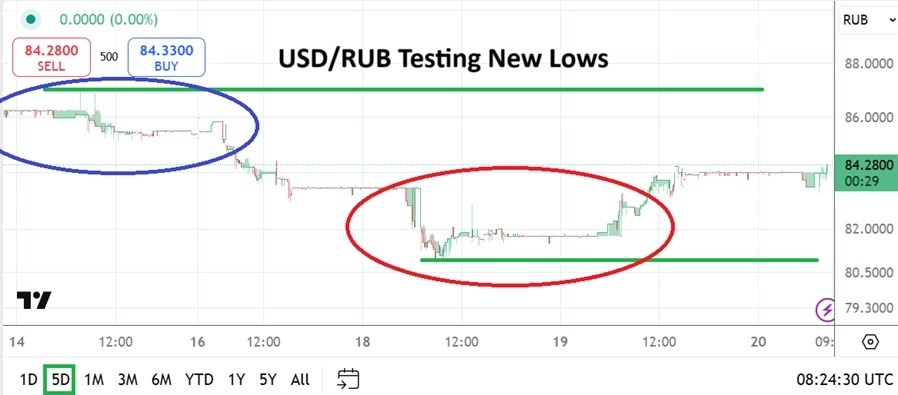

The USD/RUB touched new lows on Tuesday of this week, and the currency pair remains within the lower elements of its long-term range as financial institutions continue to bet on optimistic outcomes.

Top Forex Brokers

The USD/RUB is near the 84.2800 ratio as of this writing. On Tuesday of this week the currency pair went to a low around the 81.0000 vicinity before reversing slightly higher. The trend lower in the USD/RUB is clear to see and speculators trying to ride on the coattails of financial institutions have reasons to believe additional lows are still going to be found.

However, day traders should remain realistic because timeframes for speculators with limited accounts do not have the same staying power within Forex compared to financial institutions which can remain patient. The trend lower in the USD/RUB clearly indicates that bigger players are betting on positive outcomes regarding the ongoing negotiations between the Ukraine and Russia which are being led by the U.S White House.

Top Forex Brokers

USD/RUB and a Selloff of Risk Premium

The USD/RUB is now trading within values not sustained since the spring and early summer of 2023. Yes, there were lows achieved in August of 2024, but circumstances now compared to this past summer are far different regarding behavioral sentiment via outlooks. The USD/RUB in the spring and early summer of 2023 were actually within a bullish trend when touching current values and the lower values below are likely intriguing for financial institutions playing a long game.

The question that dominates financial institutional perspectives is how much risk premium still exists in the USD/RUB that was factored into values because of the Ukrainian – Russian war. The USD/RUB was trading near the 60.0000 ratio in the summer of 2022. And it needs to be pointed out that this lower value was after the escalation of the Ukraine – Russian war which began in the winter of 2022 and saw the USD/RUB jump to a high of nearly 156.0000 momentarily in February of that year before reversing lower.

Remaining Realistic and Not Becoming Overly Ambitious

There is a vast difference in the capabilities between day traders and large institutions. Aiming for far lower values in the USD/RUB is likely not a legitimate bet for many traders. Many support levels stand in the way of the USD/RUB before the Russian Ruble could create renewed strength and touch values seen before the outbreak of the war in Eastern Europe.

- The trend lower is intriguing and one that can be logically wagered on with take profit tactics by speculators.

- Yet, there is always the possibility of reversals higher.

- Remaining realistic about trading targets is crucial for speculators, and timeframes often need to be less than one day because carrying the USD/RUB may be expensive on broker platforms due to transaction fees.

- Patience is not easy for day traders and this is understandable, so risk taking strategy has to be done with care.

- Using resistance above as a spot to sell the USD/RUB is reasonable for conservative traders.

USD/RUB Short Term Outlook:

Current Resistance: 84.4000

Current Support: 84.1000

High Target: 84.9300

Low Target: 82.6000

Ready to trade our daily forecast & predictions? Here are the best Russian forex brokers for you to check out.