- During the trading session on Thursday we saw the silver market finally break out, something that looked like it was somewhat in the arts going forward and as we have seen no matter what happens, buyers are willing to come in and pick up silver.

- A lot of this will come down to the idea of people using it as a cheaper alternative to gold, but it also is part of the inflation equation, which although lower than it once was in the United States, it is still elevated.

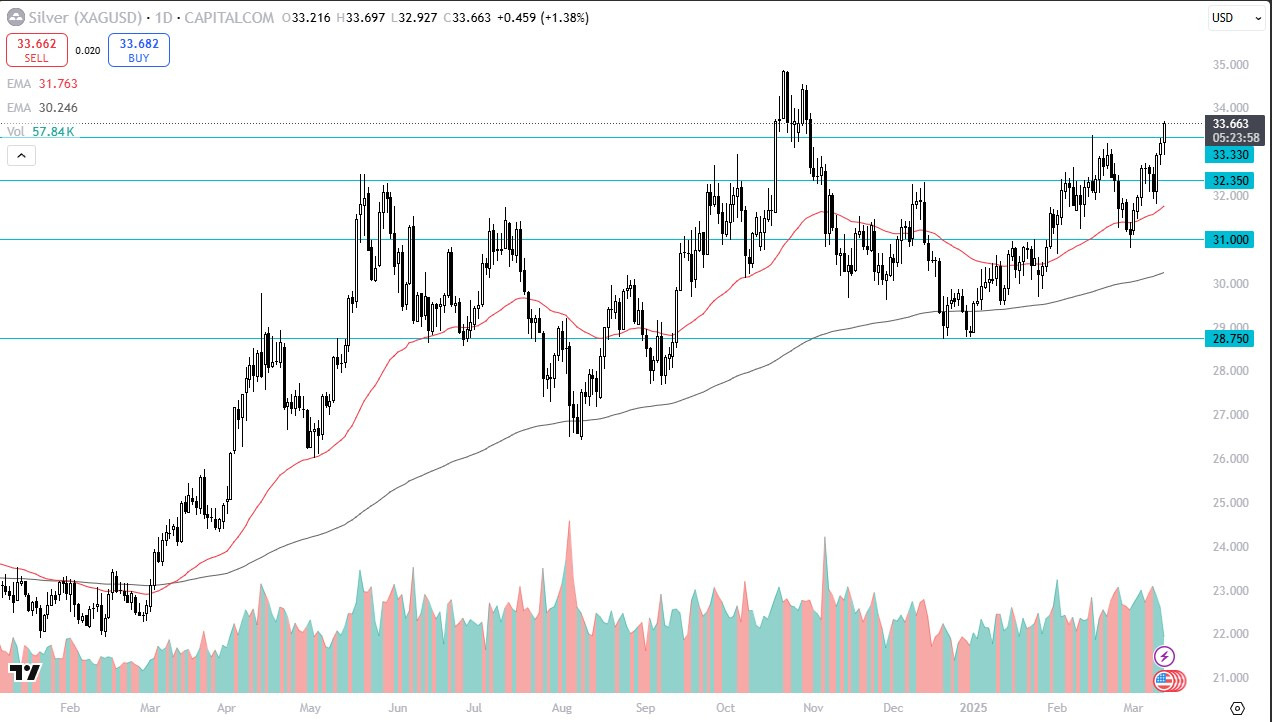

With gold breaking out, it seems like it dragged silver right along with it. All things being equal, this is a market that is not at all-time highs by any stretch of the equation, but it looks to me as if this is a market that is going to do everything it can to get to the $35 level. Even if we were to break down from here, I suspect that there are plenty of buyers underneath that will continue to jump into the silver market, so it becomes more or less a “buy on the dips” scenario.

Top Forex Brokers

Technical Analysis

The technical analysis for the XAG/USD is rather bullish, as you can imagine, and if the market were to pull back at any juncture, I anticipate that there should be plenty of people willing to get involved and start taking advantage of “cheap ounces of silver.” If we can break above the $35 level, then we could have a massive move to the upside just waiting to happen. On the other hand, if we do pull back, I suspect that there are plenty of buyers at the $33.33 level, and then again at the $32.35 level.

At this point in time, I have no interest whatsoever in trying to short the silver market, because it is far too strong, and I think it would be foolish to try to get bearish at this point, even if we do need some type of pullback in order to attract traders sooner or later.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.