Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 35.90.

- Set a stop-loss order below 35.70.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 36.25.

Bearish Entry Points:

- Place a sell order for 36.20.

- Set a stop-loss order at or above 36.30.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 36.00.

Top Forex Brokers

Turkish lira Analysis:

The USD/TRY (the dollar pair declined against the Turkish Lira) during early trading on Thursday morning, as the pair traded below the peak recorded yesterday at 36 liras. The pair received support from reports showing the Turkish government issuing its first dollar bonds this year, estimated at about $ 500 million, as the government seeks to borrow about $ 11 billion over the course of 2025. According to a Bloomberg report, the yield on seven-year bonds is expected to reach around 7.5%. The Treasury revealed that a number of global banks, including Citigroup, JPMorgan, and Goldman Sachs, are overseeing the issuance process. It is worth noting that recent government bond issuances have received high demand, with recent issuances being covered 3-4 times.

In other news, reports revealed that the Turkish government is seeking to boost foreign direct investment (FDI) to reach 1.5% of global investments and 12% of regional investments by 2028, while the volume of FDI reached $10.6 billion in 2023, compared to $13.7 billion in 2022, which is lower than the peak recorded in 2007 at $22 billion.

These expectations come as the European Bank for Reconstruction and Development (EBRD) indicated the possibility of recording a 2.7% growth in gross domestic product in 2024, expected to rise to 3% this year. Also, the forecasts included a decline in inflation to below 30% by the end of this year, along with a decline in the fiscal deficit to 3.1% at the end of 2025 after reducing spending related to the reconstruction of the 2023 earthquake.

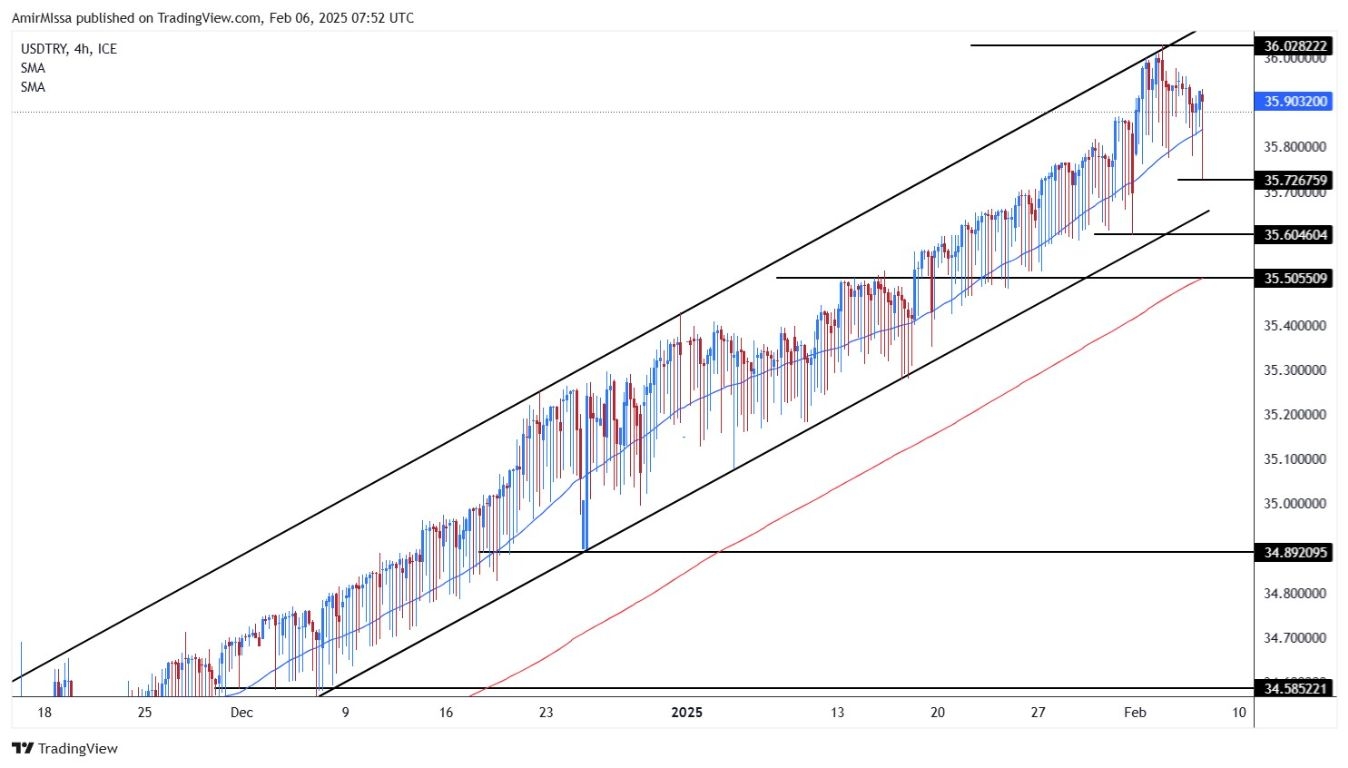

USD/TRY Technical Analysis and Expectations Today:

On the technical side, the USD/TRY pair traded below the 36-lira level recorded yesterday. The price continues to move within the ascending price channel, indicating a general upward trend. Also, the price is moving above the 50 and 200 moving averages on both the daily and 4-hour timeframes.

Currently, we expect the dollar to continue its upward rebound with the same slow pace that the pair records daily. Technically, every pullback in the pair represents an opportunity to buy again. Finally, the pair targets levels of 36 lira and 36.25 lira, respectively.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.