- The euro initially gapped lower against the Japanese yen during trading on Monday, only to turn around and skyrocket to the upside.

- All things being equal, this is a pair that is going to continue to be very noisy because a lot of traders out there are concerned about the global economy.

- As long as that’s going to be the case, there could still be traders out there looking to buy the Japanese yen for some type of safety, especially now that the Bank of Japan has at least paid some interest into the idea of tightening monetary policy.

Technical Analysis

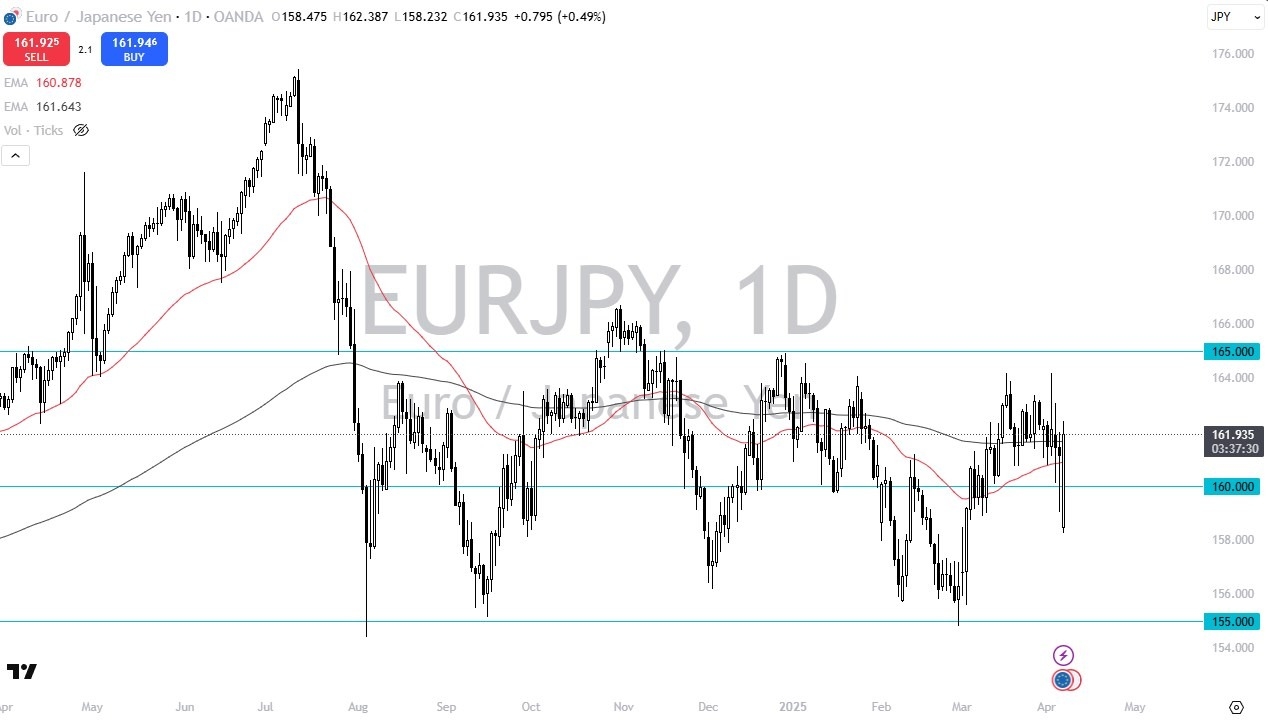

The technical analysis for this pair is actually fairly neutral, perhaps even starting to show signs of positivity, as the initial gapped lower look terrific, but the market was resilient enough to turn things around. That’s a good sign, and it does suggest that perhaps we are at least going to try to stay in the same range we have been in for a bit of normalcy. If that’s going to be the case, then I think we could go looking to the ¥165 level, but we need a little bit of positivity to make that happen easily.

Top Forex Brokers

On the other hand, if we do break down below the ¥160 level, then we will probably start to see the market reach down to the ¥158 level, the region that we had bounce from earlier in the session on Monday. Anything underneath there, then we probably see the euro drop down to the ¥155 level. This is an area that’s been important multiple times, so you need to be cognizant that this could happen, and you also need to recognize that it has been so well supported in the past that might end up being a nice buying opportunity based on value. Regardless, this is a market that I think continues to bounce around quite violently, just like the rest of the financial markets.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.