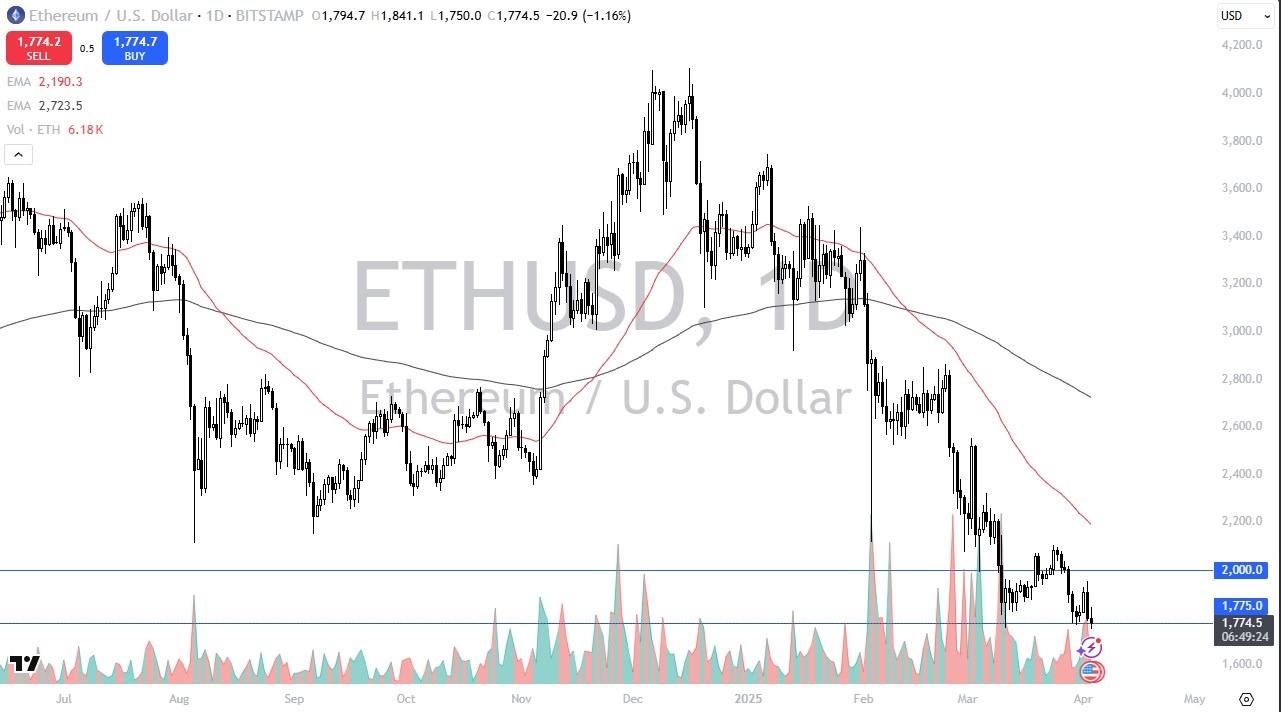

- The Ethereum market has been all over the place during trading on Thursday, as we continue to bump along the bottom.

- The $1775 level has offered a bit of support multiple times, and it does look like the market is going to try to stay above there based on the action that we saw during the day on Thursday.

- However, it would not take much to knock the market down below that level, and in fact if it did break down below there, then I think there’s a potential move down to the $1600 level for Ethereum.

This could make a little bit of sense, due to the fact that there is a major concern out there as far as risk appetite goes, but at the same time you can also make the argument that things are oversold in the crypto world. Ethereum of course play second fiddle to Bitcoin, so if Bitcoin starts to rally, that might have a bit of a “knock on effect” in the Ethereum market. This is essentially the first clue you are looking for, whether or not Bitcoin can rally. If it does, then it means that traders are willing to start thinking about digital assets again.

Top Forex Brokers

Technical Analysis

The technical analysis for this market is obviously very negative at the moment, and I think that will more likely than not continue to be the case. However, if we were to turn around a break above the $2000 level on a daily close, that might bring in a little bit of “FOMO trading”, especially if Bitcoin breaks above the $90,000 level. Ultimately, at this point in time I think you have to be somewhat cognizant of the reality that there are a lot of concerns the traders out there, not many are willing to step this far out on to the risk spectrum at the moment.

Ready to trade our ETH/USD forecast? We’ve made a list of the best Forex crypto brokers worth trading with.