- During the trading session on Tuesday, we have seen a lot of noise coming on of the stock markets globally, and India will be any different.

- Ultimately, this is a market that has recently seen a major downtrend, followed by a major pop higher, only to turn around and collapse again.

- As tariffs continue to be a major concern right now, it does make a certain amount of sense that we would see the market struggles a bit, as this is an area that previously had been very important.

Technical Analysis

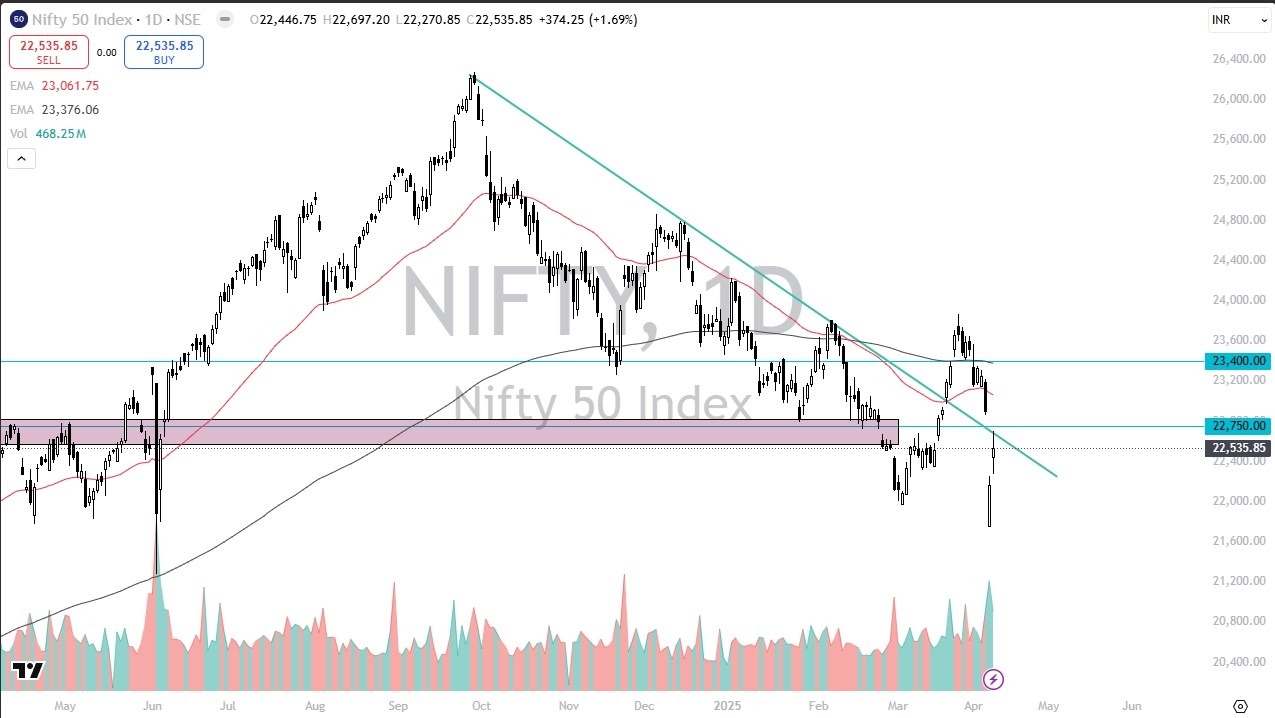

The technical analysis for this market is rather negative, although we have seen a couple of very strong days. For what it is worth, the New York indices are starting to drop late in the day, and therefore it’s likely that we could see a little bit of follow through in India. Judging by the candlestick for the Tuesday session, it suggests that we are in fact starting to struggle, and the area around the ₹22,750 level will continue to be important. Ultimately, I think you have to look at this through the prism of a market that is going to continue to be very noisy, but I also think that you will see plenty of overhead resistance in the market, as of course India being a major exporter will suffer at the hands of the rest of the world struggling.

Top Forex Brokers

Because of this, I do anticipate that we probably continue to see a “fade the rally” market, at least until we break above the ₹23,000 level. If we break above there, then it’s possible that we could see the market go much higher, but right now I think a revisiting of the lowest makes more sense than anything else. Ultimately, that could very well be the way this plays out, sellers coming in every time the buyers try to lift.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.