend starting in March of 2024. In fact, in February of 2024 the USD/BRL was around the 4.9000 level.

Technical Considerations Mixed with Behavioral Sentiment

On the 15th of October 2024, the USD/BRL was trading around the 5.6500 value. This is important because at that time in October it was not clear Donald Trump would be U.S President. The USD/BRL is trading within sight of this price as it awaits today’s trading. The ability to come off of December highs which tested the 6.3000 level as nervous sentiment became abundant is an important consideration.

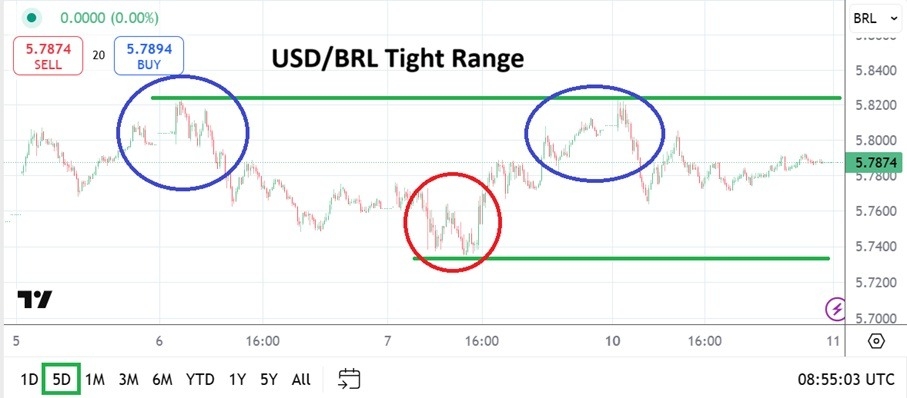

The question for day traders is if there is still room to traverse lower in a sustained manner for the USD/BRL or has the currency pair effectively begun reaching equilibrium which traders will continue to test. The incremental lower prices the past few days did produce some buying yesterday. On Friday of last week the USD/BRL touched the 5.7360 vicinity. Traders need to remember also there is not a lot of volume in the USD/BRL so entry price orders, along with stop loss and take profit targets are all advisable.

Sustained Trading and Looking for Support

The ability to sustain values below the 5.8000 level is important. However, traders should be aware that this level may now serve as a target for financial institutions as a resistance level. Which means that upon the opening of the USD/BRL today that gaps should be watched for as a possibility, if the 5.8000 level is touched and then serves as durable resistance this would be intriguing.

- Speculators are cautioned not to get too attached to downwards sentiment near-term. There are still dangers that lurk regarding President Trump’s ability to turn up the sound and create nervous reactions in Forex which could affect the USD/BRL.

- Technically the USD/BRL has been able to achieve a solid incremental bearish trend, but it has not been a consistently easy ride lower.

Top Forex Brokers

Brazilian Real Short Term Outlook:

Current Resistance: 5.7950

Current Support: 5.7810

High Target: 5.8140

Low Target: 5.7620

Want to trade our daily forex analysis and predictions? Here are the best brokers in Brazil to check out.