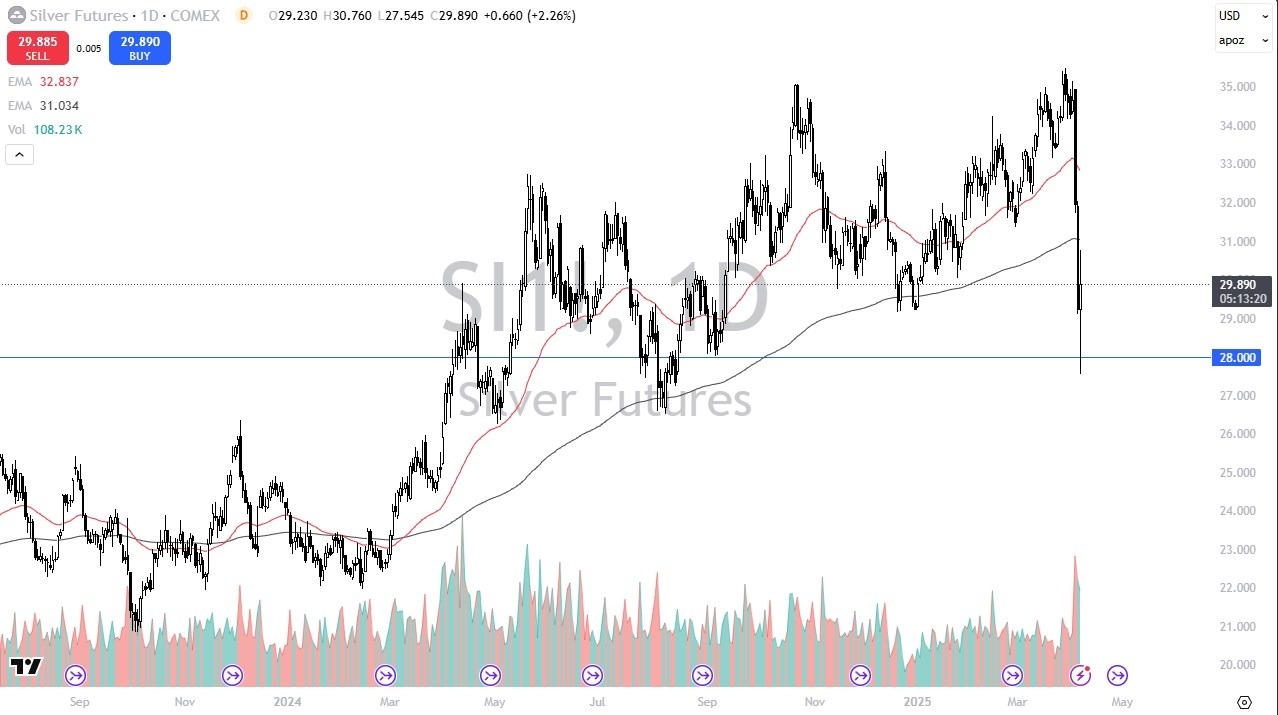

- As you can see, silver has been all over the place during the trading session on Monday as traders continue to react to the latest headline involving tariffs.

- People will continue to look at the volatility as something to be very cautious with.

- This will certainly be the case in silver because silver is very noisy under the best circumstances. Right now, we just don't have the best of circumstances.

Silver is not only a precious metal, but it is also an industrial one. So you need to keep that in the back of your mind because it will be behaving like gold at times. And then other times it will be behaving like a highly sensitive industrial metal. It does look like we are going to continue to see the markets pay attention to the latest tariff headlines because it will have a direct influence on the demand for silver. That being said, during the day, there was an erroneous report that perhaps the United States was willing to pause tariffs for 90 days. And there have been reports out of the European Union that they are interested in doing a zero for zero tariff package with America. And that could drive up the demand for silver. We'll just have to wait and see.

Gold/Silver Correlation is “Off.”

Top Forex Brokers

Ironically, silver has fared better than gold, at least so far. And I think part of that is because traders had made so much money in gold, they had to liquidate in order to cover margin in other markets. It does look like the $28 level is trying to hold silver up. And as I record this video, we are challenging the $30 level. We even rallied all the way to the $31 level at one point during the session, which is right about where the 200 day EMA currently resides. I've been trading for about 18 years. And I can tell you in times like this, what you need more than anything else is stability. We are seeing the first signs of support, but we need a couple of days of calm trading before we can really get aggressive with an aggressive market like silver itself.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.