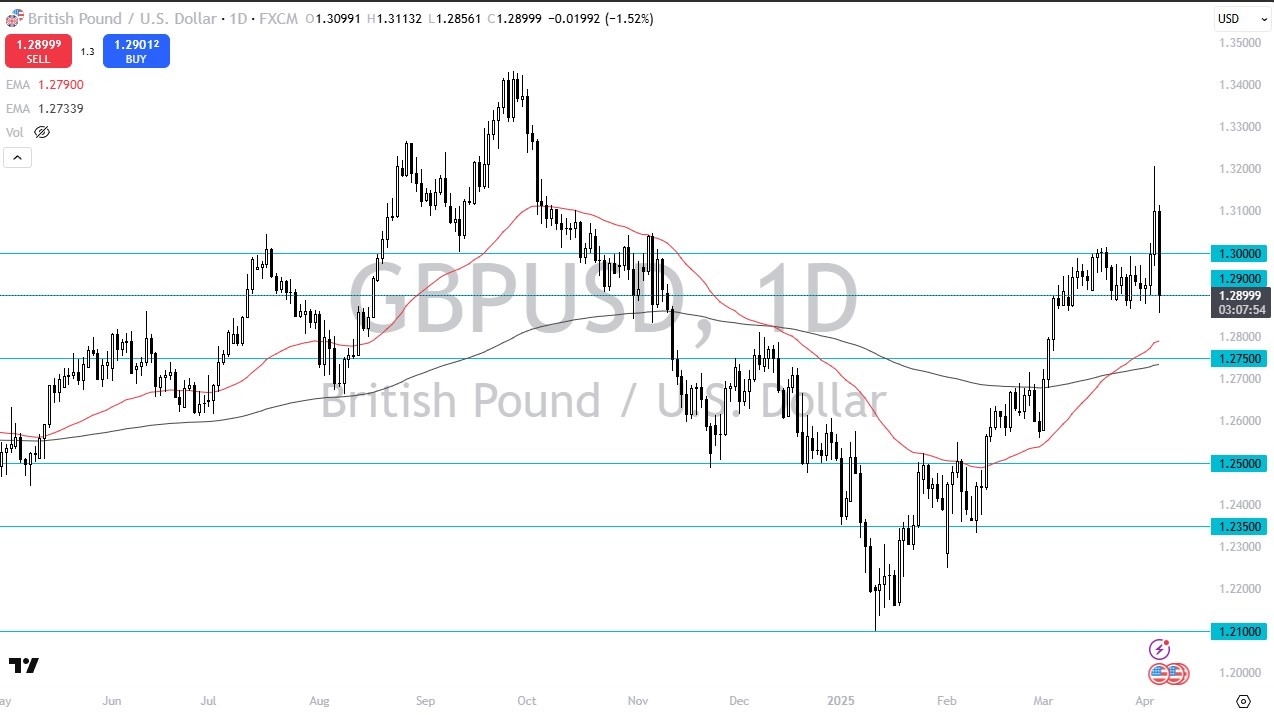

- As you can see, the British pound has absolutely cratered on Friday against the US dollar.

- As people suddenly realized that if there is going to be a massive tariff war, their debts need to be paid in U S dollars.

- It's also possible that given enough time, the holder of the world's reserve currency might have an advantage after all.

Imagine being a company in a place like the United Kingdom, a sizable market, but suddenly losing access, at least in theory, to the world's largest market. That's not a good thing. So, the question is who gets out of this without damage? The answer, of course, is nobody. That's not the assumption here. But what I do see is a complete reversal of the assumptions that were made on Thursday.

Knee-Jerk Reaction?

Top Forex Brokers

The knee-jerk reaction is quite often the wrong one, and I think we just saw that. So now, I start to look at this through the prism of, will the pound break down? If it does, it should. Visit the 50-day EMA, followed by the 1.2750 level. On the other hand, if the market turns around and recaptures the 1.30 level, then I think that's a sign that we're probably going to consolidate a bit, maybe grind higher slightly and slowly in more of a controlled manner. Keep in mind, this is not a pair that typically skyrockets and then craters like we've just seen.

So, it also suggests that perhaps a lot of traders out there may just be on the sidelines. Maybe it's a little bit of a lack of liquidity. Nonetheless, this is going to be an interesting pair to watch because the British pound has outperformed several other major currencies against the US dollar in the last couple of years, even when the pound was falling, it was falling slower than for example, the euro or the Australian dollar. I think we're on the precipice of a big move. That's quite often what happens when you see this type of volatility. But right now, we're questioning which direction it goes. You have a couple of levels to watch. I would watch those and then trade accordingly.

Ready to trade the Forex GBP/USD analysis and predictions? Here are the best forex trading platforms UK to choose from